In This Article:

- The Long Arc of Energy Demand

- Energy & Inflation – A Distorted View

- What War Hides in the Sector

- Three Energy Stocks with Long-Term Potential

- Where Energy Consumption and Stocks Go From Here

No one still visits the Oracle at Delphi, built around a unique and eternal flame, but we certainly fret about how what fueled it can change the future to this day.

Mysteries and mysticism centered around gas predate written history.

Over 2,000 years ago, bamboo pipes were used to reroute and burn natural gas seeps in China.

Over 260 years ago, the first worthwhile oil strike near Titusville, Pennsylvania, changed the course of American history.

The history of energy is a history of discovery, abundance, extraction, and application. Venting gas that the ancients found already on fire. Striking oil gushers in deserts and farmland. Fracturing rocks thousands of feet deep by force-feeding fluids into the ground.

Times change and no wildcatters are cranking augers until oil rains down on them. The nature of fossil fuels has irreversibly changed.

As this eons-long energy market has matured, it has become a matter of efficiency: capital, refining, geopolitics, and market forces.

We've just gone through a kind of reset of the energy market, minor as it may be in the long arc, but with profound implications for how we use what remains the lifeblood of the global economy.

Here is a rundown of the energy sector…

Where it was, where it is, where it will be, and three stocks to watch as it all pans out.

The Long Arc of Energy Demand

At the risk of being overly simplistic, scientists and engineers have become good at extracting maximum potential from burning things.

A lot of that has to do with modern materials and design. Trapping heat and pressure for modern-day alchemy like concrete and plastic production, computerized internal combustion engines, or closed systems feeding kinetic energy to turbines that – in turn – convert it to mechanical force, then convert that to electricity.

From smelting furnaces that reach temperatures over 5,000 degrees Fahrenheit to constant all-time high efficiency from turbines over 63%, our modern economy is approaching the physical limits of what we can do with really hot things.

Yet what remains to be solved is stubbornly problematic. Transportation and energy-intensive refining, machines that are decades-old, with designs not updated for over half a century, and that are not well-maintained. The list is long.

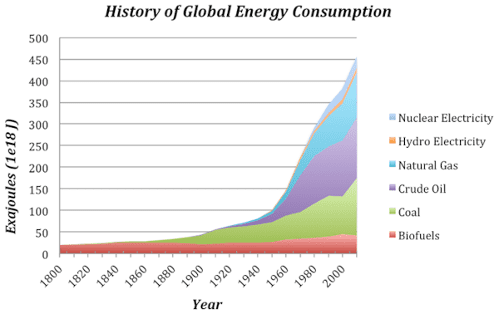

In spite of greater applications and efficiencies, demand always seems to rise with population, wealth, and technology. For this, we can use global numbers to average out all the factors, though short-term trends matter.

We'll get to that later.

The long arc of history shows an insatiable demand for more fossil fuels, short and simple. Our entire economic system is built around it.

In the short term, things get more complicated…

Energy and Inflation – A Distorted View

Before we get into the nuances of current energy sector issues, we should address a driving force in the sector.

Energy costs and inflation are bound together more than just about any other factors in any economy, domestic or global.

There are some wild swings, and it certainly hurts to pay more at the pump or for household energy bills today than several years in the past, but the numbers don't lie.

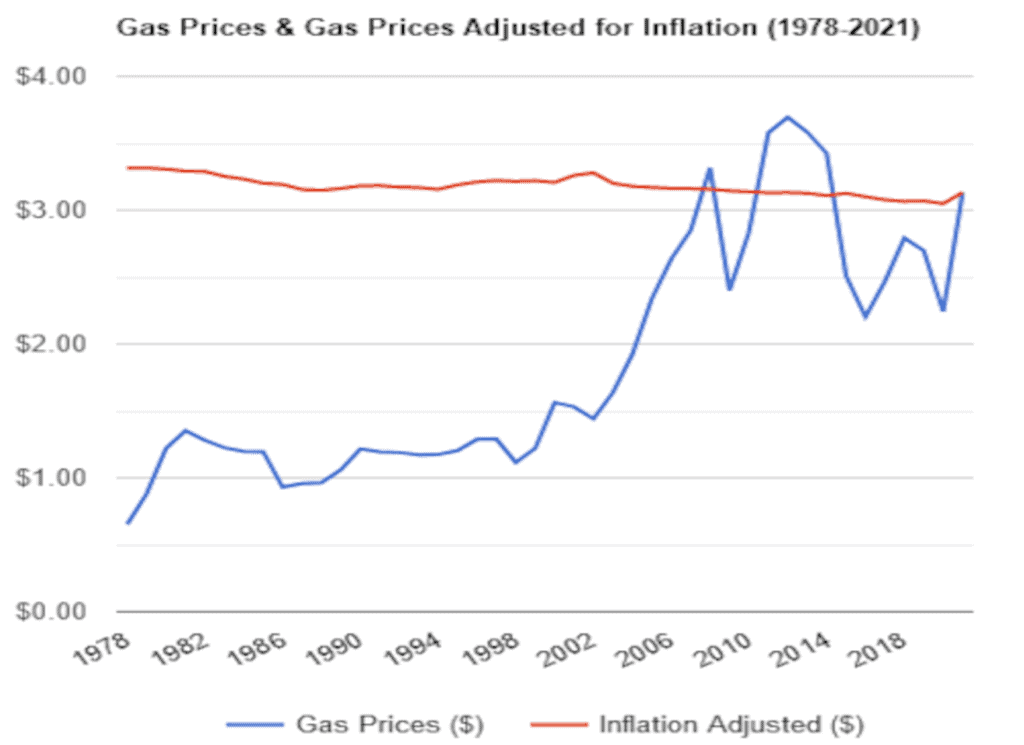

Gasoline:

First up, here's a look at gasoline in the USA. The average price for a gallon of gasoline was $4.205 per gallon in August 2022. It was still up 20% from the start of the year but saw a roughly 12%. drop from just a month prior.

What's more useful to track is price adjusted for inflation:

The short version is that, while gasoline prices have increased in the last several years, we were paying relatively more for decades. The long arc (red line) is relatively flat and downward.

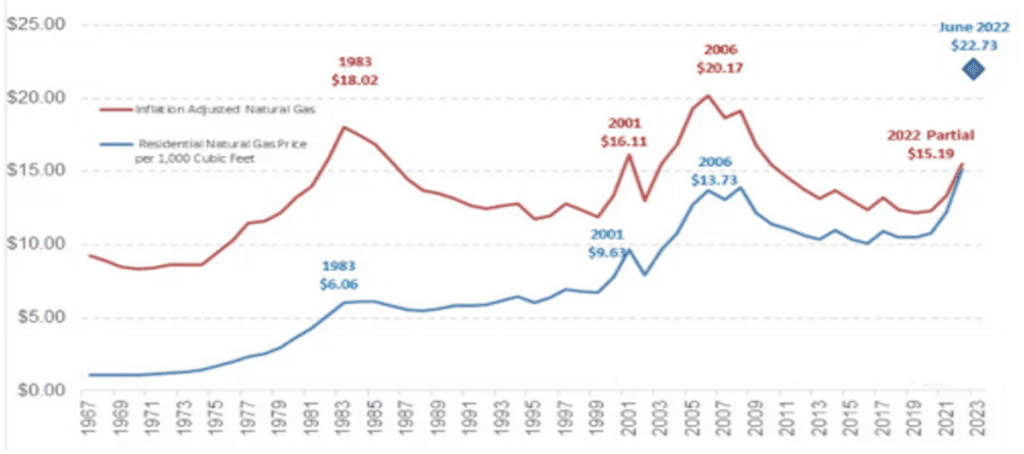

Natural Gas:

Here is a slightly different style of chart for natural gas. Again, relatively cheaper in the past compared to today.

Both charts show a reality no one wants to address: Energy costs have not kept up with inflation for decades.

What War Hides in the Sector

Our recent energy cost dilemma isn't the war in Ukraine per se. Or sanctions. The root problem is cost volatility and supply insecurity coming off of historic low levels. There is no easy fix. We're in this for many years to come.

You can take your pick for factors involved in the recent soaring prices, but a handful of constants are apparent.

- First, OPEC has been reluctant to increase production after years of low oil prices. Oil companies have been happy to return profits through dividends and share buybacks after years of reductions and tons of lost money.

- Second, supply chain costs trickle down from the source. There is a good reason why inflation is high in some categories more than others. The more components of a product move before reaching the final consumer, the worse it gets.

A haircut may cost more, but they're passing on wage, rent, tax, and electricity costs. It certainly isn't the scissors or smock that heavily weigh.

A computer chip going into a car is far more complex. The silicon board may be made in China, shipped to Korea for circuitry, shipped to Taiwan for chip installation, shipped to Mexico to be built into a component, shipped back to Taiwan to integrate better chips that control components, then shipped to the USA to be installed into what seems to be simple, like the tire pressure sensor in your car.

The fallout from the Ukrainian war in the energy sector is a mismatch of inefficiency in the global economy. We're starting to pay considerably more money to move anything and everything around than we have in decades because where we built, everything was dependent on cheap energy costs.

That is the third thing to note: globalization and historically low prices have created regional dependencies that will require massive investments to break…

- Computer chips are overwhelmingly made in Asia.

- Africa and southeast Asia are seeing rampant food cost inflation because cheap wheat and food oil aren't flowing as they used to from Eastern Europe.

- Most noticeably in the headlines, Europe is painfully dependent on natural gas from Russia to heat homes. Also to make concrete, smelt steel, press aluminum into car frames, and provide raw materials for everything from derivative fuels like acetylene for welding down to the tiniest plastic widget.

Cut energy supply, and it isn't just a matter of production… It becomes a cascade of issues that becomes impossible to manage when it comes to what matters to people – wages and jobs, transportation, lending rates, medicine, or even just a pint or glass of wine to cope with it all.

Three Energy Stocks with Long-Term Potential

With all of this volatility and uncertainty, there is room for investors to find some certainty.

As investors, all of the factors above can refine our focus going forward and highlight some clear opportunities…

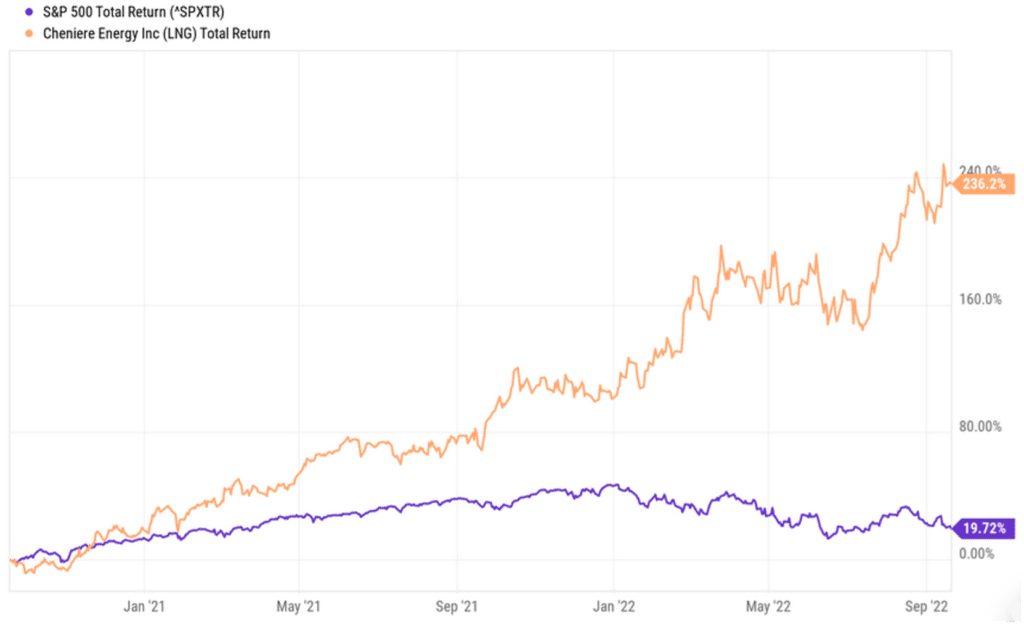

Cheniere Energy, Inc (NYSEAmerican: LNG)

First, we have a stock that we simply cannot ignore.

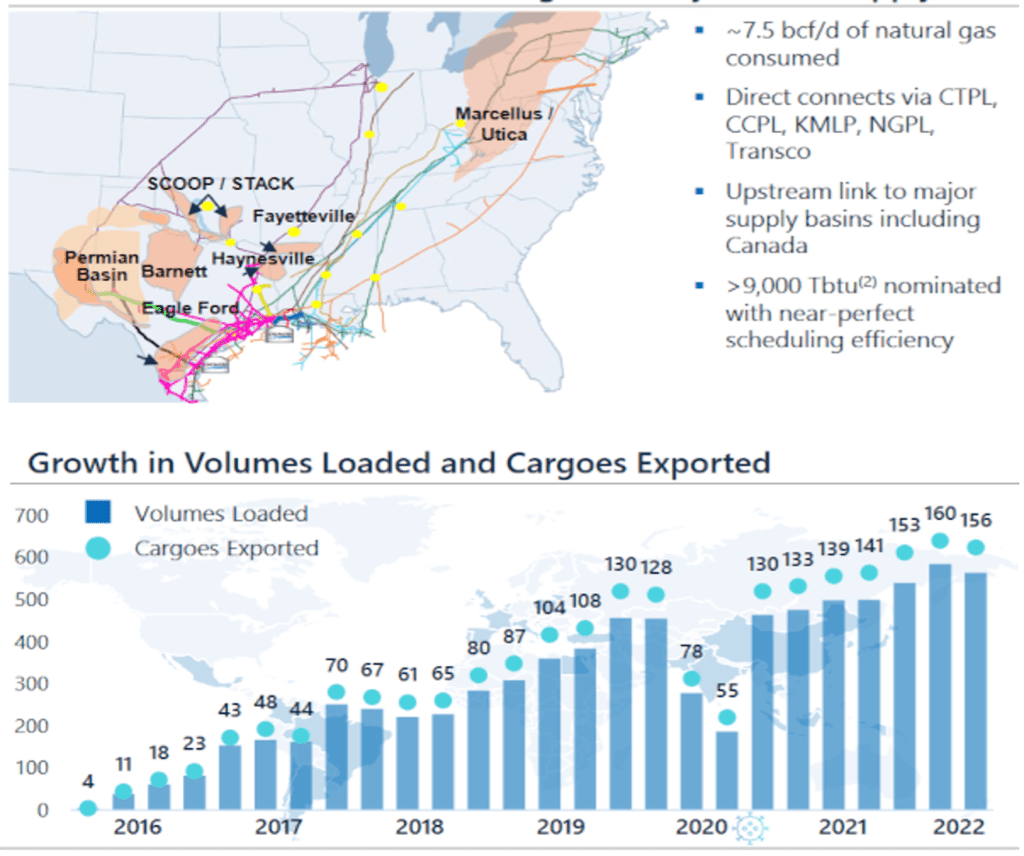

Cheniere Energy, Inc (NYSEAmerican: LNG) has been at the forefront of USA natural gas exports from when people straight up laughed at them for continuing to pursue such capital-intensive projects when a disturbing amount of natural gas was just being burnt off out in the fields.

No other company is better positioned to take advantage of arbitrage pricing between the USA, Europe, and Asia.

Its original terminal, Sabine Pass in Louisiana, has six fully operational liquefaction units, good for about 30 million tonnes per year of LNG.

Its Corpus Christi, Texas, facility has three operational terminals good for roughly 15 million tonnes per year of LNG. This location is a key focus as it aims to increase LNG production and exports by an extra 10 million tonnes per year of LNG by 2025.

This is as close to a pure play for USA natural gas exports as you can find. It's treated as such by investors, and its share prices rise and fall on overseas demand and capacity.

In recent years, especially with the energy crisis continuing to play out in Europe, it has done exceedingly well, though it does not offer a sizable dividend – 0.8% – or a dividend reinvestment plan.

Enterprise Products Partners LP (NYSE: EPD)

Second, we have a domestic company with a strong position and a structure built to return money to investors.

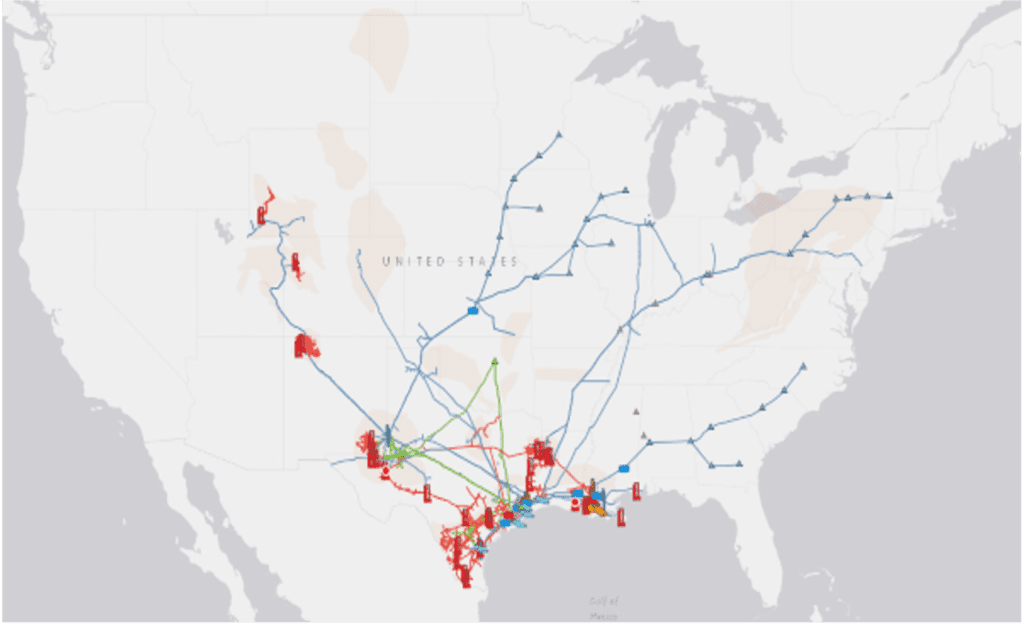

Enterprise Products Partners LP (NYSE: EPD)is one of the largest mid-stream pipeline companies in the USA, with facilities built around critical hubs.

With about 50,000 miles of pipelines moving oil, natural gas, and a long list of related products, Enterprise Products Partners is in a strong position for scale and scope.

It also owns facilities or access to key terminals along the Gulf Coast, plus barges, coal terminals, and other capital-intensive, heavily regulated assets.

One of the key advantages of EPD is its steady and sizable cash flow. It has supported constant payouts to shareholders – a key metric for MLPs required to return almost all profits to shareholders – while expanding its footprint for 23 years and running.

It's continuing to expand its revenue base with a $3.25 billion cash acquisition of Navitas Midstream Partners for 1,750 miles of pipelines and cryogenic natural gas processing facilities in the Permian Basin.

At the time of publication, EPD is returning a roughly 7.5% dividend yield, maintains a dividend reinvestment plan (DRIP), and is easily outperforming the broader market:

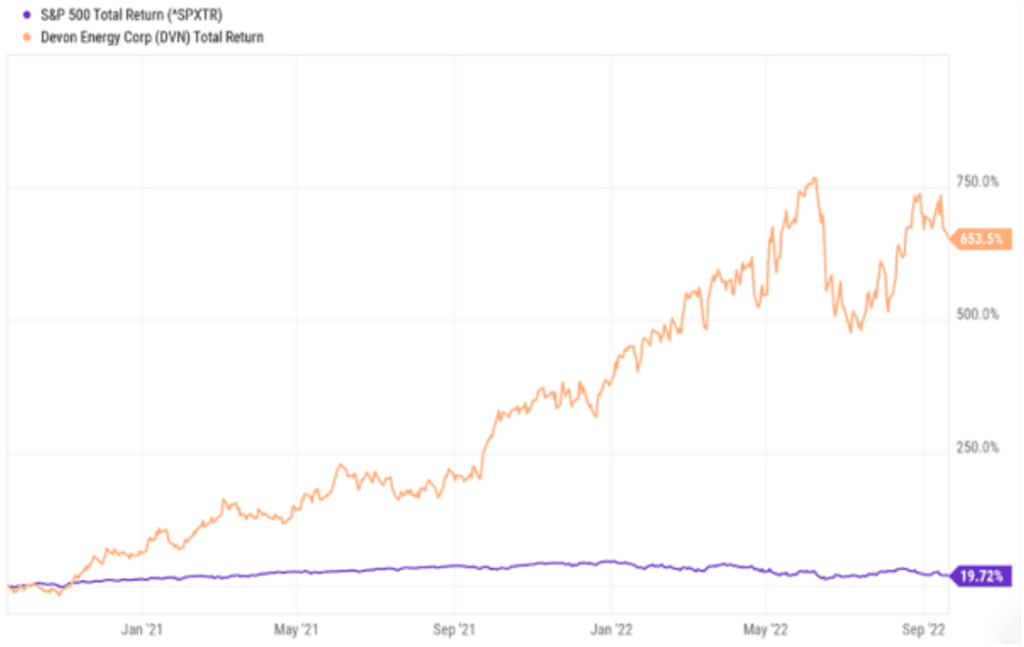

Devon Energy Corp (NYSE: DVN)

The big players in the oil game are well known. There is no need to talk about Exxon Mobil and Chevron here.

It makes more sense to bring attention to one of the far more interesting plays – Devon Energy Corp (NYSE: DVN).

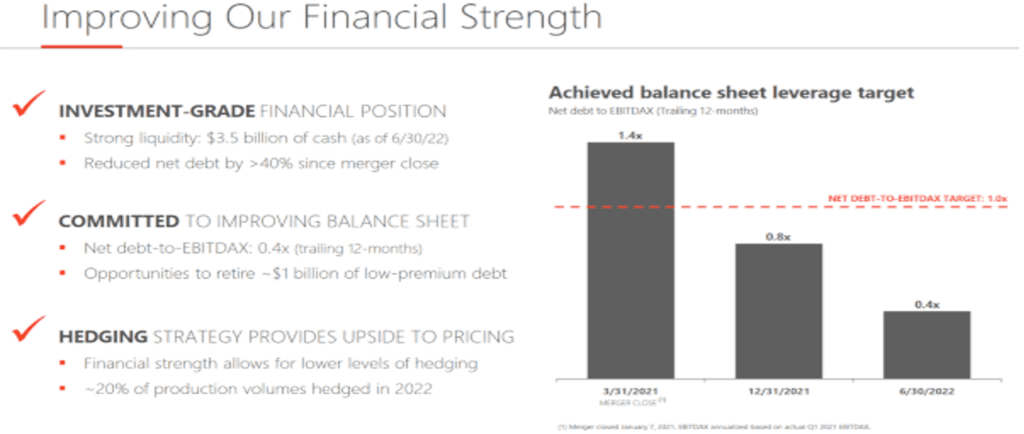

It struggled for a while as it completed a large merger and has consistently improved its balance sheet. Something very important in a time of rapidly rising interest rates.

It also has built a very unique way to provide payouts to shareholders. Devon Energy has a fixed plus variable dividend system.

It is fully committed to a set payout per share, as is normal for traditional dividend stocks. It also has a system to provide variable windfall payouts through variable additions to shareholders based on its free cash flow. Up to 50% of its quarterly free cash flow can be disbursed.

The combined payouts have exceeded what is functionally a 10% dividend yield with recent disbursements, while it has returned value through a share buyback program designed to reduce outstanding shares by 4%.

This could be an issue with share value. Plenty of shareholders may bail if the kind of windfalls that oil companies have seen fall off.

What counters this short-term risk is a dramatic improvement in Devon Energy's balance sheet.

This is a strong response to a company that found itself at a tipping point. Its peers were outperforming in financial metrics, and it was stuck in a costly merger process.

It learned fast, and it learned well. Fortunes change quickly in the energy sector, but Devon is one of the best companies in recent years for responding responsibly.

Where Energy Consumption and Stocks Go From Here

Whether we like it or not, the energy sector remains completely dependent on fossil fuels. If anything, more so than ever.

Emerging markets are collapsing under high fuel costs, food costs, and inflation. Europe is hemorrhaging money to try and mask its critical flaw while already at troubling debt levels.

The global energy market is facing geopolitical risks with countries and companies trapped between costs that spiral upwards and outlooks spiraling downwards. The war in Ukraine is a smoldering dumpster fire, and things can get far worse in winter if Russian energy exports go lower.

In the meantime, energy companies – at least the responsible ones – have cleaned up their balance sheets, are returning money to shareholders, and are leveraging experience from years of volatility from other forces to weather another storm.

Few sectors offer the same potential for dividends, including dividend reinvestment programs, multi-year stability even in the face of inflationary pressure, and total returns to investors.

Take care,

Adam English

The Profit Sector