- The Bank Run: A Reckoning We Deserve, A Resolution We Don't

- The Move to Alternative Investments and the Importance of Gold

- Risks for Gold Investments Going Forward

“Like rats fleeing a sinking ship.”

A classic simile, for sure. One that has existed for centuries.

“Yea, if but sicknesse come, these carnall delights will runne from you, affrighted like Rats from a house on fire.”

Richard Younge, The Drunkard's Character, 1638

The whole ‘ship thing' that we use to this day found its place nearly two centuries later:

“Rats deserting the sinking Ships. It is a maxim among sailors that before the vessel is to be lost the Rats will desert her. There has been a wonderful desertion of Rats lately from the Federal Ship.”

Vermont Republican (Windsor, VT), 18 Mar. 1816

Always vilified, always a kind of slur. Never quite rooted in reality but convincing enough to seem valid.

As if we all wouldn't run from a burning house or sinking ship, and as if rats are a good metaphor for those that are the most cravenly opportunistic. It's become a metaphor for deserters and fairweather friends.

This is the narrative that the current banking crisis mirrors in financial news. It's a travesty.

The Bank Run: A Reckoning We Deserve, A Resolution We Don't

The most insidious aspect of what is happening right now with banks is how we're all being lumped in together.

I'd bet my bottom dollar that you do not have more than $250,000 in a traditional bank account. The odds are overwhelming with me on this one, and if you do, I'd bet you can put the excess in “cold storage” of sorts in a high-yield account.

Here's the thing, though. Businesses and banks are not bound to the quarter million dollar limit for guarantees. Nothing stops a bank from guaranteeing deposits beyond the FDIC limit.

We heard about the risk to small tech companies meeting payroll. It's a ruse to hide unsecured lending. Nothing stopped SVB or other banks from offering other terms.

Yet the Federal government has guaranteed deposits far beyond that limit. So far, the total is in the hundreds of millions per individual company, and the aggregate is around $300 billion. Globally it's at least a half trillion and counting.

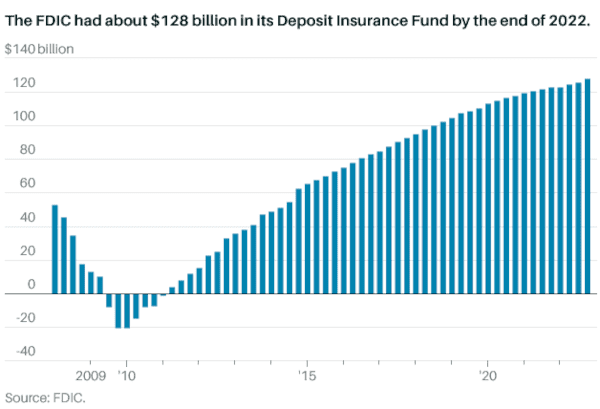

To put that in perspective, the FDIC had $128 billion on hand to back up deposits in accounts under $250,000. That's around 1.28% of what it needs to cover these small accounts and about 40% of the $300 billion the US Federal government guaranteed for high-risk, poorly regulated banks in the last couple of weeks.

Of course, people wanted to move money out of their accounts. The insured deposits are poorly insured.

As for the “not a bailout” and “no cost to taxpayers” spin, instead, it will be through fees that are passed along to depositors, of which 100% are taxpayers.

The banks that have failed so far were illiquid because of poor investments, so the narrative goes. Yet their assets were considered top-notch until recently.

Take SVB, for example. Yes, it did virtually everything wrong in hindsight. It stretched the leverage for lending it offered to tech companies to the absolute limit when interest rates were low and long and locked up its capital at the worst time.

However, that is what the Federal Reserve's policies supported. The same Federal Reserve that saw interest costs for its quantitative easing portfolio turn against it.

It was a legal Ponzi scheme. It was designed to pull in as much money as possible to reinvest with little need to cover demand for withdrawals and was entirely compliant with all regulations.

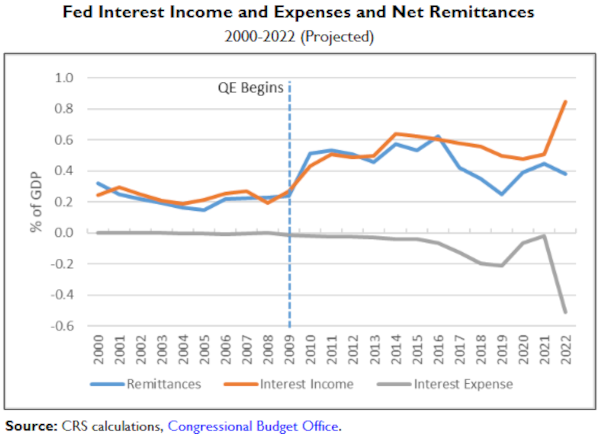

The Fed isn't much better for how its portfolio is looking. According to the Fed itself, “Interest income rose in 2022, but interest expense rose more — from $5.7 billion in 2021 to $102.4 billion in 2022.”

Imagine how that goes in 2023, with interest rates rising far beyond early estimates of what could begin to tame inflation.

What's happening now is almost unprecedented and involves interest rates (income) and remittances (payments) diverging in a way never seen before, skewing toward outgoing payments.

This is both a central bank litmus test and a series of isolated bank runs. The only reason central banks are jumping in is that they don't trust their own regulations as a backstop.

It's a bank run we deserve in the sense that regulators we should hold to account have failed, and there is no going back.

At the same time, we're seeing a reckoning of a handful of central and “too big to fail” bankers who have engineered, by design or by avarice, to remove any consequence for themselves.

The Move to Alternative Investments and the Importance of Gold

It should come as no surprise that depositors are moving their money elsewhere.

One target is money market funds. Assets held by money-market mutual funds have hit highs not seen since the pandemic's start.

Dividend stocks have performed exceedingly well, while the broader stock market has suffered.

The US dollar hasn't been strong as of late but has held up over the last several years.

The recent banking uncertainty has renewed interest in a classic hedge against all of these.

Gold has done exceedingly well from the start of 2023, and the trend has accelerated. As of late March 2023, it's within $100 per ounce of the all-time high of about $2,075 per ounce.

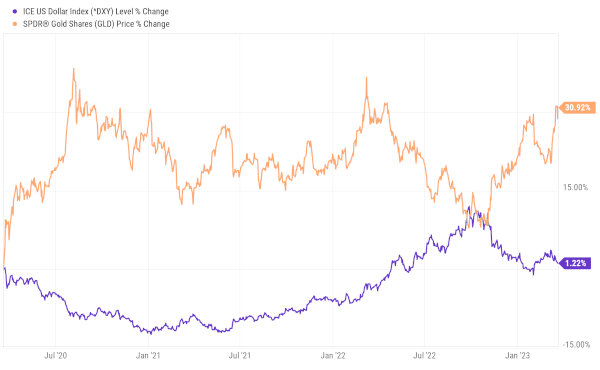

A more interesting perspective comes from comparing gold versus a US dollar index because it includes investor activity and compares how gold is priced – in US dollars – against a basket of relatively stable currencies.

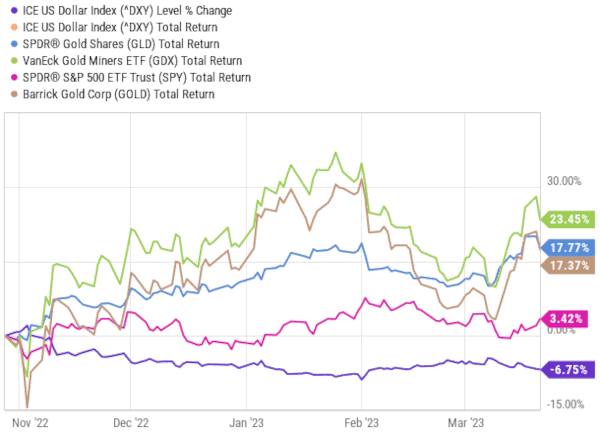

We can do this with a large gold fund – the SPDR Gold Shares ETF (NYSEArca: GLD) – compared to a US dollar index – the ICE US Dollar Index (^DXY).

As you can see, there has been a significant divergence since it became clear in late 2022 that the Federal Reserve would have to aggressively ramp up interest rates with no end in sight.

The trend has only strengthened recently as the flight to alternative investments and away from bank deposits went from a trickle to a deluge.

SPDR Gold Shares ETF (NYSEArca: GLD) is designed to track spot prices to some extent, but it is far from the only gold investment out there.

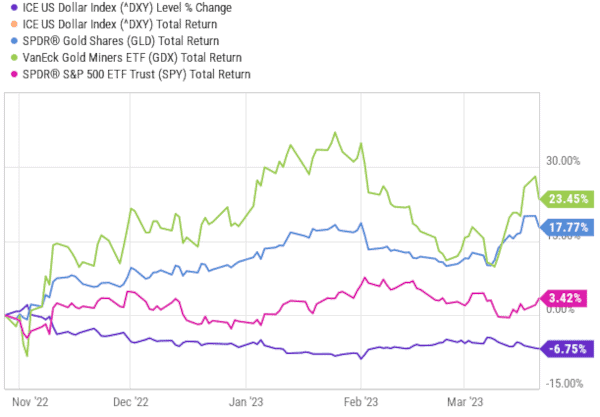

Shall we add a couple more benchmarks to our chart and get a broader picture of what has happened since that divergence in late October 2022?

Let's toss in the SPDR S&P 500 ETF Trust (NYSEArca: SPY) to get a sense of what the stock market is generally up to, along with the VanEck Gold Miners ETF (NYSEArca: GDX) for gold miners. Again, we're using ETFs to get a feel for investor demand in a bearish market, where inflows and outflows can drive prices against fundamentals, to get a sense of actual returns.

With bank uncertainty, a bearish stock market, and mixed signals from the economy, gold and gold miners are a preferred target for investors as an alternative. Otherwise, they wouldn't have seen prices perform so well.

Risks for Gold Investments Going Forward

The fundamental risks to banks should be obvious, but how we should consider them with clarity is nearly impossible, and governments and central banks are falling over themselves to obfuscate.

Interest rates are up and have risen at an alarming speed. Deposits aren't keeping up. The investments in vogue just a couple of years ago are creating massive losses and liquidity problems today.

Anyone who doesn't entirely feel comfortable holding money in the weakest links of a banking system that clearly has liquidity and insurance problems is being publicly flogged and being lumped in with some of the real rats; tech bros that chafed at the idea that they share the same air as the rest of us even as their ivory towers, now exposed as houses of cards, find themselves suddenly drowning.

Corporations, including banks, are being forced to roll any debt they took on during about a decade and a half of near-zero interest rates into new terms that don't change much, regardless of if they acted with restraint or reckless abandon.

That also includes gold miners. While their product is in demand, they also have debts to cycle through this adverse bond market.

That's the biggest risk for gold investments right there. Is there enough free cash and profits to keep profits and operating margins high while managing debt? Gold miners will have to pitch themselves to investors in the coming quarters, perhaps against the results in their earnings statements.

As for something like the SPDR Gold Shares ETF (NYSEArca: GLD), it suffers when the stock market pulls back because investors – large and small – are largely impartial when money is flowing out.

In short, the risk to gold miners is they're operating in a rising interest rate environment like every other company out there. While their product is worth nearly as much as ever, their balance sheets are being watched for weakness.

A company like Barrick Gold Corporation (NYSE: GOLD) is a good target in this environment. Let's add that to our last chart to see how one of the major gold mining companies is holding up.

While Barrick Gold Corporation (NYSE: GOLD) needs to sort out some debt issues and falls short of the VanEck Gold Miners ETF (NYSEArca: GDX), it is also paying what is projected as a 3% dividend yield going forward. It isn't anything to phone home about, and we can find better dividends elsewhere, but it keeps up with the SPDR Gold Shares ETF (NYSEArca: GLD) and is a trustworthy name for refinancing debt.

As long as it tracks the gold trend, and if you want exposure to an alternative style investment, it's in a good position.

Take Care,

Adam English

The Profit Sector