- Soaring Energy Stocks, Inflation, and Interest Rates

- Financial Stocks, Classic Interest Rate Profiteers

- Dividend Stocks That Weather High Interest Rates By Design

- Beware External Forces but Know There's Money To Be Made

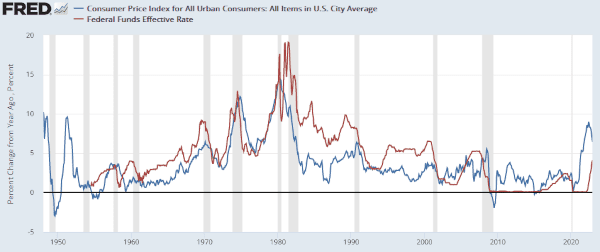

It's practically beaten into us…

Inflation up? Interest rates up? Stocks down!

Inflation has spiked for the first time in a generation. Interest rates are chasing it.

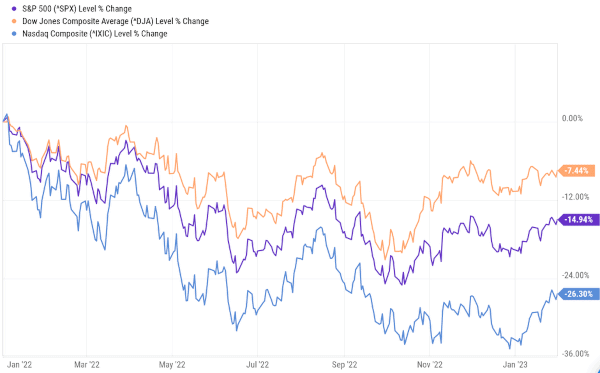

As for stocks? The “common knowledge” that they go down was beaten into us in 2022.

But that far from covers everything going on.

Interest rates only hurt those that pay more from them. Not every stock behaves the same when the broader market drops because of them.

Some do better than most. Some, at times, benefit from higher rates.

With that in mind, here is a look at some sectors and stocks that historically outperform when interest rates rise… along with some risks they face.

Investors flock to safe haven stocks when the market seems shaky, and interest rate hikes will certainly cause that.

The “common knowledge” is to move towards sectors that either have consistent revenue or can capitalize, to some extent, on higher interest rates.

Soaring Energy Stocks, Inflation, and Interest Rates

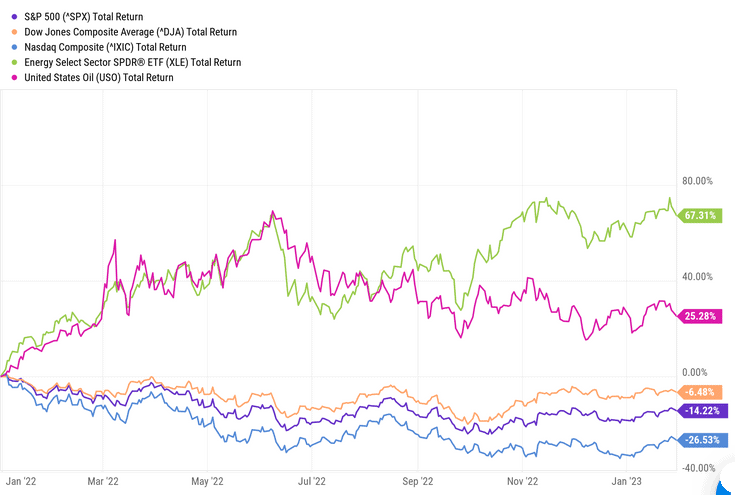

A key driver of inflation is energy consumption. Oil primarily… then natural gas, oil derivatives, and electricity too.

We're in a power-hungry world. If something is being made, moved, or markets can count on it, it means higher prices.

It should be no surprise that energy companies sell as much as possible while inflation is high and interest rates are moving along.

We've certainly seen that happening even with oil prices retreating. The energy sector remains wildly profitable with a combination of supply issues and a hot economy.

Here's a chart of 2022 to show it. There's a big caveat that energy prices are up a lot.

We're looking at the three major indices, the Energy Select Sector SPDR Fund (NYSEArca: XLE) and the United States Oil Fund, LP (NYSEARCA: USO). The ETFs are decent proxies for energy stock investment versus daily changes in US-based spot market oil prices, with some price movement based on investor buying and selling mixed in.

Energy is a winning sector. It comes with its current caveats, but historically it holds up.

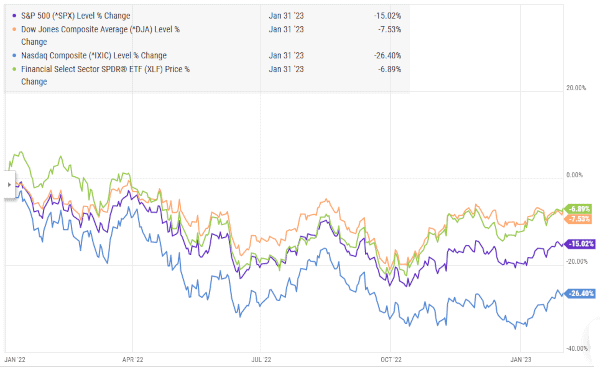

Financial Stocks, Classic Interest Rate Profiteers

Stocks that work well when interest rates rise are often stocks that, to some extent, can capitalize on the higher rates.

If the lending market sees interest rates increase, it often means more people are in a position to pay more and see more potential for it to pay off. Otherwise, new loans and total figures go down.

As long as this increased demand persists, banks and lenders can make more money from lending out deposits at a higher interest rate than they pay to depositors and from larger spreads between rates they control as a lendee and lender.

Higher interest rates almost always lead to higher spreads, or arbitrage potential, for large financial institutions. Nothing else is quite like the financial sector in that regard. However, some issues come with it.

The risk is in how quickly the interest rates of loans rise and how many people can keep paying due to these higher rates.

With the Financial Select Sector SPDR Fund (NYSEArca: XLF) as a proxy, this time around, it is clear that it is pegged to the broader market as it bounced between the total return of the S&P 500 and Dow indices.

Financial institutions have recently derived a large percentage of revenue from investment returns. They're exposed to a cooling housing market as well.

While the sector can make increasing amounts of money with higher interest rates, it doesn't like rapid change.

Dividend Stocks That Weather High Interest Rates By Design

Finally, we should mention companies that keep making people money and give it to them.

Dividend stocks are a safe haven, but they aren't all equal.

In recent years, dividend stock yields have trended lower. Investors have chased riskier high-yield investments as bond yields bottomed out, and rising stock prices have made the percentage of money returned by dividend-paying companies compared to share prices fall.

Yet this glosses over a fundamental reality. The best dividend-paying companies consistently pay out returns to their investors, and the best of them consistently increase this amount.

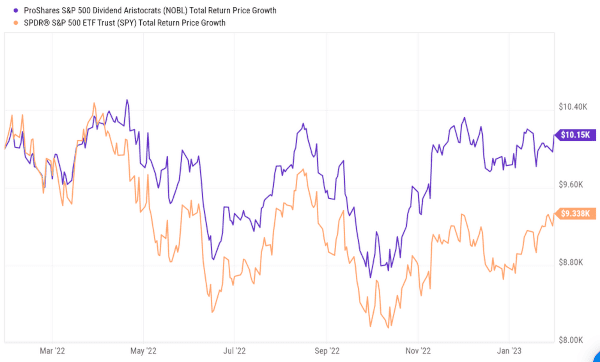

Look no further than the total return from the Financial Select Sector SPDR Fund (NYSEArca: XLF) versus Financial Select Sector SPDR Fund (NYSEArca: XLF) as a proxy for how this payout looks in the real world (with $10,000 to start).

Even in a falling market in 2022, a brutal one by any measure, these dividend payouts returned limited actual losses in portfolios. It also provides more money to invest in easier times.

Beware External Forces But Know There's Money To Be Made

2022 was a wild ride. 2023 and beyond may be worse. The markets will be volatile. Time will tell.

Inflation and interest rates will dominate the news.

Supply issues will persist. Energy market distortions are normalizing but far from over. Politics is a dumpster fire, perhaps the most bipartisan of opinions.

Yet we need to keep in mind that we always have options. While the big tech companies sink the broader measures of the market, like the Dow or S&P 500, the trend is not universal if you dive a bit deeper.

Companies are making money. Some more, some relatively more, some enough to keep trusting while share prices rise and fall.

But there is always money to be made. It's out there for us if we stay smart about it.

Stocks and sectors that outperform when interest rates rise will be a big part of that going forward.

Take care,

Adam English

The Profit Sector