Like almost everyone my age, I have fond memories of the iconic McDonald’s Happy Meal.

What more could a kid ask for than a warm hamburger, crispy french fries, and a soda? Oh, that’s right, give me a toy while you’re at it!

While it was usually a cheap piece of plastic promoting some new Hollywood blockbuster, getting a little something extra with your side of fries still felt good. And at the very least, it gave my brother and me something to bicker about when one of us got the “good” toy, and the other was stuck with the loser toy.

In any case, McDonald’s (NYSE: MCD) has always been good with cross-promotion and nostalgia. Right now, they are cashing in on that nostalgia in a big way…

The “Adult” Happy Meal

Happy meals aren’t just for kids anymore, as McDonald’s launched the “adult” happy meal earlier this month. The Golden Arches have teamed up with the clothing Cactus Plant Flea Market to unveil the Cactus Plant Flea Market Box.

You can get it with a Big Mac or a 10-piece McNugget, along with the standard fries and soda. But it comes with a toy. It’s not an adult toy – which made me snicker at the thought of McDonald’s sneaking a sex toy in with your fries – but a small plastic figurine like the Happy Meal toys of old.

You get classic characters like Grimace or the Hamburgler, or Cactus Buddy – the logo for Cactus Plant Flea Market.

But they are all slightly twisted-looking versions of themselves, with two pairs of eyes for some reason:

The whole promotion begs the question: how many adults give a damn about a cheap plastic toy?

Apparently a heck of a lot of them…

Selling Out

In doing my due diligence on the subject, I decided to visit my local Mcdonald's to satiate my own nostalgia. I hadn’t had a Big Mac in years, and this seemed like an opportune time to indulge myself while also doing some boots-on-the-ground reporting.

When I arrived at the drive through I immediately got nervous. The cars were stacked 15 deep at 3 o’clock – not exactly prime time for munching. When I finally made it to that little ordering speaker box, I somewhat sheepishly asked for an adult Big Mac meal. The lady on the other line immediately corrected me that it was a Cactus Plant Flea Market Box that I wanted. I said sure, whatever…

“We are all sold out of them.”

“The toys?” I asked incredulously.

“Yes, we’ll have a truck coming later today if you’d like to come back.”

I declined and began driving north to yet another Mcdonald's up the road.

Editor’s note: The average distance to a McDonald’s in the lower 48 states is 3.07 miles from your home.

I struck out yet again and got the same answer. I figured that there was no way all the adults here in Maryland rushed to Mcdonald's to get a crappy little plastic toy – which costs two bucks more than the regular meal – so, in a confused panic, I went to yet another Mcdonald's.

(Editor’s note: 13,439 McDonald’s are operating in the United States as of 2021.)

A swing and a miss for that location too. I had to resign myself to a toyless, unhappy meal. You may think that I’m crazy, but I repeated this fiendish little rendezvous the two days following with the same result: these adult Happy Meals were sold out as soon as they left the truck.

I did notice the rising distress among McDonald’s employees. Every time I arrived, they seemed more and more irritable, and I was even bothering to ask about it.

“We ran out of boxes the first day we had them, ran out of toys the second, and on the third day, we had to say the truck doesn’t come till tomorrow,” wrote one commenter on Reddit. “It’s been…not fun.”

The company itself had a much sunnier take. “We had a feeling the Cactus Plant Flea Market Box would be big… and leading up to the launch, we prepped crew with training and resources in anticipation of higher traffic in restaurants. After just a few days, the excitement we’re seeing from fans has been nothing short of incredible.”

While being a McDonald’s employee has never been a coveted position, being a McDonald’s investor has been a complete windfall…

The McDouble

Warren Buffett – arguably the best investor in history – loves him some McDonald’s. He eats there every morning.

He even bases his McDonald's breakfast on the stock market's opening: if it's down, he orders two sausage patties. If it's up, he splurges on a bacon, egg, and cheese biscuit.

Frankly, between that and his six-a-day Coke habit, I'm shocked that he's lived this long…

But I understand his love for the company: Berkshire Hathaway’s McDonald’s position was mostly sold off in 1998 at a cost of around twenty-two bucks per share. That reaped them $1.3 billion worth of stock based on sixty million split-adjusted shares.

And that doesn’t include the dividend payouts.

But look how well McDonald’s has done over the last decade alone:

You’d have gotten a 200% return on a very safe, “boring” company. If you reinvested those dividends, you’d have banked 235%.

Golden Arches?

McDonald’s shares are up in the last six months compared to a 16% drop in the Dow. They are also paying a 2.3% dividend. That’s a pretty solid return in a turbulent market. People inevitably return to cheap fast food when the economy is going down, and there is no more obvious bet than McDonald’s iconic burgers and fries.

However, we could see the stock take a haircut in the next few months – and it won’t have anything to do with adult Happy Meals…

Europe may pose the biggest problem for Micky D’s

Inflation in key European markets has ramped up rapidly and is now taking a low-double-digit bite out of discretionary spending power — compared to a single-digit hit here in the U.S.

U.S. McDonald’s sales may not be able to keep the company from sinking a bit internationally. Once energy prices spike this winter, there will be even less money for Big Macs.

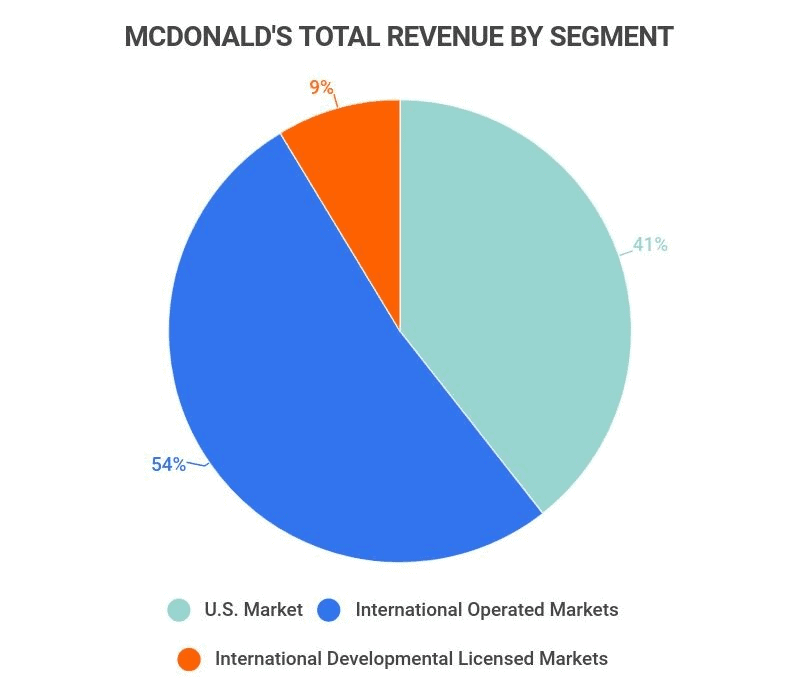

The company had about $8.7 billion in revenue in the U.S. in 2021. However, internationally, they had about $14 billion in revenue. Overseas is the largest chunk of their revenue:

Long term, like any nostalgia stock, McDonald's will do just fine – especially if you are dollar cost averaging your position.

They do pay that dividend of 2.35%, but I feel they will see some headwinds for the rest of this year before they pick back up again.

Unlike the adult Happy Meal, I wouldn't worry about investors buying up their whole stock right now.

Godspeed,

Jimmy Mengel

The Profit Sector