In This Article:

- Food Inflation and Supply Disruptions

- The Ukraine War Spike

- The Bigger Issues

- Three Fertilizer Stocks

- An Overview

Agriculture has rapidly evolved in the last hundred years. Some changes are apparent, and some are not unless you know where to look.

From family farms being swallowed into corporate giants. From animal labor to tractors to $500,000 plus combines with GPS units and computerized controls. Just a couple of generations ago, farmers would barely recognize the tools and skills required today.

The dazzling array of tech and complex corporate machinations masks the real force behind modern farming. Fertilizers are a recent development as well.

There are three key mineral fertilizers: nitrogen, potash, and phosphate.

We're extracting potash and phosphate on grand scales. The business has evolved from small co-ops to extraction on a massive scale using the latest mining equipment and techniques.

Nitrogen fertilizers functionally didn't exist commercially until 1905 with the discovery of the “Haber Bosch” process. Through a dangerous process, nitrogen is pulled directly from the air and bound to ammonia to make ammonium nitrate.

All three have seen an explosion in production to keep up with demand. And while recent issues have made demand issues worse, it is clear that they will only grow in the long term.

Food Inflation And Supply Disruptions

Fertilizer production and prices were stable and low for a long time, languishing in a mostly forgotten corner of the commodities market.

That came to an end with the pandemic lock-down supply disruptions and ensuing food price inflation. After an initial drop in prices, fertilizer prices have soared since the summer of 2020.

While food and fertilizer transportation were prioritized via boat, road, and rail, increasing energy prices sent production costs soaring for both.

Then China, which produces about a quarter of the world's phosphates and an eighth of its nitrogen fertilizers, halted exports the following summer.

Prices soared even before the war in Ukraine made matters worse.

The Ukraine War Spike

An immediate consequence of Russia's invasion of Ukraine was another kind of lockdown, as trade through the Black Sea virtually halted.

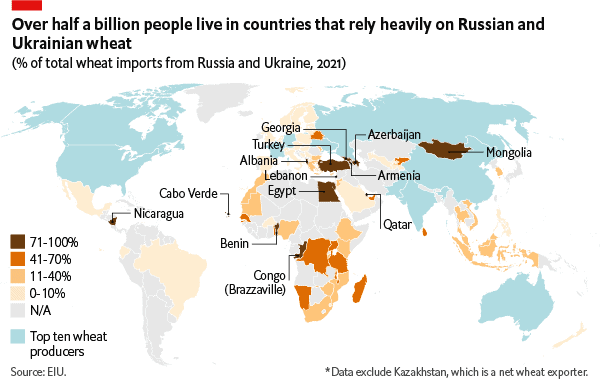

Together, Ukraine and Russia produce more than a quarter of the world's wheat supply. While no sanctions have been placed on food exports by the USA or EU nations, grain shipments from Ukraine virtually halted, and Russia changed its exports to bolster its agenda.

Even with a reopened trade route, Ukraine still cannot recover to providing its normal 10% of global wheat demand.

Sanctions have also been avoided for fertilizers, but the war is disrupting global supply. Russia and its close ally, Belarus, provided 41% of the global potash supply in 2020. Now they are retaining as much as possible and using supplies as geopolitical leverage over other nations.

To make matters worse, natural gas is a critical requirement for fertilizer production. The Haber Bosch process for creating ammonium nitrate is particularly power-hungry.

With a drop in Russian natural gas exports and the possibility of an outright ban by the EU or further export reductions by Russia, fertilizer production is at risk, and prices continue to climb.

The Bigger Issues

These recent disruptions and the resulting scarcity only worsen a long-term problem.

According to the International Food Policy Research Institute, around 75% of countries depend on imported fertilizers for more than 50% of their demand.

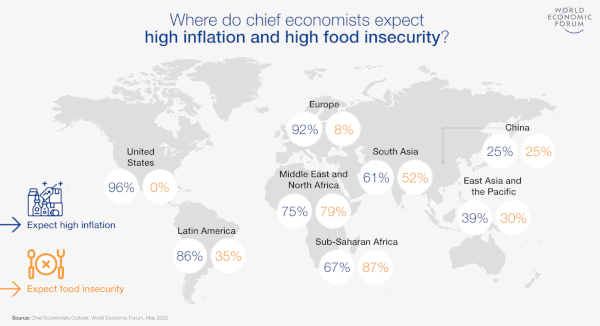

This makes food subsidies nearly impossible for poor countries already facing humanitarian crises, especially in the Middle East, Southeast Asia, and Africa. 36 countries imported more than 50% of their wheat from Russia or Ukraine in 2020. Global food inflation is creating a global humanitarian crisis.

As richer nations price out poorer ones to secure fertilizer and thus their food needs, local production in poorer nations suffers as domestic production declines and reliance on global food prices increases.

[You Might Also Like: Is Beyond Meat (NYSE: BYMD) Beyond Saving?]

All of this is evolving as the amount of arable land we can use for agriculture declines.

According to the United Nations Food and Agriculture Organization, only 12% of the global land surface is used for crop production, with little room for further expansion.

The FAO estimated a decline of 54 million hectares of arable land in 2011, and projections are for much more to become unusable by 2050.

Several far-reaching reports have all raised the concern that we're decades past peak agricultural land use.

Meanwhile, the global population is projected to hit 9 billion in 2050, a 49% increase.

The pressure on the remaining land to produce more food will only increase, creating a multi-decade surge in fertilizer demand.

Three Fertilizer Stocks

With short-term prices seeing continued upward pressure and long-term demand assured, now is an advantageous time to look at some key fertilizer investments.

CF Industries Holdings (NYSE: CF)

Founded in 1946 and headquartered in Deerfield, Illinois, CF Industries Holdings produces a range of nitrogen fertilizer products in the USA, Canada, the UK, and the Netherlands.

Though it started as a federation of local farmer cooperatives, it went through a charter and structure change in 2002 to become a publicly traded company and is a component of the S&P 500.

It sold off its phosphate business in 2013 to concentrate on nitrogen fertilizers, such as ammonia, urea, and urea ammonium nitrate. Today it operates 17 ammonia plants in nine facilities worldwide.

Unfortunately, soaring natural gas prices forced its UK operations to shutter due to unprofitability. In June 2022, it was forced to shut down one of the fertilizer facilities permanently. The UK has flirted with subsidizing it, but it has bigger fish to fry, with prices soaring at an unsustainable rate for industry and home use.

Natural gas costs continue to be an issue for CF Industries overall. Average costs in the first half of 2022 were more than double those in 2021. While this is a major concern for the company, it is far from alone. The entire sector is suffering. How companies adapt will be key in the short term.

In this regard, CF industries seem to be doing relatively well. It beat expectations in its second quarter 2022 results with earnings-per-share of $6.19 and revenue of $3.4 billion. Analysts expected $6.06 per share and revenue of $3.6 billion.

The long-term trend is strong as well. CF Industries continues to increase nitrogen fertilizer volumes and reduce outstanding shares through buyback programs with free cash flow.

Going forward, CF Industries expects to maintain a buyback program to return over $1 billion to shareholders on an annualized basis.

Further support for the long-term viability of this plan comes from the company hitting its long-term gross debt target of $3 billion this year, along with consistently improving financial metrics like free cash flow yield and enterprise value vs. adjusting EBITDA.

An ongoing risk exists for CF Industries' overseas facilities and their dependence on extremely expensive natural gas at risk of full-blown supply disruptions.

This is a long-term play built on the continuation of high fertilizer prices, ever-increasing demand – especially overseas – and consistent buybacks supporting share prices beyond its competitors. The 1.6% dividend yield will also consistently return some extra money directly to shareholders.

Nutrien Ltd. (NYSE: NTR)

Our next stock to watch is the largest market leader in the game.

Nutrien Ltd. is a Saskatoon, Saskatchewan, Canada-based producer of potash, nitrogen, and phosphate products, covering the full gamut of fertilizer types.

This is technically a very new company. PotashCorp and Agrium proposed a merger in 2016 to consolidate operations in the face of low fertilizer prices. The deal closed on January 1, 2018.

Since then, it has made some adjustments. In late 2018, Nutrien sold off its 24% stake in Chilean lithium mining company Sociedad Quimica y Minera (SQM) to satisfy China and India over potash market share concerns.

It acquired Australian retailer RuralCo and now owns just under half of the rural merchandise stores in the country.

In July 2022, it also announced it would acquire Casa do Adubo, a Brazilian retail fertilizer company, to expand its market share in Latin and South America.

This is being added to what, by any measure, is a massive company. With a roughly $45 billion market capitalization, it is over twice the size of CF Industries. It has a much more diversified portfolio across North and South America, Europe, Asia, and Australia.

While Nutrien has performed well for years and foresees strong results long-term, it barely met expectations for its second quarter 2022 results, posting earnings per share of $5.90 on revenue of $15 billion.

It also had to lower its estimates for total 2022 earnings per share from $16.20 to $18.70 to a range of $15.80 to $17.80.

Yet long-term growth is on track, and the company has shown consistent results as it expands its overseas operations and market share.

Nutrien is a big name, and investors are banking on that. In the last couple of years, it hasn't kept up with CF Industries and some other smaller competitors with regard to share price gains.

As the company recovers from a stumble, it presents an opportunity to pick up an undervalued company with the size and muscle to steadily expand its global operations and reach scales of the economy its competitors cannot. Nutrien also offers a 2.18% dividend yield.

The Global X Fertilizers/Potash ETF (NYSEArca: SOIL)

Our final selection is a broad play. While companies like CF Industries and Nutrien can jockey for regional and price advantages, one of the safest ways to invest in fertilizers to mitigate some of the ongoing supply chain and energy risks, all while capitalizing on long-term demand, is to buy a big basket of as many companies as possible.

That is exactly what the Global X Fertilizers/Potash ETF does by tracking the Solactive Global Fertilizers/Potash Total Return Index. This index is designed to include a maximum of 40 companies weighted by market capitalization. It has a broad range of companies in the fertilizer sector across all fertilizer types and exposure across the globe.

As an ETF, there isn't much else to note. It has one job and one job only – track the wide swath of companies by size and location – in this broad fertilizer index.

You should know the 0.7% expense ratio baked into the investment. However, it also comes with a 1.17% dividend yield and maintains a relatively small amount of assets under management – roughly $7.5 million.

The Global X Fertilizers/Potash ETF is a straightforward prospect for investors. By using this ETF, they may avoid some of the systemic risks that individual companies face from energy and supply disruptions by indirectly buying small stakes in 40 companies around the globe.

An Overview

All three stocks have their advantages and disadvantages.

- CF Industries Holdings (NYSE: CF) is primarily a domestic play, with most revenue coming from business in the USA. Its enviable low energy costs aren't large enough to shrug off European exposure. Its core business will do well, but it doesn't have the same global scaling potential and exposure as the next stock.

- Nutrien Ltd. (NYSE: NTR) is a global powerhouse with a balance sheet and corporate structure to weather the current economic climate, but its diversification is a double-edged sword. It has the scale to maintain global advantages but has struggled to compete regarding operating and profit margins.

- A broad basket of fertilizer stocks available through a single investment like the Global X Fertilizers/Potash ETF (NYSEArca: SOIL) removes a lot of the risk of single company investments, for better and worse. It ultimately plays on overall investment interest and fertilizer costs through diversification and dilution.

All have their place depending on how you want to invest in the short- and long-term demand for fertilizer. One thing is for sure, though…

What once was an ignored and undervalued corner of the commodities sector is seeing massive demand and renewed investor interest. That's something worth keeping an eye on for years to come.

Take care,

Adam English

The Profit Sector