In This Article:

- A Safe Spot to Land

- Monopoly Money

- Safe, Slow and Steady

- 3 Utility Stocks to Buy and Hold Forever

- Electric Company

- Water Works

- Your Utility Knife

- Lights Out

Have you ever spent an entire afternoon screaming at your family, plunging them into a pit of despair and leaving them absolutely penniless?

I sure have, and those afternoons are some of the fondest I’ve ever had.

You may call it ruthless. You may call it callous. You may call it madness.

I call it Monopoly.

The classic board game has been tearing families asunder since 1935. Monopoly taught generations how to count money, manage properties and tempt fate. (And rob a bank if you’re one of those people.)

Monopoly can be a nail-biting endeavor when you’re running out of cash, and your back is against the wall. Does that sound familiar here in 2022?

It does. Housing and rental prices have gone berserk. Inflation has crept into every facet of our lives, and equities have been plunging further every day. The Federal Reserve is raising interest rates at the highest level in decades, pushing us into an almost certain recession.

But unlike the Fed, we’re not playing with Monopoly money, and we can’t just start a brand new game after this nightmarish one ends…

A Safe Spot to Land

I wouldn’t blame you if you’ve been nervously peeking at your portfolio through your fingers this year. It’s been one hit after another as the market has been given a haircut to the tune of 20%. And the worst could be yet to come.

With stocks teetering on the brink of another 20% drop, the smart thing to do right now is to go back to the basics. What companies will at least tread water while the rest of the market tanks?

The easy answer is utility stocks…

The S&P 500 Utilities Index has gained 4% this year, compared with a 19% loss for the S&P 500 overall.

Utility companies are a low-risk business model. Nobody wants to live in the dark without water, so people are going to pay their electric and water bills before anything else.

Not just anyone can start a water treatment plant. Upstart entrepreneurs aren’t going to launch an electric company overnight. There is a serious barrier to entry for these companies, and the ones that have already established themselves tend to roll along just fine in times of feast or famine.

Monopoly Money

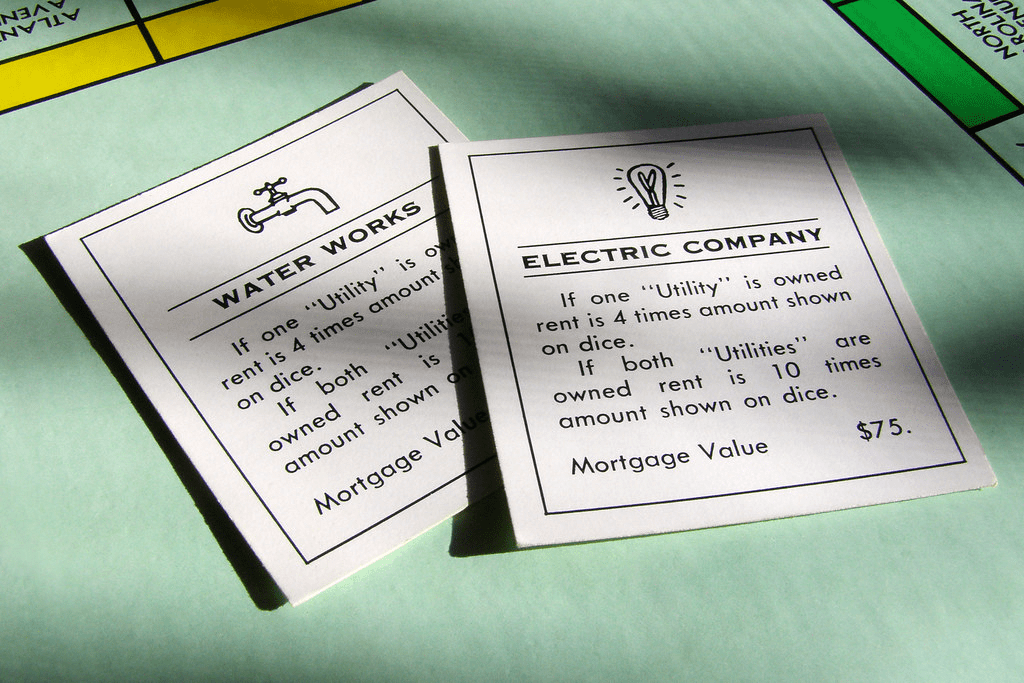

You see, the government sets regulations on utilities, essentially making them monopolies. While we’re talking about monopolies, this probably brings back some memories:

While you may not have struck fear into your opponents with Electric Company and Water Works, you certainly have collected some dice roll income over the years.

I know this firsthand because I was playing my 10-year-old son in Monopoly the other day, and he scooped up both Electric Company and Water Works on his first trip around the board. The utilities are great “set and forget” properties, which pay for themselves almost immediately.

They don’t have the same explosive-growth potential as the “big” properties like Boardwalk or Marvin Gardens, but they’re cheaper – and spread out. You’re not going to bankrupt anyone with them, but they can be decent money-makers over the course of the game.

(Editorial note: Always buy railroads. The probability of landing on a railroad every time going around the board is 10%. Railroads are also attractive stocks to own right now.)

They’re better in the early game for fast and easy income, but later on, they’re more valuable simply as squares you can land safely on, and the other players typically have enough cash on hand to pay you.

Like in real life, people will pay their utility bills before anything else. And when you own both utilities, whoever lands on them has to pay 10 times the amount shown on the dice. My son bought both immediately, and I ended up landing on those spaces over a dozen times over the course of a game. He easily tripled his $300 investment.

While you won’t get that huge windfall as you would with a hotel on Park Place, you’ll make a steady income the whole game through with a very small investment.

Luckily for us, the real investment world isn’t quite like Monopoly…

The goal of investing long-term isn’t to bankrupt everyone else with high-stakes risk-taking. And in real life, you get dividends for your positions, not just by “Chance”:

The average electric utility dividend yield is now 3.2% – twice the S&P dividend yield.

Let’s try our hand with real money…

Say you put $10,000 into Consolidated Edison (NYSE: ED) – one of the biggest U.S. utilities – 10 years ago. Here’s what you’d be looking at today:

That’s a total return of over 100% on a safe, simple utility stock. And you’d have been getting checks in the mail every February, May, August, and November.

However, if you had reinvested those dividend checks into the company, slowly but surely, you would have grown that investment into much more.

That’s a return of 131% – $3,000 more than if you just cashed the quarterly checks.

Consolidated Edison is also a dividend aristocrat – they have paid out dividends since 1885 – which makes its 3.31% dividend yield safer than most. (You can view the entire dividend aristocrats list.)

That is the sneaky power of utility investing. Utilities aren’t sexy, they aren’t fun – but they yield great dividends. The top utility companies offer an average dividend yield of 3-4%.

Safe, Slow, and Steady

One of the major reasons to invest in utility companies is safety. And odds are, the utility will stick around as long as you do since the chances of a competitor moving in are slim. Slow and steady wins the race, and everyone should have utility stocks in their long-term portfolios.

My utility stocks never keep me up at night.

They never require me to check in on them. I set them and forget them.

They also are known for steady, generous dividend payouts. This means that the revenue streams for utility companies are extremely consistent, often resulting in steady and sizable dividends for shareholders.

Here are my personal recommendations for “Electric Company” and “Water Works”…

Three Utilities to Buy Forever

Electric Company

Dominion Energy, Inc. (NYSE:D) produces and distributes energy in the United States.

The company employs over 17,000 people in 15 states, providing reliable, affordable, clean energy to nearly 7 million customers.

The company's portfolio of assets includes roughly 30 gigawatts of electricity.

With a $63 billion market cap, it’s one of the largest utility companies out in North America.

Dominion has been incredibly stable over the years, which would already make it a wonderful utility to own. However, the company has been expanding its operations. They have already financed a $37 billion capital expenditures plan over the next five years that is projected to field annualized earnings growth of 6.5% through 2026. Much of that is due to the development of solar and wind farms, which – thanks to recent carbon legislation – come with their own set of government subsidies.

Dominion currently holds the second largest solar portfolio in the country. These new initiatives should serve them well as we approach a lower carbon future.

The company also pays a generous 3.34% dividend yield on the 20th of March, June, September and December. You can enroll in their dividend reinvestment plan here.

Dominion Energy (NYSE: D) Stats:

Market Cap: $63.13 billion

P/E Ratio: 31.30

EPS: 1.93

Dividend Yield: 3.34%

52-Week Range: $70.37 – $88.78

Honorable mention: Consolidated Edison (NYSE: ED)

Now let’s make with the waterworks…

Water Works

A. O. Smith Corporation (NYSE: AOS) manufactures and markets residential and commercial heat pumps, electric water heaters, boilers, tanks, and water treatment products in North America, China, Europe, and India.

Pretty much everything you need to get clean, hot water into homes around the world.

They also have some serious longevity. A.O. Smith was founded in the summer of 1874 in Milwaukee. That’s when Charles Jeremiah Smith hung a sign outside his family’s home:

C. J. SMITH, MACHINIST

Since that very day, the company has developed and manufactured everything from metal components for baby carriages and bicycles to beer kegs and brewing tanks. Eventually, they settled on the water sector, producing residential water heaters and boilers and becoming one of the leading global water technology companies.

A.O. Smith is number one in market share in U.S. water heaters. It has captured over 30% of the domestic residential share and over 40% of the commercial market share. 72% of their business is in the United States. However, they have begun expansion initiatives in China and India, two key emerging markets with large populations and high economic growth.

A.O. Smith is also a dividend aristocrat, increasing its payout every year for the past 28 years. In the past five years alone, it has increased its dividend at a compound annual growth rate (CAGR) of 17%.

They are currently trading at a near 52-week low. Now would be a good time to start a long-term position. A.O. Smith offers a dividend reinvestment program (DRIP) as well. You can find details on their website here.

A.O. Smith – like most companies – does pull back a bit during recessionary periods when homebuilding slows and existing homeowners aren’t prioritizing new hot water heaters. For my money, that is a perfect time to dollar cost average your position.

A.O. Smith is an industry leader. It not only has the top brand in the U.S., but it holds growth potential in emerging markets like China and India. Whatever issues may arise in the short term should easily be overcome in the long term.

A. O. Smith Corporation (NYSE: AOS) Stats:

Market Cap: $7.68 billion

P/E Ratio: 15.20

EPS: 3.25

Dividend Yield: 2.25%

52-Week Range: $49.27 – $86.74

Honorable Mention: Essential Utilities (NYSE: WTRG)

Your Utility Knife

You can also play a basket of utilities all at once with an ETF. Doing so protects you from any one sector having an off year — and gives you the security of collecting dividend checks with a solid yield at little risk.

Utilities ETFs track the benchmark utilities index that includes electric companies, water utilities, gas companies, and energy traders. You’ll see companies like Consolidated Edison, Dominion, and A.O. Smith in these funds.

Here’s my pick…

Fidelity MSCI Utilities Index ETF (NYSE: FUTY)

The fund invests at least 80% of its assets in securities included in the fund's underlying index. The fund's underlying index is the MSCI USA IMI Utilities 25/50 Index, which represents the performance of the utility sector in the U.S. equity market.

FUTY has assets totaling $2.23B and a dividend yield of 2.53%.

It also sports the lowest expense ratio of the major utilities ETFs, clocking in at 0.8%. Utilities Select Sector SPDR (NYSE: XLU), another large utility ETF, has a 1.12% expense ratio, which may not seem like a massive difference, but those fees do add up over time.

Here are the top five holdings for FUTY:

| NextEra Energy Inc | NEE | 13.82% |

| Duke Energy Corp | DUK | 7.30% |

| Southern Co | SO | 6.15% |

| Dominion Energy Inc | D | 5.70% |

| Exelon Corp | EXC | 4.16% |

Lights Out

Utilities are a defensive way to play any down market. They act as de facto monopolies, they receive government subsidies, and their customers pay up regardless of the financial situation on the ground.

If you’re looking for a safe, solid investment for whatever the market bears, look no further than a long-term, dividend reinvested utility play.

It’s as simple as “Passing Go” – no matter how your Monopoly game is going, you can still bank that $200 each and every time around the board – or as far as your dividend payments go, every couple of months.

Godspeed,

Jimmy Mengel

TheProfitSector.com