Two days from now, around 7:30 AM on Friday, October 14, investment bank JP Morgan (NYSE: JPM) will put out a press release detailing how much revenue the bank brought in for the third quarter (July-September) and how much of that revenue was profit for the bank.

Then, an hour later, JP Morgan Chief Executive Officer (CEO) Jamie Dimon and Chief Financial Officer (CFO) Jeremy Barnum will host a conference call where they will field questions from analysts.

JP Morgan’s press release and conference call officially kick off third-quarter earnings season. And the process will be repeated by thousands of companies over the next six weeks.

Yes, the press releases are important. But the real action happens during the conference calls.

Because this is where the analysts get to ask for more detail on various areas of interest from the quarter that just ended. And more importantly, the analysts get to dig for insight into the business climate heading into the year's final quarter.

And because companies have a mandatory quiet period before they release earnings, information gleaned during the conference calls is relatively new and carries a special significance.

Of course, Dimon and Barnum will offer up their expectations for revenue and profit for the fourth quarter during their call with analysts. But these conference calls aren’t just about numbers. You can bet that the analysts will want to talk about a lot more than earnings. Mr. Dimon will certainly be asked for his thoughts on inflation, the Fed’s interest rate hikes, the global economy, the housing market, the outlook for mergers and acquisitions, the bond market, the quickly deteriorating economic situation in Great Britain…

Because as the head of one of the world’s biggest investment banks, Mr. Dimon has his finger on the pulse of the global economy. And given the fact that just a couple of days ago, Dimon warned about the increasing odds that the U.S. will join Europe in a recession, Thursday’s JP Morgan conference call will help set the tone for all the earnings reports we get over the next several weeks.

Take it Day by Day, Sector by Sector

We will hear from the other big banks in the early part of next week. And then the flood of information starts building up. On Tuesday, October 18, 87 companies are scheduled to report their 3Q earnings…

That day, we’ll hear about how much stuff is getting shipped around the country’s railroads when CSX (NYSE: CSX) and Canadian Pacific Railway (NYSE: CP) report.

We’ll also get an early read on the health of the U.S. consumer that day from credit card company Discover (NYSE: DFS) and casino operator Las Vegas Sands (NYSE: LVS). As consumers get squeezed by inflation, we can expect to see credit card delinquencies rise, so Discover’s insight can be useful. And gambling trips to Vegas tend to get delayed or canceled when money gets tight. Casino companies like Las Vegas Sands are particularly vulnerable to economic downturns.

Finally, we get Tesla (Nasdaq: TSLA) and NetFlix (Nasdaq: NFLX). Netflix isn’t really a market-mover. I mean, yes, NetFlix does depend on the health of the consumer. But it’s also kind of a niche service from which there’s a limited extrapolation to the board economy.

Tesla, on the other hand, is one to watch. Supply chains in China, manufacturing in China, the electric vehicle (EV) market, the Starlink satellite internet service, the recent demo of the Optimus humanoid robot thing, and self-driving automobile tech – this is all stuff to pay close attention to. Because when the economy gets dicey, investors tend to focus on employment, consumer spending, mortgage rates, and home values. People don’t want to hear so much about $20,000 robots and driverless taxis and trucks. But there is massive potential from these things, and in bear markets, you can find fantastic opportunities that can make you a boatload of money when the economy turns back to growth.

There was a time when Intel (Nasdaq: INTC) was an important earnings release. But its range of influence has been greatly diminished by a string of bad business decisions and failed execution. On Wednesday, I’ll be much more interested to hear from steel companies Nucor (NYSE: NU) and Schnitzer Steel (Nasdaq: SCHN).

Tech and Retail

Third-quarter earnings season gets cooking the week of October 24-28. Nearly 1,000 companies report that week. Advanced Micro Devices (AMD: Nasdaq) and Google parent company Alphabet (Nasdaq: GOOGL) are the ones to watch on Monday, October 24.

Boeing (NYSE: BA) on Tuesday, October 25, could shed some light on global airline travel. Travel here in the U.S. has remained strong, but overseas (especially Europe) could be vulnerable to falling bookings, which might translate to canceled orders for new Boeing planes. Also, Boeing could find itself in the crosshairs of the escalating economic feud between the U.S. and China.

Apple (Nasdaq: AAPL) and Amazon (Nasdaq: AMZN) report on Wednesday, October 26.

Caterpillar (Nasdaq: CAT) on Thursday, October 27, is usually one to watch due to its reliance on international sales.

During the week of October 31-November 4, nearly 1,500 companies report earnings. And the week after that, November 7-11, doesn’t let up much – another 1,294 companies report that week.

In an effort to keep this article from getting completely out of hand, let me skip ahead to the week of November 14-18 because that’s when we hear from the all-important retailers. If you want to know about the health of the U.S. consumer and maybe get an early read on the recession, this is the week for it. And given the rising fear that the U.S. economy may already be in recession, this is probably the most important week of the third-quarter earnings season.

Walmart (NYSE: WMT), Target (NYSE: TGT), and Home Depot (NYSE: HD) all report on the same day, November 15. Inventory levels and the outlook for the holiday season from Walmart and Target are all-important. Home Depot is an interesting case. As mortgage rates rise and the housing market falls apart (as it currently is), homeowners tend to put off plans to sell their homes and move into a new one. Instead, they may choose to go the home improvement route and spend a little money to make their current homes more comfortable.

So I wouldn’t look to Walmart or Target to post strong earnings results, Home Depot is a company that could do pretty nicely in the current environment.

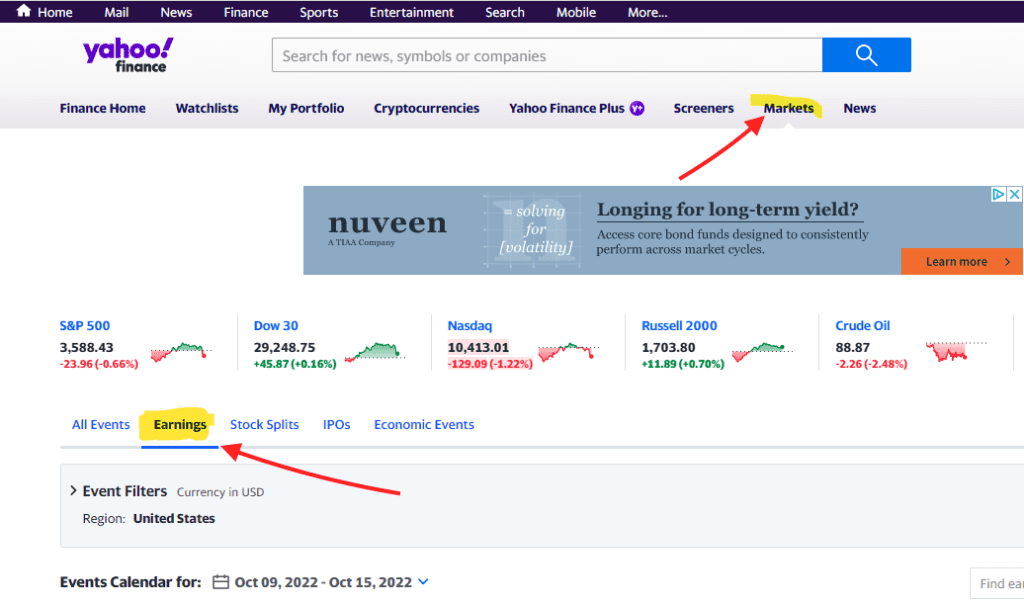

Now, if you want to know what earnings reports are coming and when, you can do so easily and for free at Yahoo! Finance. It’s a great resource, and here’s a screenshot to help…

I’ve highlighted in yellow the two spots you need to click to access Yahoo’s earnings calendar. At the top (https://finance.yahoo.com/), click on “Markets.” And then, when you get to that page (https://finance.yahoo.com/calendar/), click on “Earnings,” and get the earnings calendar page.

Until next time,

Brit Ryle

The Profit Sector