- Pioneer Natural Resources Company (NYSE: PXD)

- Enterprise Products Partners L.P. (NYSE: EPD)

- Get High Yields While They're Hot, But Stay Vigilant

A wink and a nod. That’s all you’d get for years.

The energy sector has always been boom or bust. Sometimes it makes fortunes, and sometimes it loses them.

The goal, the only goal, is a big payout. Money straight out of the ground, as long as the oil or gas flows. Stories about “gushers” on ranchland repurposed. Prairie profits that make homesteaders millionaires.

The days of a wink and a nod aren’t entirely over, but they have certainly changed over time. The industry has evolved. It isn’t as much about real estate land grabs anymore. It’s about surveys and their results. LIDAR, plane-based electromagnetic mapping, horizontal fracking, environmental reports, etc. Add in permits and all-in costs estimates.

But when oil or gas starts flowing, so do profits, same as ever — the higher the price, the higher the profits.

We’re in the boom years of the cycle for energy stocks, and we should look at how they’re paying out to their investors. Few other investment opportunities come close these days.

Let’s look at some high-yield energy stocks that are paying out right now. These companies are at the top of their game for transferring money to investors right now through dividends.

Pioneer Natural Resources Company (NYSE: PXD)

Pioneer Natural Resources is returning more money to shareholders than virtually any other company out there.

It’s a natural gas and oil play in the Permian Basin in Texas. One of the simplest out there. It drills and sells, and that’s about it.

Its fortunes will rise and fall with oil and gas producer prices in the region. Right now, times couldn’t be much better. A picture is worth a thousand words.

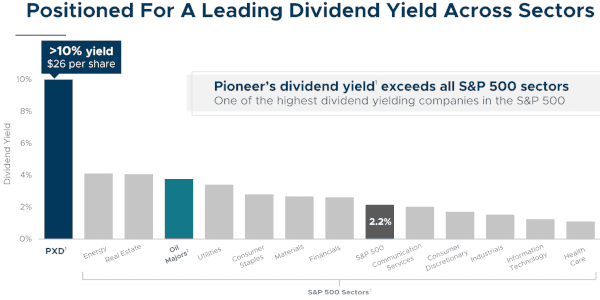

Currently, the dividend yield, using forward-looking data, is about 11.5%, putting it far above any averaged S&P 500 sector and far above most peers in the energy sector.

This is especially true since it is pulling in a profit. With that kind of return, we should look at it in more ways than just a broad comparison.

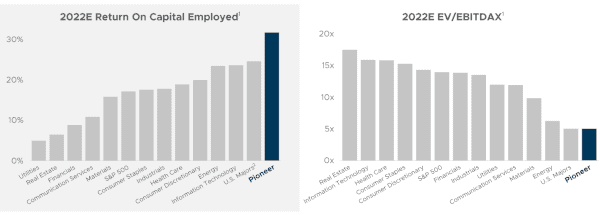

Pioneer maintains incredible value regarding return on capital investment and enterprise value versus earnings (EBITDA).

Pioneer, in short, is a company at its peak. It’s returning a fantastic amount of money to shareholders and maintaining baseline metrics that support it, at least for now.

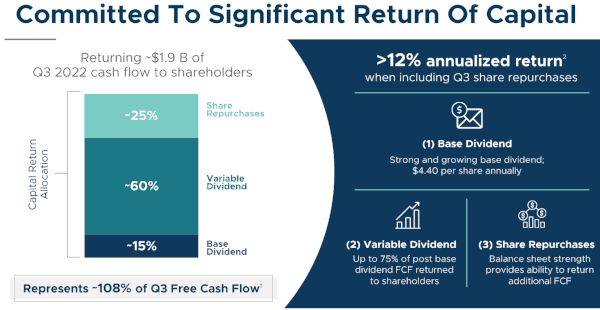

Fair warning, Pioneer is also a company that is very comfortable with variable dividends. That dividend yield will move, as it usually does with share prices, but also with how much money it has on hand to return to shareholders.

In 2022, its four quarterly payouts were $0.84, $1.11, $1.37, and $1.17. They rose and fell with fuel prices. They were fantastic compared to share prices, for sure, but they were and will continue to be variable.

Having said that, and for the foreseeable future, Pioneer is in an enviable position.

Its projections show plenty of cash to use based on the industry outlook for oil and natural gas prices. Caveat emptor – those prices set these surpluses.

Plus, it is not heavily indebted. Total debt-to-asset ratios work out to about 20%, which will evolve as debt rolls over. Still, it is far from the headline numbers we see for corporate debt and leaves a lot of room before the company suffers from a high ratio premium.

For now and for several quarters to come, Pioneer Natural Resources Company (NYSE: PXD) has plenty of cash on hand and free cash flow to maintain its payouts, making its high-yield payouts relatively secure.

Compared to the broader market that continues to struggle, few other companies can offer as much without the risk of a cash flow or share price collapse.

Enterprise Products Partners L.P. (NYSE: EPD)

Enterprise Products Partners is a different kind of beast. Instead of production, it’s all about utilization.

After all, what good is anything if it isn’t where it’s needed?

Enterprise Products Company (as it was once called) was formed in 1968 as a wholesale marketer of natural gas liquids. It has evolved into an integrated energy infrastructure network providing midstream energy services to producers and consumers of natural gas, natural gas liquids, crude oil, refined products, and petrochemicals.

With a market capitalization of about $57 billion, it is one of the largest companies of its kind in the USA.

Enterprise Products Partners is structured as a master limited partnership (MLP) and, as such, has to pass on virtually all earnings to their “shareholders,” which are technically limited partners.

With this kind of structure, good governance and maintaining earnings are critical. Enterprise has 24 straight years of earnings distribution (technically not dividends, but functionally the same) increases, showing the strong track record we like to see.

Furthermore, Enterprise Partners just reported record results for 2022, along with its fourth-quarter results at the start of February 2023.

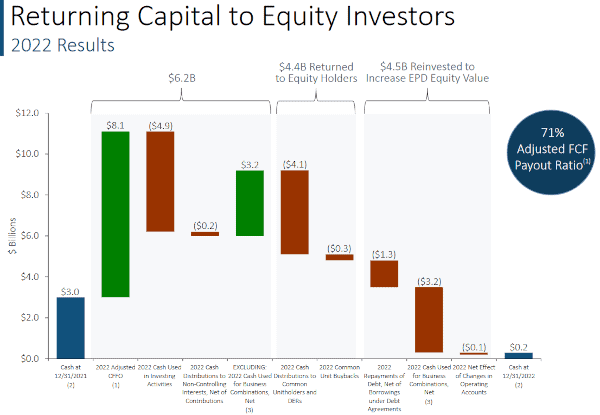

Here’s how that looks in a chart.

This is a bit of a strange chart if you’re used to “normal” stocks. Basically, it’s where money was used, along with the return to investors. Yet it does an excellent job of showing how it made money (going up) and returned that as distributions or business reinvestment that will drive value going forward.

Overall, Enterprise reported net income attributable to common unitholders of $5.5 billion, or $2.50 per unit on a fully diluted basis for 2022, compared to $4.6 billion, or $2.10 per unit on a fully diluted basis for 2021. That’s a 19% increase year-over-year, of which the vast majority goes back to investors.

That worked out to a distributable cash flow (“DCF” or what investors get back) increased 17% to $7.8 billion for 2022 year-over-year to $6.6 billion in 2021.

Enterprise also retained $3.6 billion of DCF in 2022 to reinvest in the partnership, repurchase partnership units (shares, if you will), and reduce debt.

All this adds up to a 5% increase in distributions in 2022 over 2021.

Adjusted cash flow provided by operating activities (“Adjusted CFFO”) increased 13% to $8.1 billion for 2022 compared to $7.1 billion for 2021. In other words, the cash coming in increased and allowed greater payouts.

Enterprise’s payout ratio of distributions to common unit holders and partnership unit buybacks was 54% of Adjusted CFFO in 2022. Excluding the $3.2 billion used to acquire Navitas Midstream Partners, LLC, which will only expand the business going forward, the partnership’s payout ratio of Adjusted free cash flow was 71% for the year.

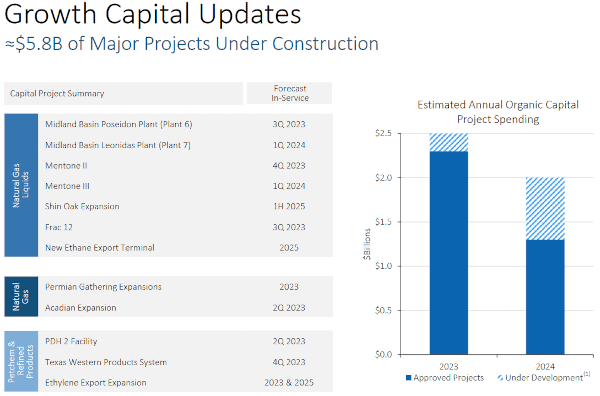

Speaking of business expansion, plenty is in the works, but it has not overextended itself. Striking a balance is extremely important, and the company management knows it. The 24-year track record shows the long-term effect of good governance, but a short to mid-term update reinforces that they aren’t locked into projects that will reduce distributions going forward.

These are solid numbers, and an expanding business will provide expanding distributions going forward. Plus, they can always add more in time.

This is all a bit dense. Yet it shows a company riding high on strong energy prices that is bringing decades of expertise to bear.

The current 7.3% distribution ratio indicates that strength even as energy investments are riding high in the markets. This is a company that will continue to return money to its investors regardless of what comes in the coming years.

Get High Yields While They're Hot, But Stay Vigilant

Both Pioneer Natural Resources Company (NYSE:PXD) and Enterprise Products Partners L.P. (NYSE: EPD) are fantastic companies for shareholder return on investment for now, but it can change.

They’re high-yielding energy companies and their investors will continue to see a return on investment in the short-term that is unparalleled.

However, we want to keep a couple factors in mind.

First, energy costs are fueling (sorry for the pun) their high yields. These companies are seeing high earnings and free cash flows that support these large payouts to investors. If prices collapse, payouts may as well.

Second, we want to consider debt. Debt ratios are falling for both companies, but if interest rates for corporate bonds increase, as they have in other sectors, it can undermine top line results.

For now, these factors seems to be manageable. While they are, investors are pulling in historically high yields from both with the potential for reinvestment of earnings to support future profits for years to come.

Take care,

Adam English