- The US Downshifted But Remains Strong

- The World Entered a Buying Frenzy

- The Renewable Energy Sector Outperforms the Broader Markets

- Two Stocks to Watch Right Now

My uncle is a great guy, but he is that uncle – the fabled Thanksgiving uncle. The one people don’t want to get into it with.

Yet there I was, partly taking one for the team and mostly getting my just desserts, well before the pies came out, for being unable to resist.

He’s a good guy but an old-school guy, and you can boil his investment down to ‘nothing from the last two decades.’

He’s a dividend and ‘companies that make things’ man, and we see eye-to-eye. He’s anti-crypto, and who can blame him with its greater fool mentality and wild swings? After the dot-com bust, he never cared for tech, though he has plenty of exposure to the big names through index funds, like us all.

Where we split, though, is when it comes to the energy sector, and that was the topic du jour. He’s a coal, oil, and gas man, and everything else is a gimmick in his eyes.

I have nothing against fossil fuels. I’m pretty sure oil is going nowhere for many years to come, and right now, I particularly like a handful of natural gas companies. We couldn’t be farther apart on renewable energy, though.

I’ll spare you a synopsis of the discussion, but he had some valid points. Subsidies for many years propped up renewables. They need a lot of growth and capital to scale up. Investors chasing renewable momentum stocks have taken the fall as many leveraged up, diluted shares, and restructured. Fair enough.

My take is that his view is antiquated. Renewables are in a spot to scale up in responsible ways, money-wise, and the trend is strong.

Investors like my uncle don’t need to get behind the politics that get lumped in with the sector. They need to take another look at the financials and projections to see the real potential.

Here is some of what I have to back that up and why 2023 may be a great year to establish a position in the sector.

The U.S. Downshifted But Remains Strong

2022 was a mixed year for renewable energy. According to Deloitte, utility-scale solar growth slowed by 26%, and wind growth slowed by 8% in the first eight months of 2022 compared to the first eight months of 2021.

Yet solar and wind accounted for nearly 70% of capacity added, and renewable energy rose 2% to 23% of U.S. electricity generation.

The drop in growth is a list of common woes in our economy: Project delays, supply chain disruption, trade policy uncertainty, inflation, and rising interest rates. These will carry into 2023, but long-term trends remain strong.

Solar and wind remain the cheapest energy sources in most parts of the USA. Residential solar demand is chasing this trend with a 35% surge in growth in the first half of 2022 year-over-year.

Government policies provide long-term support with federal incentives codified in the Inflation Reduction Act, and 22 states and the District of Columbia target 100% renewable energy or carbon-free energy with deadlines between 2040 and 2050, which is just 17 years away now.

On the corporate and private side, 43 of the 45 largest US-investor-owned utilities are committed to boosting renewables as part of their core growth and revenue generation strategies. Meanwhile, private investment hit a record high above $10 billion.

The World Entered a Buying Frenzy

On the international stage, Europe, in particular, is seeing a massive surge that won’t slow for years to come thanks to its apparent energy issues and how untenable the costs for residential and industrial power have become. The E.U. installed 37% more solar power generation capacity in 2022 compared to 2021, good for a 25% overall increase.

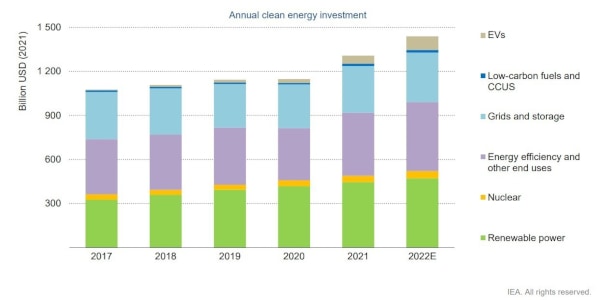

Global clean energy investment was estimated at over $1.4 trillion last year, according to the World Economic Forum, representing nearly three-quarters of total energy investment. Since 2020, we’ve seen a 12% average annual growth rate.

Also of note is the continued surge in clean energy spending in China even as the rest of its economy pulls back and its financial sector is in turmoil.

Chinese solar power generation jumped over 30% from January to October 2022, while wind saw a 25% increase.

These are increases over 2021 when China installed more renewable energy generation capacity than the rest of the world combined, pushing its total share of the country's energy generation to nearly 32%.

The global investment was concentrated in North America, Europe, China, and India. The rest of the world largely kept renewable energy investment flat, and many countries saw investment drop.

This has always represented a small fraction of global investment outside of developed and developing countries. While a number of years of large growth could move the needle, small drops in this category will not. Investment in the EU and China dwarfed the global drop many times over.

The Renewable Energy Sector Outperforms the Broader Market

As for how that looks in the stock market, take a look at the largest sector ETF, the iShares Global Clean Energy ETF (NASDAQ: ICLN), as a proxy over the last year compared to the S&P 500.

Though the iShares Global Clean Energy ETF (NASDAQ: ICLN) has a small return of 3% over the last year, it has outperformed the broader market represented by the S&P 500 by nearly 20%.

Even with the risk of a bear market year in 2023 looming and a general pullback by investors across the markets and in growth or tech stocks in particular, renewable energy stocks are faring relatively well and retaining investor interest.

Of course, this is small compared to the broader energy sector stock performance. Natural gas stocks, in particular, saw a fantastic year but may be in a tough spot going into 2023.

We will see a year of strong demand for U.S. natural gas exports, especially in the E.U., which is scrambling to increase liquified natural gas import capacity. Stock prices are high, and market distortions from the war in Ukraine and the rift between Russia and the E.U. add a lot of uncertainty.

After 2022 saw surges in stock prices, 2023 will see a continuation of profit-taking and returns to shareholders through dividends and buybacks in the shorter term.

Stocks to Watch

The renewable energy sector has become a mix of companies that are very different.

My focus so far has been on solar and wind, and I will be specifically looking at these, plus power storage in 2023 and beyond. However, companies like lithium miners and small, speculative tech stocks get lumped into the sector.

There are reasons why I’m avoiding them. First up, lithium miners really should be exclusively considered commodity stocks.

Lithium demand is poised to soar with E.V.s and grid-scale power storage. However, the businesses themselves face all the problems mining companies face. They have massive capital expenditure requirements up front, face years upon years of regulatory red tape, and often are highly leveraged, dilutive, or both. As far as I’m concerned, it's a niche that shouldn’t get packaged with renewable energy power generation.

As for smaller, speculative tech stocks, look at 2022. Both good and bad tech stocks were punished as the threat of a bear market rose, and investors pulled their money out across the board. 2023 shows all the signs of continuing this trend, and owning companies that aren’t generating revenue yet is highly risky.

I’m sticking to these two stocks to watch for now. Well, one stock and one soon-to-be stock.

Brookfield Renewable Partners L.P. (NYSE: BEP)

Brookfield Renewable Partners is an established name in the sector and one of the largest companies in the world for renewable power generation.

With over 20,000 MW of combined hydroelectric, solar, and wind generation across 6,000 locations in the Americas, Europe, India, and China, it is already operating globally and generating solid revenue.

Brookfield’s business model is built on a mix of stable revenue from long-term power purchase agreements, mergers and acquisitions, and a long list of projects that add up to 100 GW of capacity. 19 G.W. of that future capacity will come from projects already underway.

According to company projections, most of its power purchase agreements have provisions for inflation, which will boost funds from operations (FFO) by 2% to 4% annually. M&A targeting high-return projects is projected to add another 9% to FFO per year, with its in-house projects adding 3% to 5% FFO per year.

The stock took a hit in 2022 though it didn't entirely deserve it. Brookfield Renewable has used debt to fund its growth, and higher interest rates can be a problem. However, Brookfield Renewable’s balance sheet is well-built for the risk.

97% of its debt has fixed interest rates with an average weighted interest rate of 5.1%. That rose from 4.0% year-over-year in 2021. It will likely increase further as debt is rolled over.

With stable and growing FFO projected to outpace rising interest rates and a 38% consolidated debt to total capitalization rate, it can take this hit and still expand. The company maintains its BBB+ credit rating, which is the best among its peers.

Investors didn’t care about this capacity for resilience as much as they should have, and a pullout in 2022 saw share prices drop about a quarter after a five-year 126% gain between 2017 and 2021.

That’s making Brookfield Renewable Partners L.P. (NYSE: BEP) shares attractive as it maintains the scale and growth it needs to be a major global player. It also pushed the stock's dividend yield to 4.8%, which only sweetens the deal for shareholders that hold or steadily build a position in 2023.

MN8 Energy – (tentatively NYSE: MNX)

MN8 Energy, the second company I’m watching, is rapidly growing its domestic solar and power storage capacity but might as well not exist as far as public investors are concerned.

The company filed for an NYSE listing under MNX in September 2022 after Goldman Sachs Asset Management created it in 2017.

What do I like about MN8? A big part is that it may offer a relatively clean slate. There shouldn't be the kind of legacy cost averaging, debt or subpar returns on investment baked in that many renewable sector companies are dealing with these days.

Plus, these kinds of solar and battery storage projects will continue to attract the lion’s share of utility demand for years and decades while solar power remains among the cheapest.

I also think people don't care where power comes from, outside of NIMBY issues, as long as it is cheap. Profit potential and demand will always trump the politics associated with clean energy.

I don't like that we don't get a peek at MN8's books yet. I want to see reasonable debt levels, debt rotation, low-interest rates, and the IPO fueling growth potential instead of an underwriter cash-out opportunity.

So far, it is looking good, though. Jon Yoder, head of Goldman Sachs Asset Management’s Renewable Power Group, will take the reins as Chief Executive Officer. David Fernandez, head of management and oversight of Goldman Sachs Renewable Power, will become Chief Operating Officer. About 100 other Goldman Sachs Asset Management are also expected to follow the spin-off.

As it describes itself: “Established in 2017, the Renewable Power business within Goldman Sachs Asset Management has sponsored more than 800 solar projects across 27 U.S. states that collectively have a capacity of more than 2.3 gigawatts of clean, renewable power.”

It’s going to be much smaller than companies like Brookfield Renewables. Still, it will be entering the stock market with executive and staff experience, deep-pocketed institutional investors, and an infusion of cash, a target of $100 million in its SEC filing, from the stock offering. All point to a new player in the sector capable of targeting the best growth markets for solar and power storage sometime in 2023.

That’s worth a watch, for sure.

Take care,

Adam English

The Profit Sector