What is the Boston Blackout of 2023?

What Will Cause the Boston Blackout?

Porter and Company’s 3 Natural Gas Stocks to Own Today

Who is Porter Stansberry?

What Does Porter and Company Offer?

Here is the Pitch

In late October, a troubling letter landed on the desk of President Biden.

“As both an energy company CEO and a lifelong New Englander, I am deeply concerned about the potentially severe impact a winter energy shortfall would have on the people and businesses of this region.”

Eversource CEO Joseph R. Nolan Jr., top executive of one of the largest energy companies in New England, called for invoking emergency measures through the Federal Power Act. His letter highlighted an increasing reliance in New England on foreign-sourced liquefied natural gas at a time when there is little to buy as Europe faces its most severe energy crisis in generations.

That makes the most recent offer from Porter and Company all the more prescient.

Porter and Company call it “Boston Blackout 2023”. Let’s look at what kind of investment is discussed, who and what Porter and Company are, and what they offer.

What is the Boston Blackout of 2023?

New England faces the same threat as Europe if this winter is bitterly cold. There is a real possibility that it will run out of its reserves of natural gas and not be able to bring in enough to keep the power on for homes and businesses.

The risks are across the board: no light, no heat, no refrigerators, no wi-fi or internet services, and a functional return to the 19th century.

Outside of the obvious threat to the health and well-being of the people, New England is an economic powerhouse, contributing over $1.2 trillion to the USA’s GDP per year, or about 5% of the total US GDP.

A hit to the region at a time when the country is teetering on recession and is fighting stubbornly high inflation presents a threat that would ripple across the nation, especially if natural gas prices spike in the manner they have in western Europe.

Citizens may need to abandon their homes and flee to shelters. Food cost increases would worsen as regional production and distribution is crippled and spread across half the nation.

There is no easy way to replace natural gas, as seen in this chart.

Twenty-five years of steep growth in power capacity in New England comes from increased natural gas consumption.

It all raises the question, ‘how could this situation get so bad in one of the richest parts of the richest nation in the world?’

What Will Cause the Boston Blackout?

The underlying cause is nearly as old as New England’s surge in reliance on natural gas.

As with so many things these days, it comes from years of increasing, often intentional, neglect through politics.

Despite the massive growth in reliance, politicians have refused to increase pipeline capacity going into New England.

Even though the Marcellus Shale natural gas fields in Pennsylvania have seen explosive growth over the years, no significant new pipelines have been built since 2008.

The pipelines in place are aging and at max capacity. LNG Imports have surged from overseas, sending billions of dollars out of the country to anyone with fuel to offer, including Russia.

As Porter and Company put it, “experts estimate such policies have already cost New England residents over $3 billion in higher energy costs compared to consumers in Pennsylvania.”

Money has poured into renewable projects and power generation, but it is like a relay race. The baton needs to be passed very carefully at just the right time. Simply put, New England has failed to do this in a way where natural gas imports could keep up with growth while other power sources get up to speed.

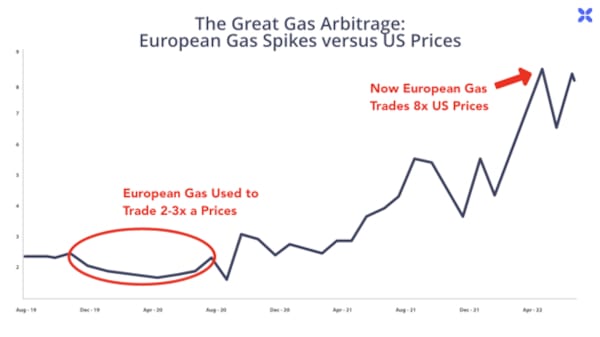

What makes this even more absurd is how cheap natural gas is in most of the USA compared to western Europe.

If New England needs to compete with Europe for international LNG shipments, there is a real possibility of regional prices rising to match these budget-breaking prices.

Porter and Company’s Three Natural Gas Reports

A key aspect of Porter and Company’s Boston Blackout 2023 presentation are three reports covering different companies to use this new, yet seemingly inevitable, arbitrage profit opportunity to your advantage:

- The Gods of Gas,

- The Next LNG Giant,

- and Energy Royalties

“The Gods of Gas” focuses on a small, independent oil and gas firm founded by three brothers and centered in the Marcellus Shale that is slated to land the first international end-to-end production and distribution deal for American shale gas.

According to Porter and Company, “it could soon be the world’s biggest and most important energy company,” and they “wouldn’t be surprised to see the “Gods of Gas” earn returns of 10x or more over the next ten years.”

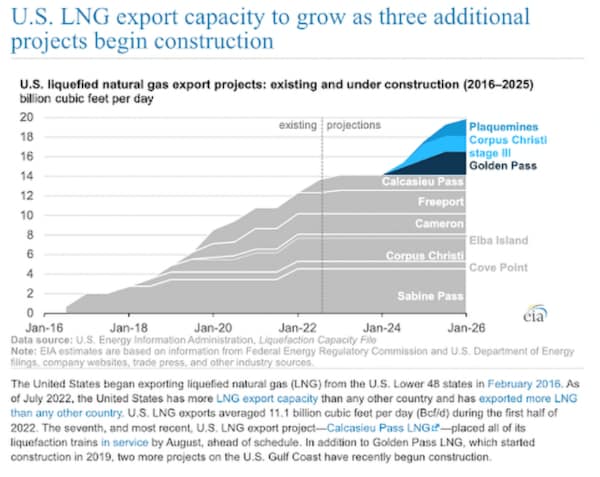

“The Next LNG Giant” focuses on LNG export capacity through terminals. Despite all the natural gas the USA extracts, only eight export terminals are running in the nation.

Two other LNG plants are approved and under construction, and Porter and Company hone in on one of them – fully permitted and under construction by a small company few, if any – could name. The potential is massive, with a spike of LNG exports on the way.

America only started exporting more gas via LNG than by pipeline for the first time in 2021.

There is no substantial link between these businesses that own both gas production and LNG distribution networks are not related. There are no vertically integrated businesses that are highly efficient and capture all of the profits involved. That is going to change.

Finally, there is the “Export Royalties” report, which goes into an easy way to capture ongoing and lucrative royalties, following in the footsteps of an energy sector legend.

T. Boone created the first energy trusts primarily for tax reasons, but the advantages of these structures go well beyond tax benefits and persist to this day. You’ll get all of the background and know-how needed to get involved.

Who is Porter Stansberry?

We've covered a lot of information about some bold predictions, so we owe it to ourselves to look at who is making them.

Porter Stansberry is an investing and financial sector legend in his own right.

He’s been active in the financial advisory sector for over 25 years, founding multiple companies, including Porter and Company, Stansberry Research, and MarketWise Inc.

Porter and Company, in particular, takes on the model of a boutique research and analysis firm founded in April 2022 after Porter Stansberry retired as MarketWise’s Chairman of the Board.

It marks a return to his roots, with a highly-focused, independent small team making bold predictions for a select group of readers.

What Does Porter and Company Offer?

Along with the three reports mentioned above, Porter and Company are offering a package of subscription services.

Bi-Weekly Investigative Reports

Every other Friday, The Big Secret on Wall Street (This Week) will lay bare the most essential (yet often hidden or overlooked) opportunities in the markets.

Presented in plain English, not Wall Street jargon, you’ll have exclusive access to all of the analysis from Porter and his team of experts.

The Big Secret Library & Exclusive Investment Guides

Along with the three reports above, you’ll have access to in-depth research reports from Porter and his team across a range of topics, Including:

- The Goldman Sachs of White Trash

- The Secret Behind T. Boone’s Fortune

- Grab a Bucket: It’s About to Rain Gold

- The End of America

- The Guide to Property & Casualty Insurance Investing

- The Guide to Capital-Efficient Investing

- The Guide to Distressed Debt Investing

- The Big Secret Portfolio

Getting up to speed on Porter and Company’s investments is a snap for new subscribers with immediate and constant access to information on stock picks from The Big Secret on Wall Street (This Week) in the model portfolio, along with all updates from issues and special alerts.

Private Invitations to Porter’s Farm

Porter & Co. operates directly from Porter’s farm, and he often hosts invitation-only events.

This is your chance to sit down with like-minded individual investors – at a gorgeous historic estate in Maryland – and hammer out the best possible wealth-building strategies for the coming years with speakers, food, drinks, and entertainment.

If you can’t be there in person, you’ll always have an exclusive digital access pass to attend remotely.

Here is the Pitch

Typically, a subscription to The Big Secret on Wall Street (This Week) is $1,425 per year, but as a special offer to soon-to-be Founding Members, you can join for only $1,000.

That works out to $41 per issue, not including the extra reports and coverage mentioned above.

Plus, it comes with a 30-day full refund guarantee.

It’s a unique and compelling offer for a time-sensitive existential crisis in New England. One of unprecedented concern for even the top executives of energy firms that are reaching out to President Biden to raise the alarm.

With the discount and full refund guarantee, it is also a unique opportunity to join a top-tier boutique firm led by a legendary figure in the financial advisory sector.

![[Review] Boston Blackout 2023, Porter Stansberry and Company & New England’s Natural Gas Crisis](https://theprofitsector.com/wp-content/uploads/2022/12/boston-blackout-2023-header-image-750x375.jpg)

![[Revealed] Dr. David Eifrig: “America’s #1 Retirement Stock”](https://theprofitsector.com/wp-content/uploads/2023/10/RetirementMillDoc-360x180.png)