Table of Contents

- Just a Quick Intro

- Who is Michael Robinson?

- What is Digital Fortunes?

- Ronald Reagan Lays the Groundwork

- What Cap and Trade Means Today

- $100 Trillion: Turning Carbon into Cash

- What's Included with Digital Fortunes?

- Cornering Carbon: How YOU can stake a claim in the $100 TRILLION transformation of the century

- BONUS REPORT #1 – The Secret $5 Company Behind Elon Musk and Jeff Bezos' Race to Own the Internet

- BONUS REPORT #2 – How to Profit from the iPhone Killer

- Digital Fortunes Refund Policy

- Where to Find Digital Fortunes

- In Summary

Just a Quick Intro

Michael Robinson and the team at Digital Fortunes have released a promotional offer to inform readers about a Reagan-era program primed to produce massive gains for today's investors.

In 1982, the Reagan Administration crafted a unique and somewhat obscure solution to an urgent global crisis. The program took advantage of free market principles to combat the problem of environmental pollution from lead-based gasoline.

As Robinson describes it, Reagan's solution had at its heart a “secret currency” that solved the crisis and created fortunes for the select few who knew how to leverage that “currency.”

Michael's research has revealed that President Reagan's brilliant system has once again been tapped to solve a worldwide environmental crisis. And while the “little guy” has traditionally been barred from playing this particular game, he believes he's found a way for individual investors to claim their share of potentially massive profits.

Keep reading if you're interested in learning more about Digital Fortunes, the free resources in the current promotion, and Michael Robinson's strategies for making a potential fortune from the rebirth of Ronald Reagan's “secret currency.”

Who is Michael Robinson?

A Pulitzer Prize nominated journalist with an economics degree from the University of Missouri at Columbia, Michael Robinson has made his bones as a tech industry insider for nearly 40 years.

The Detroit News has published his work, The Oakland Tribune, the Wall Street Journal, and the New York Times.

Using the hard-fought expertise gained from decades in the trenches of Silicon Valley, Michael has served in an advisory capacity to venture capital firms, high-tech startups, and mega-corporations from Boeing to Chrysler to FedEx.

Robinson also authored an acclaimed book about the infamous United States savings-and-loan collapse called: Overdrawn: The Bailout of American Savings.

Michael eventually turned his talents to financial research and analysis, and his track record speaks for itself. He's been ahead of the curve on call after call, from Bitcoin to vaccines. And for those savvy readers who followed his advice, the gains could have been life-changing.

As publisher and Chief Technologist at Trend Trader Daily, Michael manages several services, including the Digital Fortunes newsletter.

What is Digital Fortunes?

Digital Fortunes is a monthly investment research newsletter written and edited by Chief Technologist Michael Robinson.

The publication identifies Wall Street's hottest trends and provides its readers with a blueprint for turning them into profit.

Each month, readers receive a simple, straightforward investment prospectus detailing the latest trend and the stock Michael's picked to capitalize on.

The past trends highlighted by the newsletter include 5G, Mobile Payments, Cannabis, 3D Printing, and AI.

Digital Fortunes concentrates on conservative strategies with significant potential gains. The recommendations are generally low-risk, mid and large-cap companies that appear best positioned to produce short-term gains of “50% to 100%+.”

Ronald Reagan Lays the Groundwork

In 1982, President Ronald Reagan took action to avert a global calamity.

In classic Reagan fashion, rather than rely on profit-choking regulations or federal government overreach to solve this crisis, he put his faith in the power of the free market. He created what Michael Robinson calls a “secret currency.”

And guess what? Reagan's plan worked like a charm.

Lead-based gasoline additives caused the environmental nightmare that plagued the world in the early 1980s. This lead in automobile emissions leached out into our environment in massive quantities, hammering the health of our citizens.

So President Reagan decided to implement something called a Cap and Trade Market.

Companies were each granted a limit on how much lead pollution they could pump into the atmosphere before incurring fines.

If a particular company exceeded its “Cap,” it could avoid those massive fines by buying the leftover lead allowances from other companies that had come in under their own cap.

The market that developed for these allowances exploded in value by 500%, eventually solving the lead gasoline pollution crisis.

And just a few years later, Reagan's Cap and Trade model was used to combat the primary pollutant responsible for causing acid rain. It succeeded again, and the “secret currency” experienced a price spike of over 1,200%.

So how does President Reagan's system apply in the 21st century?

In a word…Carbon.

What Cap and Trade Means Today

Michael Robinson makes a good point. When it comes to climate science, debating politics or the cause of excess carbon dioxide in the atmosphere isn't his job…his job is to help you make money.

And from the viewpoint of the famed investment analyst, that money is there to be made.

Atmospheric carbon levels have gone through the roof, and, agree or disagree, the world's governments are circling the wagons to take it on.

And just like with lead emissions and acid rain, the weapon of choice will be President Reagan's free market Cap and Trade system.

According to Robinson, carbon allowances will be bought and sold, and prices will spike as this “0 trillion investment opportunity” entirely comes online.

The returns he expects aren't the 500% or 1,200% of past Cap and Trade cycles.

Micheal Robinson believes all signs indicate potential gains of as much as 33,233%.

He points out that Tesla is already trading carbon credits to the tune of BILLIONS of dollars per year. And that's with carbon prices sitting around 30 cents per ton.

The United Nations believes that the price should be more like $75 per ton…and there's your 33,233% increase.

According to the famed investment bank Credit Suisse:

“…we view carbon markets as an emerging asset class that could potentially rival the global oil market in size.”

The real question is, how does an average individual investor get a cut of a global carbon cap and trade market?

Michael Robinson has a plan of attack…

$100 Trillion: Turning Carbon into Cash

Unfortunately, there's no direct way for individual investors to buy into the carbon allowances market. It's the private playground of mega-corporations, big banks, and Wall Street billionaires.

As Michael says, the “little guys” are “locked out.”

Never one to take “no” for an answer, Michael Robinson has figured out a workaround.

He's created a 5 Step Plan to guide everyday Americans through the “backdoor[s]” and loopholes to claim their fair share of the action.

STEP 1:

Michael has identified an Exchange Traded Fund (EFT) that invests in “three major carbon cap and trade programs.”

Buying into this EFT enables investors to profit from the potentially massive gains in carbon credits without doing any of the “heavy lifting.”

STEP 2:

The next page in Michael's playbook is to invest in a small company that produces silicon carbide chips vital to electric vehicle manufacturing.

With electric vehicle demand only increasing as the world weans itself off fossil fuels, some experts believe that the sales of these chips will increase as much as 10x by 2030.

STEP 3:

This step involves a new term that the conversion to electric vehicles has introduced into America's vocabulary: Range Anxiety.

“Range Anxiety” refers to electric car owners' fear that their batteries will run out of juice and leave them stranded. To combat this issue, billions of dollars in public and private funding have been earmarked to construct a vast new charging station network.

And Robinson has found a “pick and shovel” investment that seems primed to capitalize on this infrastructure boom.

STEP 4:

Michael's found a “controversial” play in the energy sector. A technology long out of favor but set to become increasingly crucial as decarbonization policies take hold.

The small Virginia-based company he discovered produces a “complex steam generator technology” critical to this alternative power source. Already making impressive profits, Michael expects them to grow…and grow…and grow.

STEP 5:

And finally…

Michael Robinson drops the details on four more stocks that he believes are primed to skyrocket as carbon cap and trade drags the world into the future.

These opportunities include renewable natural gas, solid-state battery tech, large-scale battery storage systems, and a semiconductor firm “set to dominate” the electric vehicle sector.

What's Included with Digital Fortunes?

During the limited-time promotion, subscriptions to Digital Fortunes are packaged with special reports selected to help readers profit from the “$100 trillion carbon trend.

Here's everything new subscribers receive in the bundle:

One Full Year of Digital Fortunes:

At the beginning of each month, subscribers receive this digital newsletter containing Michael's latest investment trends, and complete breakdowns of the stock picks primed to ride that trend to potentially huge gains.

FREE REPORT – Cornering Carbon: How YOU can stake a claim in the $100 TRILLION transformation of the century

This bonus spells out Michael Robinson's complete step-by-step game plan for seizing your piece of the potentially life-changing gains expected when the “$100 trillion” decarbonization market gets rolling.

The 20-page report lays out Michael's seven top stock picks in fields ranging from silicon carbide to battery storage to renewable natural gas.

He insists that everything in this guide is written for ease of understanding, with “straightforward research and actions to take right now to stake your claim in this massive global sea change.”

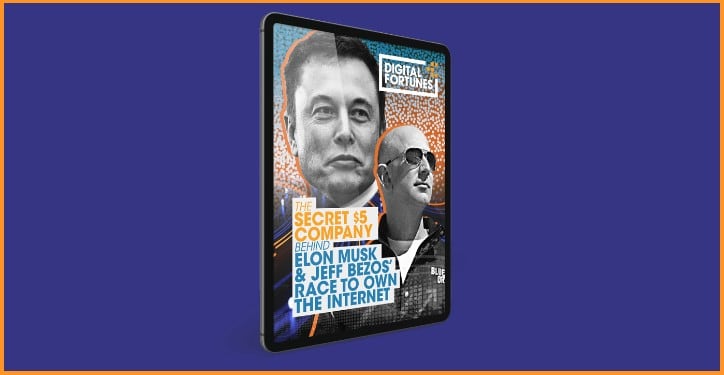

BONUS REPORT #1 – The Secret $5 Company Behind Elon Musk and Jeff Bezos' Race to Own the Internet

Robinson provides the details needed to jump on board Elon Musk's latest push for the stars.

Only this time, it's not rockets. It's satellite-based internet.

Michael notes that Elon's Starlink project makes the news almost daily. However, he's discovered a fascinating angle that most people haven't heard about.

According to the renowned investment analyst, Elon's satellite ambitions are about to require the services of a certain $5-per-share company.

When that little detail goes global, Robinson predicts potential returns of as much as 7,535% for early investors.

BONUS REPORT #2 – How to Profit from the iPhone Killer

In this second bonus report, Michael lifts the curtain on a top-secret Apple device codenamed “N421.”

According to his research, when this groundbreaking device hits the market, the smartphone industry will be completely turned on its head.

And he's found a $10-per-share company whose technology might be “indispensable” to Apple's latest revolution.

Digital Fortunes Refund Policy

Their website says Digital Fortunes has a risk-free, 30-day, 100% money-back guarantee.

They do NOT charge any “processing” or “restocking” fees for those wishing to cancel.

Where to Find Digital Fortunes

Digital Fortunes is written by Michael Robinson and published by Trend Trader Daily.

An online financial newsletter and market research firm, Trend Trader Daily produces a suite of different investment advisories, each with the following goal:

“To make sure you're always on the right side of the big, explosive trends that can impact your investments — and potentially change your fortunes and your life.”

Go HERE to learn more about Digital Fortunes and Michael Robinson's team at Trend Trader Daily.

In Summary

Michael Robinson and Digital Fortunes have launched a promo offer based on a potentially MASSIVE investment opportunity in the carbon market.

Robinson believes that a “secret currency” created in the 1980s by President Ronald Reagan may hold the key to massive profits in the 21st century.

To solve the problem of global lead emissions, Reagan created a system called Cap and Trade. The program allowed businesses to buy and sell pollution credits to avoid hefty fines.

This free market approach resolved the problem and generated massive profits for savvy investors.

As Reagan's system grows in popularity as a solution for carbon pollution, those potentially huge profits again appear to be in sight.

Although individual investors can't directly buy and sell carbon credits, Robinson has designed a strategy for everyday Americans to claim a piece of the predicted $100 trillion decarbonization boom.

![[Revealed] Dr. David Eifrig: “America’s #1 Retirement Stock”](https://theprofitsector.com/wp-content/uploads/2023/10/RetirementMillDoc-360x180.png)