- Michael B. O'Higgins and Beating The Dow

- The Dogs of the Dow Explained

- Dogs of the Dow Results

- Wrapping it Up and a Dividend Alternative

I have a brother who's a mathematician. And he's highly skeptical of math.

He isn't jaded. His skepticism comes from what math aims to do. He views it as a tool. What the math aims to do is as important, if not more, than the answer it gives.

In other words, finding a meaningful equation matters more than any meaning of the number you get to at the end.

Another way, again – are you even asking the right question?

A legendary investor aimed to frame the right question, and his solution has been controversial for over 30 years. Yet it remains one of the most compelling takes on value investing.

He coined the term “Dogs of the Dow.” If you're interested in finding hidden gems in plain sight, you should know about it.

Let's dig into the details and what's involved, with some examples, and take it from there.

Michael B. O'Higgins and Beating The Dow

So, who tried to ask the right question, and what meaning did he try to find?

Back in 1991, Michael B. O'Higgins published a book, Beating The Dow.

Here's a self-published biography:

In 1991, Michael B. O'Higgins, one of the nation's top money managers, turned the investment world upside down with an ingenious strategy, showing how all investors–from those with only $5,000 to invest to millionaires–could beat the pros 95% of the time by putting 100% of their equity investment into the high-yield, low-risk “dog” stocks of the Dow Jones Industrial Average.

His formula spawned a veritable industry, including websites, mutual funds, and billions and billions of dollars worth of investments.

In the process, he established a simple mathematical equation that excluded much information others considered critical.

The answer he aimed to get and how he did it seemed too simple to many.

It removed a lot of information others considered necessary. It moved a lot slower and encouraged people to do nothing for long stretches of time.

Here is the basic version…

The Dogs of the Dow Explained

The “Dogs of the Dow” system is almost more about what is excluded than anything else.

First, ignore all other stocks except the Dow 30; there used to be some 8,000 in the mid-1990s when he wrote his book.

Then take the Dow 30 companies' dividend payments and divide them by the share price.

That calculates a simple dividend yield. Then, of those thirty companies, only invest in the ones with the highest dividend yields once per year.

The goal is to isolate companies that are undervalued compared to their peers. That's a common enough goal.

However, how much he chose to exclude in his equation was wildly contentious. Surely, people reasoned, more information was necessary.

These are already companies that get a lot of attention. Plus, they are all huge, with market capitalizations in the billions. What they do is already closely watched.

Michael B. O'Higgins said you should ignore all other factors. Once a year, divide dividend yield by share price and change your allocation.

That is it. Nothing more.

Changes to price versus earnings? Gone. Price versus book value? Same. Future revenue projections? Not an issue.

Ignore it all.

Large drops in share price that drive up relative dividend yields? It supercharges the system without any need to accommodate why.

That is the “Dogs of the Dow” system, short, simple, and wildly reductive.

Imagine going through all of 2022, where the Dow 30 lost nearly 9%, and someone told you it meant nothing at all. Ride it out. Shift some money around at the start of 2023. Touch nothing until 2024.

Only the bottom ten of the Dow 30 based on dividend yield matters once per year.

Dogs of the Dow Results

As hard as it is to accept, this once-per-year reallocation can be tracked.

Pick and choose your date, but the first of the year is pretty easy as a benchmark.

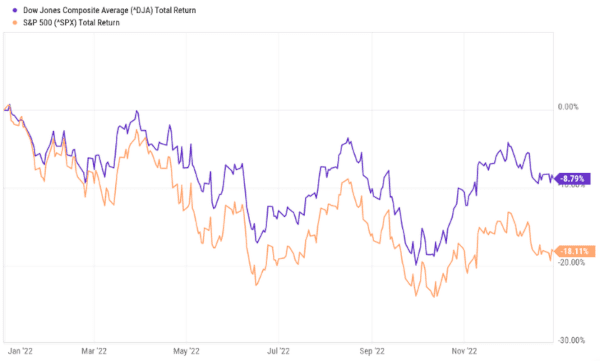

In 2022, The Dow Composite Index was down 8.79%. The S&P 500 was down 18.11%

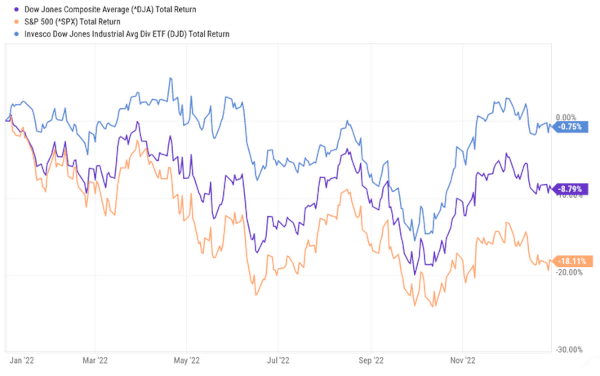

Let's look at that compared to an ETF weighted for the highest-paying Dow component companies by dividend yield.

We're using the Invesco Dow Jones Industrial Average Dividend ETF (NYSEArca: DJD) as a proxy here. It is far from perfect, but it is a convenient way to prioritize the high yields of Dow companies in a one-stop-shop.

It isn't pretty, but it is a difference of over 8% compared to the total return of the Dow and over 17% compared to the total return of the S&P 500.

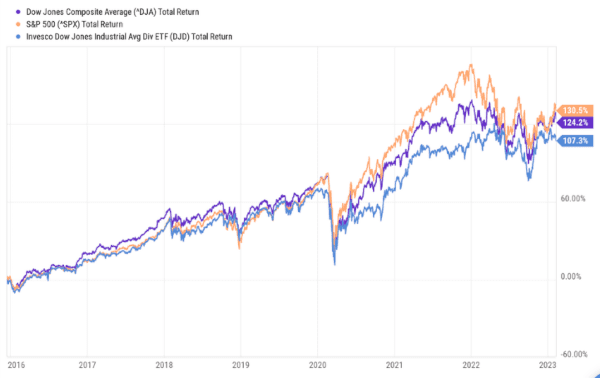

The longer-term charts are clear that the strategy isn't always going to outperform.

Let's look at a chart going back to the end of 2015 to see how that looks.

The dogs of the Dow are not as impressive here. They trail the larger indices during bullish years.

They are, after all, the ten companies with the highest yields, and a large part of that is how their share prices aren't keeping up with the rest of the pack.

Wrapping it Up and a Dividend Alternative

The Dow Dogs hold up well for such a simple system that ignores so much data. It's especially true when we're bombarded with so much market uncertainty.

Even with inflation and wild daily, weekly, or monthly market movement, the dogs of the dow show potential in a unique way.

All that data and speculation don't matter as much, with a focus on long-term trends.

It is far from the only system to do this, though.

A prime example is dividend aristocrat stocks. They are stocks that have grown dividend payments annually for at least 25 years.

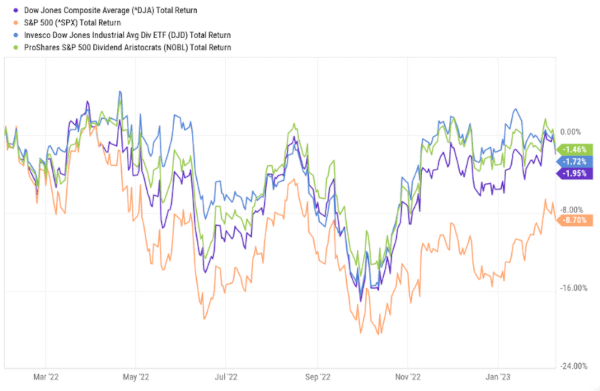

Here's one last chart dating back to February 2022, when the Federal Reserve first started increasing interest rates at an aggressive pace.

This chart adds the ProShares S&P 500 Dividend Aristocrats ETF (BATS: NOBL) to show that we can use other long-term tools that capitalize on long-term trends.

They may be more complex, slightly, but a long-term outlook can be defined in many ways. We need not stick to one.

The dogs of the Dow are a very interesting way of looking at the market, nonetheless. Here's hoping it helps show how purposely removing a lot of information – often pointless, anxiety-inducing noise – can reveal a valid, if contentious, market strategy.

Take care,

Adam English

The Profit Sector