- Two Types of Accounts – Two Types of Risk

- High Yield Savings Account Advantage

- High-Yield Dividends Advantages

- The Pros, Cons, and Middle Ground

- Conclusion – It’s All About You

Take your pick – 5% or 15%.

That’s the difference between a high-yield savings account and a high-yield dividend company.

That’s about all the information you’d get if you didn’t dig deeper.

Only one number matters in the end – the best. Why should anything fall short?

No one could blame you for picking the latter over the former. There has to be a reason why, though. So much money is at stake.

Let’s dig into the details that differentiate between high-yield savings and high-yield dividends and make sure we know the difference.

Two Types of Accounts – Two Types of Risk

It should be clear that we’re talking about two very different things. However, they aren’t presented that way.

The yield is what sells. You’ll always see a percentage long before you see anything else. What generates the yields are different.

We need to set a bar for how we compare them, though. Two are pretty easy to agree upon.

- First, banks need to be FDIC insured. That comes with its own requirements, but it guarantees the government will back up your first quarter million in a savings account if those requirements are met.

- Second, companies must be SEC compliant and at least a component of the Russel 2000. We have to set a bar somewhere that meets some requirements for financial disclosure.

That puts the top high-yield savings account at 5.03% from Primis Bank right now and the highest dividend-yielding company listed in the Russell 2000 as Lumen Technologies, Inc (NYSE: LUMN) around 15%.

That’s an obscene difference. It seems too good to be true, and it is.

What’s interesting is how Primis Bank advertises over 5% return on deposits, and Lumen probably will not mention its dividend yield at all.

This ties into a fundamental difference between high-yielding savings accounts and high-yielding dividend accounts…

The High-Yield Savings Account Advantage

The main advantage of high-yield savings accounts is the guarantee that you will never lose money.

The FDIC, Federal Deposit Insurance Corporation, guarantees a quarter million of it.

You get a simple yet compounding rate of interest.

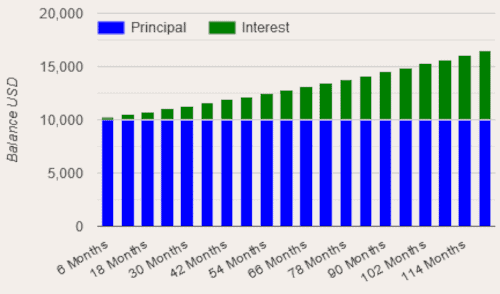

When it comes to interest rate accumulation from a high-yield savings account, it compounds at a set rate, and a chart of it over ten years, assuming you invest $10,000, would look like this.

The blue bar is your original money. The green is what you get from it at 5% interest, compounding over time, assuming you don’t touch it.

After ten years, you have over $16,000. It snowballs, and you have a guarantee that ALL of it is available through an FDIC-insured bank.

The only problem is that you aren’t guaranteed a set rate of return.

That 5%? It is set at the end of the interest term and at the bank's sole discretion.

Your deposit and money, and after interest is deposited into your account, is guaranteed.

The rate of return is not.

High-Yield Dividend Advantages

What separates high-yielding savings accounts from high-yielding dividend stocks are two variables in play.

- Companies can choose the amount they pay as a dividend and thus the dividend yield.

- The stock price can be highly variable.

Remember that 15% yield mentioned above?

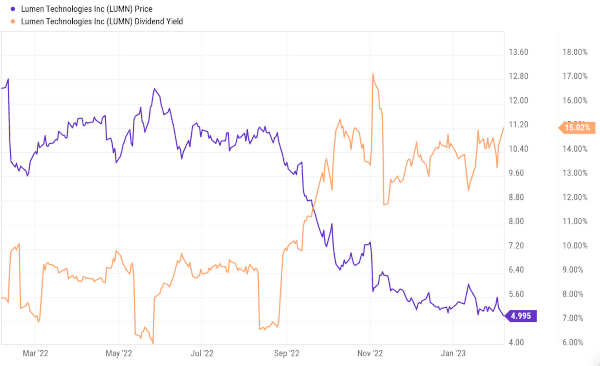

It’s Lumen Technologies Inc (NYSE: LUMN), a maker and provider of online data and streaming products – cloud storage, communications, etc.

Look at how the stock price plunges as the dividend yield grows.

Also, think about how dividend yields work. The companies aren’t bound to a percentage. They pay out a set amount per term and are evaluated on what they’ve paid out in the past.

The last payment was in August 2022 at a quarter ($0.25) per share.

The company’s earnings per share are considerably down over the last couple of quarters. Why would it now pay 15% of its share value as a dividend? Even if it did, is that sustainable?

To compare it to the high-yield savings chart above, you’d have lost nearly 60% of any investment value in 2022.

Even if 15% dividend yields were sustainable, it’d be a consolation prize at best. The bottom fell out, it’s a highly volatile company, and your initial investment continues to be at risk.

The Pros, Cons, and Middle Ground

We’ve covered high-yield savings accounts with their guaranteed principle, how that principle is not guaranteed, and how yields can appear to go up.

We haven’t mentioned one thing, though – companies that do everything they can to protect payouts to investors regardless of both over at least a quarter century.

They exist, and we’ve covered them before. Here’s one about high-yield dividends from a month ago that holds up.

Here’s an article about a couple of new dividend aristocrats for 2023. We even have a full list here.

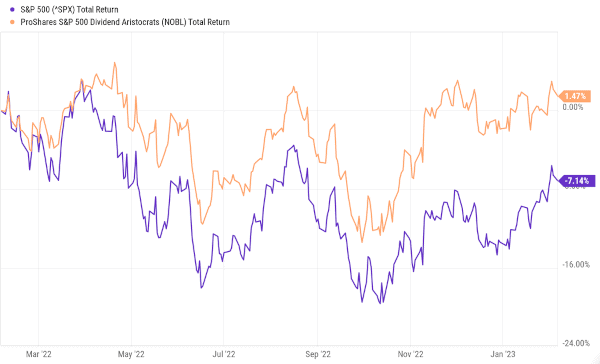

]You can see how well dividend aristocrats compare against the S&P 500.

That’s the ProShares S&P 500 Dividend Aristocrats ETF (BATS: NOBL).

We also have more information on some of the highest-yielding sectors. REITs stand out, and here is a couple:

Energy stocks are also in rare territory for how much they pay as dividends:

Conclusion – It’s All About You

We’ve covered a fair amount so far, and it might be worth making it clear…

The difference between a high-yield savings account and high-yield dividend stocks is about your risk tolerance level.

A legitimate savings account will come with FDIC insurance that your deposit, or principle in the investment, is secure. It also means you will see lower returns over time.

Investing in high-yielding dividend companies comes with more risk than the value of your investment… in spite of whatever dividends you may collect, the stock itself could drop and ultimately undermine the whole purpose of making money over time.

Understanding the pros and cons between the two matters, and this is a good start.

If you want to invest in a high-yield dividend company that is recession-proof, has an impeccable track record and an ironclad dividend yield, look no further. We call it the Wealth Fortress for a reason: it's as safe as a bank, but pays you like a banker.

Take care,

Adam English

The Profit Sector