In This Article:

- A Short History of Railroad Unions and Why It Matters

- Where Railroad Strike Negotiations Stand Right Now

- The $2 Billion Per Day Carried by Railroads Cannot Be Replaced

- Railroad Stock Plays Stand Out For Crucial Reasons

Congress and the Senate, in a rare act of swift and bipartisan solidarity, ended a railroad strike after four days.

As the Los Angeles Times put it:

“The House and Senate passed emergency legislation barring strikes and lockouts by large margins, setting up a “last, best offer” arbitration system to resolve the three major union-management disputes that had idled virtually all U.S. railroads…

“Many lawmakers objected strongly that the action was anti-labor, but anxiety about the impact of a prolonged stoppage on the still-fragile economy overrode those concerns.”

It's been a little more than two decades since that happened… And it could describe what is about to happen in the coming days or weeks.

The first President Bush and an overwhelming congressional response broke that strike quickly, but the damage was already done.

Skip forward to the present day, and President Biden stepped in to broker a tentative deal that is already anemic, at best, but delays an impending strike with national consequences. The risk still looms large.

Where this goes from here has profound implications for consumers and investors alike… and a long history we ignore at our peril, to the tune of a conservative estimate of $2 billion per day.

Let's break this down and look at what is going on, the kind of big business that doesn't drive headlines when the trains arrive on time and cause chaos when they don't.

A Short History of Railroad Unions and Why It Matters Today

Railroads are easily considered a relic of the past, as are many of the unions related to them.

But nothing could be further from the truth. Never before have they been more important for the kind of commerce we're all too willing to take for granted.

Hearkening back to the Gilded Age, 24 years after the final golden spike was nailed into the transcontinental railroad, the American Railway Union arguably became the first nationally influential railroad union after a series of mergers and consolidation.

The ARU quickly imploded after the Federal government and one of the most contentious uses of the U.S. Army on national soil intervened.

Through fits and starts, and sometimes cruel violence on both sides, a long incremental path was carved.

Everything from standard work days, to collective wage negotiation, to rules for union-busting, to safety standards were pioneered by them. Even disparity in race-based standards was chipped away through organizations like the Brotherhood of Sleeping Car Porters.

This led to the creation of a far greater number of individual unions for railroad workers than you'd see anywhere else in the US economy, which has seen a generation's worth of union consolidation and membership decline in other sectors.

This history has created the diverse and sometimes fractured coalition of unions that still exists to this day. Twelve railroad unions form the coalition for National Freight Rail Bargaining. They need to unanimously confirm the deal that is on the table. Though minor members often defer to the large unions, already one of the big three has voted it down.

Thus, union buy-in is critical, especially with President Biden, famous for riding Amtrak trains back home to Delaware since voters sent him to DC half a century ago, getting involved in spite of the risk of Congress breaking a strike nearly as soon as it starts.

Since this particular passenger line may need to shut down, it's worth mentioning the publicly traded company and party to the negotiations on the corporate side – CSX – owns the route that Amtrak functionally leases.

Where Railroad Strike Negotiations Stand Right Now

Here is what the tentative deal includes:

- A 24% increase in wages through 2024, with an immediate 14% increase

- A stop to a strike-based penalty policy for missing work for any reason

- A (poorly defined) change to 24/7 “on call” status

- A $1,000 annual bonus over five years

- A (just one) paid sick day for workers

Wages haven't increased since 2019, and over a cumulative eight years, it works out to 3% per year. Railroads have dramatically reduced workforce size over decades, but payrolls are a big part of operating costs.

The average annual wages of union members start around $50,000 but, according to reports from workers, end up over $100,000 per year with overtime pay and excluding benefits.

This is tempered by the aforementioned “on call all week” status and lack of leave. Many workers report hitting the 16-hour maximum, already set by federal law, for each 24-hour day for at least five days per week while facing penalties for failing to report if summoned on the other two.

A particularly contentious part of this “on call” status are penalties based on the medical necessity of the workers or their dependents. No accommodation is made for many works, even with documentation of hospitalization.

A large part of the International Association of Machinists and Aerospace Workers voted to reject the tentative agreement, which has scuttled unanimous agreement among the three largest unions involved, but IAM as a whole decided to delay a strike to allow other unions to vote.

The IAM has said it will delay a strike until September 29th at the earliest.

Effectively, the deal is in limbo, and the unions would have to agree on a new strike date. The can was kicked.

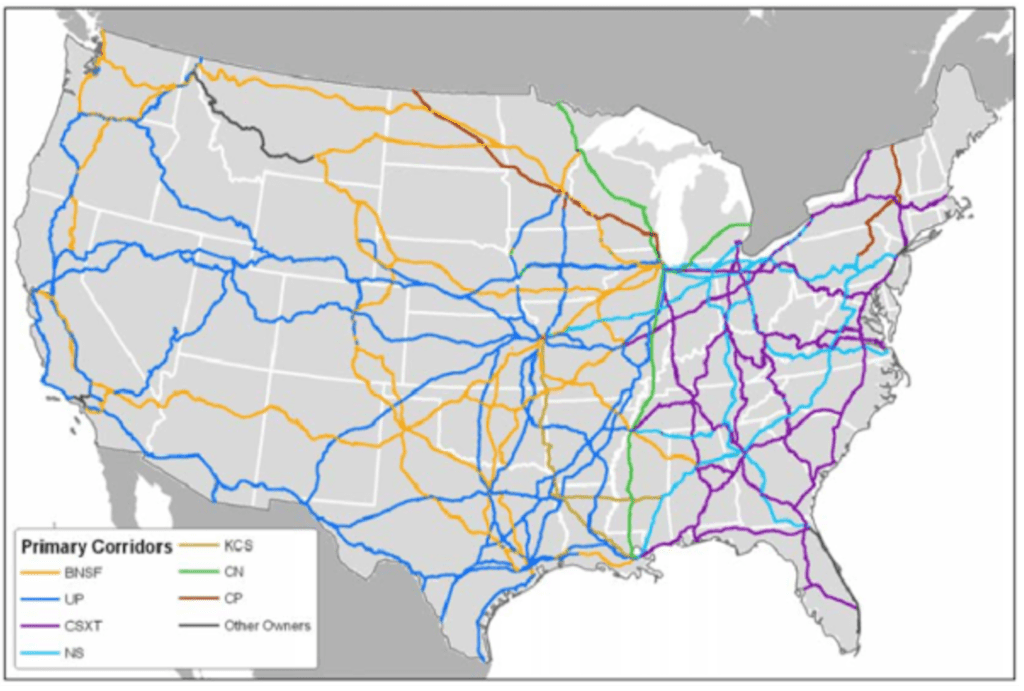

The $2 Billion Per Day Carried by Railroads Cannot Be Replaced

In a time of rampant inflation and supply chain disruptions, rail freight has never been more important, to the tune of $2 billion per day, according to a report by the Association of American Railroads, an industry trade group.

Companies that depend on moving heavy goods, or goods deemed “heavy” because of their bulk, are already dependent on existing rail lines to minimize cost.

Plus, the alternative of moving goods by road runs head-on into existing problems with rising costs created by a lack of long-haul truckers and sky-high diesel fuel costs.

In short, there is no pressure release valve. There is no excess capacity. This is creating a leverage that hasn't existed in decades.

With everything detailed above, this is quickly becoming a political nightmare. There is virtually nothing to gain over the status quo through federal intervention and a profound amount to lose.

The proverbial “third rail” comes to mind.

At the same time, railroad companies have recently reported windfall profits, some hitting new records.

Railroad Stock Plays Stand Out For Crucial Reasons

BNSF, owned by Warren Buffett's Berkshire Hathaway (NYSE: BRK.A), reported a year-over-year increase of $8.8 billion in operating income, marking a 13.7% increase and an all-time high

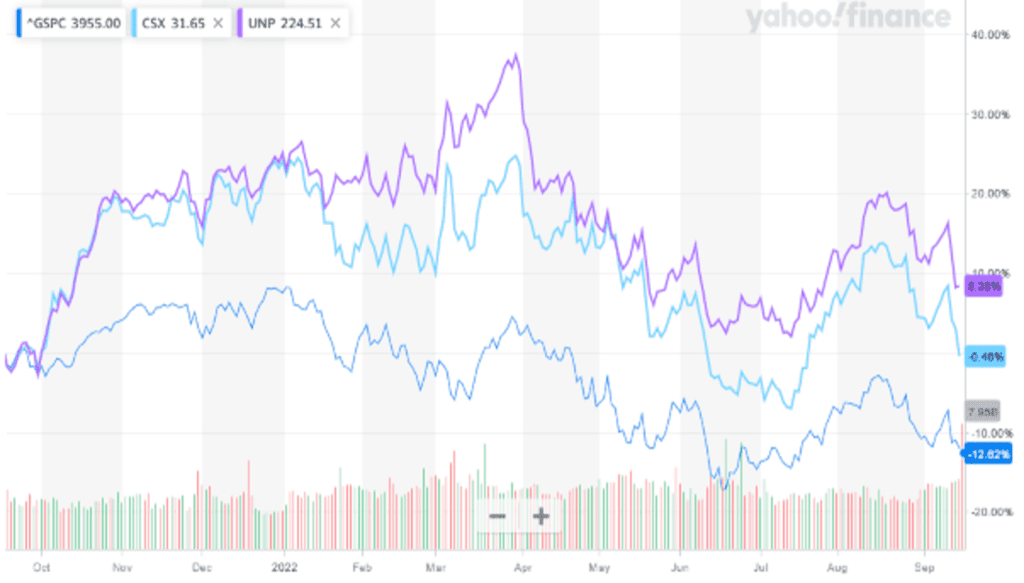

CSX Corporation's (NASDAQ: CSX) last fiscal year, reported at the end of June 2022 for the 12 months prior, didn't see that kind of spike in operating income, but total revenue spiked 23.7% and marked a quarter-to-quarter increase of 27.6%. That's on top of a 2021 annual report detailing an 18.3% increase.

Union Pacific (NYSE: UNP) looks like a laggard with data for the past year, also released at the end of June 2022, marking a 13.9% increase year-over-year while the prior year saw an 11.63% increase.

As for benchmarking stock performance, we cannot isolate BNSF, which accounts for just a bit under 10% of total Berkshire Hathaway revenue, but CSX and UNP standout against a particularly bearish stock market to the point where a simple chart will suffice:

Both companies offer advantages for current shareholders.

CSX Corporation (NASDAQ: CSX) offers a small dividend, at a roughly 1.4% yield as this is written, and a dividend reinvestment plan (DRIP).

Union Pacific (NYSE: UNP) offers a larger yield through a 2.45% yield, again as this is written, and offers a DRIP plan for existing shareholders.

While railroad stocks offer a blend of advantages and caveats, the threat of strikes and the threat to further consumer and business inflation costs put them in a unique position as strong value stocks going forward.

While the tentative plan would erode operating margins and profits, the inability to increase capacity, the resilience of demand, impossible to replace capacity for low-cost freight transportation, the retreat of fuel costs such as oil – specifically diesel – trends downwards.

And bipartisan political pressure to avoid interruptions, all show that as anachronistic as railroads may seem, they're integral…

Not only for the economy but as outperforming components of the stock market and potentially for individual portfolios.

Take care,

Adam English

The Profit Sector