In this Article

1) What is a REIT?

2) Sometimes, a Cigar is Just a Cigar

3) Healthy Income: Healthcare REITs

4) Fun Money: Entertainment REITs

5) A Stash House for Cash: Cannabis REITs

6) Closing

Have you ever been a landlord?

I have, and I have to say — it stinks.

The calls in the middle of the night because the basement has flooded… The weekend trips to fix a backyard fence… The electrifying experience of shocking yourself while installing a ceiling fan…

All those things happened to me when I rented my old house. I could go on and on, but I’ll get to the point. Despite all of the years of the inconvenience of renting a property, there is one thing I do miss: plenty of extra cash coming my way.

That’s why I suggest investing in a much easier, more fruitful, and stress-free way of creating income from rental spaces. And you won’t even have to leave your house…

I’m talking about Real Estate Investment Trusts. You may have heard of them referred to as “REITs.”

REITs, if you are unfamiliar with them, utilize a unique company structure with massive tax advantages.

A REIT is a company that owns and typically operates income-producing real estate. That means any space that produces rent and money for the owners. Anything from office and apartment buildings to warehouses and hospitals, shopping centers, malls, and hotels — you get the picture…

The idea is to allow all investors to invest in large-scale, diversified portfolios of income-producing real estate — not just the wealthy who own the buildings.

To do this, REITs were designed with a structure similar to mutual funds and can be easily purchased like any other liquid securities.

To qualify as a REIT, a company needs to meet these criteria:

- Invest at least 75% of its total assets in real estate

- Derive at least 75% of its gross income from rents from real property, interest on mortgages, financing real property, or sales of real estate

- Pay at least 90% of its taxable income in the form of shareholder dividends each year.

- Be an entity that is taxable as a corporation.

- Be managed by a board of directors or trustees.

- Have a minimum of 100 shareholders

It is a simple formula and works out wonderfully for investors — especially investors who want some meaty checks coming to them every few months.

That’s because REITs pay out massive dividends.

Because they don’t have to pay income taxes on the dividends they shower investors with, the yields get pretty high — far more than you’d see from a typical blue-chip stock.

The National Association of Real Estate Investment Trusts (Nareit) has a REIT index that averages a dividend yield of 4.0%, more than double that of the S&P 500’s 1.9%.

REITs are also forced to pay out those dividends by law to maintain their status as REITs in the first place.

That makes for about as safe a dividend as you could imagine. I’ll outline three of the best bets below, but first, here’s a bit of history on REITs…

Sometimes, a Cigar is Just a Cigar

The first REITs were started in the 1960s. Congress created REITs in 1960 and enabled large and small investors to enjoy rental income from commercial properties. President Eisenhower signed them into law as part of the Cigar Excise Tax Extension.

While it was a strange name for the law, it was enacted to give all investors the opportunity to invest in diversified portfolios of income-producing real estate in the same way they could buy a stock.

“Sometimes, a cigar is just a cigar,” Sigmund Freud once said.

Essentially Dr. Freud was saying that sometimes things don’t need deep interpretation. Like investing in general, sometimes the simplest explanation is the most accurate, and this is most certainly the case for investing in REITs.

You buy shares in a company that collects rent from tenants. You become the landlord and make money whenever the owner does.

The first REITs to list were mostly mortgage companies, but they have grown into a sector that now sports over 200 different companies of all different kinds. There are two major categories for REITs: equity and mortgage.

- Equity REITs are those companies that actually manage properties. That includes office buildings, malls, hospitals… you name it. Equity REITs account for most of the sector.

- Mortgage REITs are the second type and are exactly what you’d expect. They loan money for other companies to other real estate owners to cover their acquisitions and make money by charging interest on those loans. It breaks down to owners or financiers.

So, what REITs should you be looking at today?

Healthy Income: Healthcare REITs

I think that healthcare REITs will be one of the major long-term drivers of income for investors.

The entire world is getting old. In case you haven’t noticed firsthand, here are some shocking facts about our aging population… Every year, over 3.6 million baby boomers are retiring. That’s 10,000 people every single day!

The U.S. Census Bureau reports that by 2060, 92 million Americans (20% of the population) will be 65 or older. 70% of the disposable income in the U.S. is in their hands. They drive at least $7.1 trillion in annual economic activity. That’s around 46% of the entire U.S. economy.

By 2032, this economic growth is expected to surpass $13.5 trillion. And that’s just in the United States… Baby Boomers are turning 65 and leaving the workforce at a rate of one every nine seconds. About 72 million of them make up 28% of the entire U.S. population.

By 2050, 81 million of them will reach retirement age. Not only is the country getting older, but we’re also getting healthier, which means it’s going to get older than ever before. By 2040, the number of people around the world over 65 will eclipse the entire U.S. population.

Healthcare REITs own real estate properties like hospitals, extended care facilities, or retirement homes. Retirement communities, senior apartments, assisted living, and all sorts of real estate associated with this demographic are sprouting all over the country. But the supply of these properties is still extremely low.

Demand will only rise as more Americans age. You see, the current growth rate of senior housing units is just 21,950 units per year. To keep up with demand, 60,000 units per year are needed. In other words, a 173% increase per year is required to meet the demand, which is projected to peak in 2044. According to the American Seniors Housing Association, six million boomers will need generation-specific housing.

Here is my pick for serious dividend income from Health-Care REITs…

Omega Healthcare Investors (NYSE: OHI)

Omega primarily deals in skilled nursing and assisted living facilities.

Its portfolio is operated by a diverse group of healthcare companies, predominantly in a triple-net lease structure.

A triple-net lease is a good thing for investors like us…

I’m sure we’ve all been in a situation where you’re renting a property, but you are a bit unclear about the bills you pay that are different from what your landlord pays. Perhaps you foot the bill for electricity and internet, but your landlord takes care of the water bill, insurance, and property taxes.

This arrangement is quite clear with a triple-net lease structure: the tenant or lessee pays all the property's expenses, including real estate taxes, building insurance, and maintenance.

These expenses are in addition to the cost of rent and utilities. In contrast, some or all of these payments are typically the landlord's responsibility in standard commercial lease agreements.

That isn’t the case with Omega. They provide healthcare properties and collect money from those leasing the property. This adds up to a win-win situation for investors. Their tenants are locked into contracts and responsible for all day-to-day payments.

But for you, the investor? All you have to do is collect a yield upwards of 8%!

Over the past five years, that healthy dividend has not been cut, even during the worst of the pandemic, which shows the strength of Omega’s balance sheet.

All told, Omega has run its streak of annual dividend increases to 18 years. Seven more years of doing so would put them in the company of the coveted “Dividend Aristocrats.”

Like many healthcare companies, the COVID-19 situation took a toll on the stock price. But since hitting a 52-week low in May, Omega has rebounded 32% and shows signs of solid returns going forward.

Omega Healthcare Investors (NYSE: OHI) Stats:

Market Cap: $7.76B

PE Ratio: 17.17

EPS: 1.88

Dividend Yield: 8.21%

52-Week Range: $24.81 – $33.99

Another REIT sector that has rebound potential is the entertainment sector.

Fun Money: Entertainment REITs

It’s no surprise that “experiential” entertainment stocks nosedived when we were all stuck at home during COVID-19. Theme parks, movie theaters, concert venues, and restaurants were all shuttered for over a year.

The lockdown conditions deprived us of those fun excursions that everyone needs to stay sane in good times and bad. But now, the virus has slowed to a point where people are comfortable going out, and those experiential locations are filling back up:

Consumers have been flooding into casinos, theme parks, restaurants, and resorts. In other words, they are out spending money on a good time.

Let’s have some fun with our portfolios, shall we?

EPR Properties (NYSE: EPR)

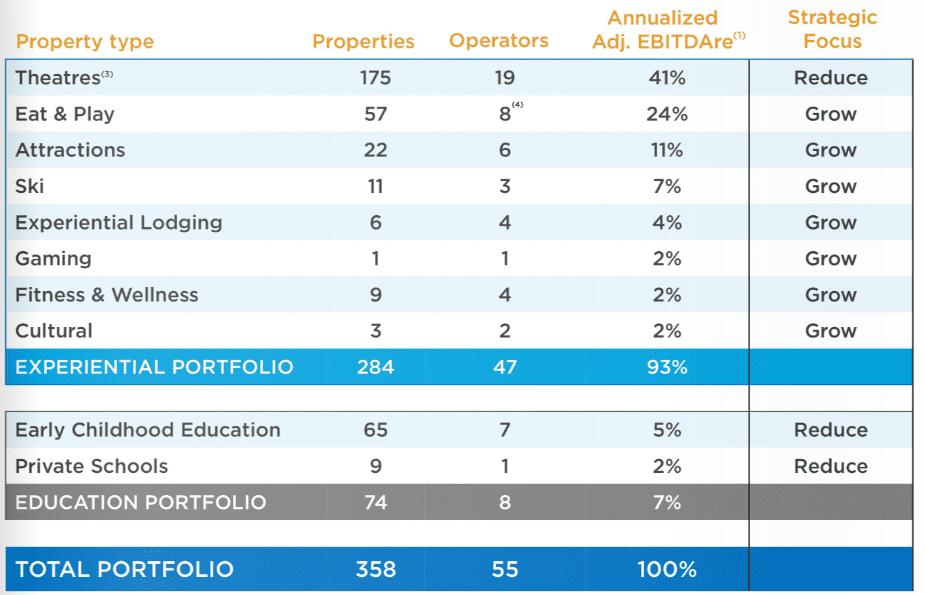

EPR Properties is a premier entertainment REIT. It sports a $6.6 billion portfolio in over 350 different entertainment properties across the country, everything from movie theaters and casinos to water parks and museums.

This makes it nicely diversified compared to REITs that only specialize in, say, health care or shopping malls.

Here’s a rundown of their entire portfolio:

The above image shows that EPR is highly skewed toward the theater segment. However, in their recently held Q2 earnings call, the company made a note of its desire to pull back on that area and focus more heavily on other experiential properties.

TopGolf is one example of a new niche experience they are betting on.

Now, while I enjoy a round or two here and there, I’m not what you would call an active golfer. It’s expensive, time-consuming, and weather dependent.

TopGolf, however, strips down the intricacies of golf to focus on the social interaction and fun factor of getting together with friends over dinner and drinks and whacking a golf ball around – whether you are a golfer or not.

It’s essentially a driving range mixed with a video arcade.

The demographics of Top Golf are also attractive: families, children, Millennials, and serious and novice golfers alike.

With over 30 million guests in 2021, their fun, flexible, all-inclusive approach to what used to be known as a privileged man’s game is expanding into every demographic imaginable. TopGolf’s 2021 full-year revenue hit $3.1 billion, a 97% increase compared to 2020.

It’s just one example of how EPR adjusts its portfolio of properties to match the fun customers crave. Gaming, concert venues, and museums are other examples.

While its high exposure to movie theaters carries some degree of risk going forward, the fact that they are recalibrating that sector of its properties will eventually pay off in the longer term.

The current slide in EPR’s stock has much to do with their movie theater business, so it is currently trading at a discount. EPR’s economics are solid for a long-term investment. They have an average of 14-year leases on their properties, their cost structure is very tight, and they have plenty of dry powder to acquire profitable properties over the next few years.

Oh yes, and they have a 7.8% dividend.

EPR also offers a dividend reinvestment program – or DRIP – which allows you to reinvest your dividends and take a long-term position that keeps growing. If you invest $10,000 in common shares, EPR will provide you with up to a 5% discount on your share purchase.

EPR Properties (NYSE: EPR) Stats:

Market Cap: $3.13B

PE Ratio: 22.86

EPS: 1.82

Dividend Yield: 7.82%

52-Week Range: $41.14 – $56.38

Let’s move to another high-ceiling REIT that operates in a rather non-traditional space.

A Stash House for Cash: Cannabis REITs

Would you ever consider renting your property to a drug dealer?

That was a bit of a setup. In the past, that would be an obvious red flag for any landlord. Fast forward to today, and legal cannabis sales have been one of the most lucrative industries to launch in the past decade.

19 U.S. states have legalized cannabis for recreational and another 19 for medical cannabis. Many more will eventually follow.

But the cannabis companies that provide the goods need something very important: a place to grow it. The problem is that setting up a large-scale growing operation can cost millions and millions of dollars. Upstart companies can’t always afford to do that — especially in the U.S., where financing from traditional banks can be all but impossible.

That’s why REITs could be such an important factor in the industry going forward. Enter…

Innovative Industrial Properties (NYSE: IIPR)

Innovative Industrial Properties was the first cannabis REIT listed on the NYSE — and one of the only cannabis-based companies allowed such a prestigious listing. The company has a simple premise: it acquires cannabis facilities and rents them out to licensed growers and producers.

These industrial real estate properties can allow their tenants to meet the quality standards for medical-use cannabis and provide the space and technology needed to run a successful cannabis company. Once it sets up its properties, it lands tenants who pay huge premiums for the space.

As the demand for cannabis grows with each new state that legalizes recreational and medical cannabis, the list of prospective tenants grows for Innovative Industrial Properties. It continues to acquire new facilities to bolster its portfolio of properties.

Currently, IIPR owns 111 properties in Arizona, California, Colorado, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Texas, Virginia, and Washington.

That adds up to approximately 8.7 million rentable square feet, including 2.1 million in rentable square feet under development.

It yields 7.89% these days, which is more than triple the average S&P stock. As federal legalization inches its way across the finish line, countless tenants will be standing in line to lease properties from IIPR.

With cannabis stocks beaten down across the board, there is nowhere to go but up for a safe company like IIPR.

Innovative Industrial Properties (NYSE: IIPR) Stats:

Market Cap: $2.47 billion

P/E Ratio: 17.40

EPS: 5.08

Dividend Yield: 7.89%

52-Week Range: $87.47 – $288.02

Closing

So there you have it: a rundown of REITs. Whether looking for high-yield, short-term income, or long-term retirement investments, REITs are crucial to any well-diversified portfolio.

Become a landlord. Collect some rent. Retire wealthy.

Godspeed,

Jimmy Mengel

The Profit Sector