“Everyone has a plan until they get punched in the face,” according to Mike Tyson, and through attribution, many people that quote him (myself included, it seems).

It's a quote often undermined as soon as it's trotted out.

What tends to come next is some version of an immediate call to action, a riposte, if you will, an immediate counter-action.

Here's where I may disappoint you. There is no place for them in an article about investing in a recession or bear market.

It isn't that you shouldn't get back in the fight. It's all about how you take the hit.

You don't punch back first. You brace yourself on your back foot. That's where your strength comes from for whatever you might be able to pull off next.

What does that involve when it comes to investing? Knowing what parts of your portfolio work as anchors as everything else is in flux.

Let's talk about investing in a recession or bear market with that in mind.

Nothing will change the fact that you're reeling from the hit. Keep your head clear and your feet under you.

Be realistic about what can come next and what you can fall back on to build yourself back up. Here is some information on what to expect.

Contracting Market Concussions

If you read anything about investing in a recession or bear market, the same advice comes up again and again.

Stay invested!

Broadly speaking, this is absolutely true. Your investment funds, especially in retirement accounts, are the last thing you should tap.

The examples often used are flawed. A classic example comes from articles discussing how investors miss out on massive returns if they stay in the market.

This kind of stuff looks good on paper. Here's some data from Bank of America backing it up. It's nothing but fantasy, though, a mathematical model that doesn't exist in the real world.

Do you see what's wrong with it? A lot of people don't. No one can blame you. The flaws are purposely hidden.

It implies constant cash flow, infinite timelines where no one has a reason to divest, and ignores the realities most investors face. And, by the way, how many investors alive today were investing in 1930?

No matter what – buying a home, sending kids to college, losing a job in a downturn, wage growth always matching inflation, health care – there are times when reducing investment, or even pulling money from accounts, is for the best.

Say you were born in the '50s or '60s, had kids in the '80s, and paid for college in the early 2000s – how would that pan out for many people who needed to pull on funds right as the “dot com” bubble burst? Even worse, the Great Recession?

This kind of data is wildly disingenuous. When the economy is hot, and the markets are bullish, it's easy to keep close to these idealized returns. But that's not how the real world works for long.

People need money that they park in the stock market when it isn't ideal for pulling it out, especially at the absolute worst times when the stock market reacts to the economy and jobs are lost.

What can you do? Having a plan to maintain cash flow, especially by having the capacity to trim spending, is ideal. Making sure you don't take a tax hit from pulling funds from certain kinds of accounts is nearly as important.

And sometimes, like it or not, it means just eating it and taking that hit in the short term. That doesn't make you a bad investor. It doesn't mean you're bad with money. It means you got pinched between two priorities.

You took a hit. You're reeling from it. Plant your back foot and find some stability.

Don't overreact. Try to move fast, and compensate for losses. Don't throw in the towel. Gut your accounts, and go into full retreat.

You can do it, but that's part of a long-term, multi-year plan. It may not get you back on track for what you wanted, but it'll be for the best down the road.

Solid Market Footing

Keeping a solid footing in a bear market or recession is easier if you know what has stayed firm in the past.

These days, it also means taking a fresh look at some popular “safe” investments to see if they still hold up.

In my opinion, passive ETFs and mutual funds are one of the best and worst aspects of retirement and investment account funding and performance.

The short version is that I don't like how some of the “broad market” ETFs and funds invest for people who want exposure to a broad swath of stocks.

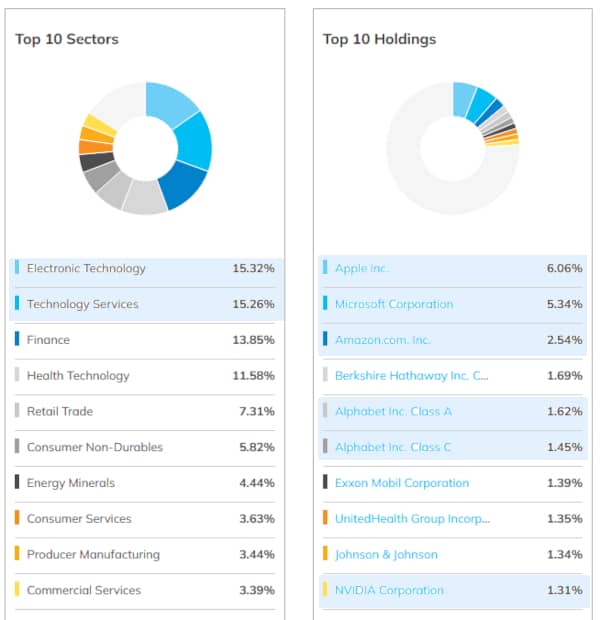

Let's take a look at what the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) holds with some highlights:

The S&P 500 is portrayed as a broad market measure, but it is weighted by market capitalization. Tech stocks have an outsized presence – over 30% in total and over 18% in the top ten holdings.

If you want a broad-market passive fund, you are already exposed to many stocks that tend to suffer in a bear market.

What is particularly interesting is comparing the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) to the Invesco S&P 500 Equal Weight ETF (NYSEARCA: RSP), which is designed to invest equal amounts across all companies listed in the S&P 500 instead of owning more of some over others based on market capitalization,

Look at this two-year comparison and the 10% gap between the ETF's performance:

What does it mean for you? That you should be careful about what you count on as passive investments. For what you can count on as being a core investment.

I've called out this tech dependency in the S&P 500 for years. It isn't the fact that big tech stocks are mixed in. It is that they carry so much weight.

Roughly 30% of any money in ETFs and funds that track the S&P 500 is invested in tech stocks. It was over 40% before tech stocks tanked over the last several years.

A couple of years ago, I abandoned all “growth funds” in my accounts because – even without them – roughly 20% of my funds were tied to mid or large-cap tech stocks.

Some exposure was fine by me, but lordy, I did not need any more past what was baked into what were once considered “conservative” investments.

Long version short? Make sure your core investments, the ones you can count on to avoid fads and volatility, have a stable, broad base.

Building Now For Later

We've already covered plenty of investments you can depend on, but we're not done yet.

Stable investments are not static investments. Your money can work for you during a recession or bear market with a focus on some companies that are built for it.

Let's add another line to the chart from above and talk about what it means.

So what's new? We added the ProShares S&P 500 Dividend Aristocrats ETF (BATS: NOBL) to the mix.

Why? It tracks 64 companies that have increased dividend payments over the past 25 years.

These companies have always paid shareholders more and more, regardless of share price changes, since 1998. They're paying about 50% more than both SPY and NOBL too.

A lot of dividend-seeking investors are singularly focused on yield. They aren't wrong, but they aren't right either.

In a bear market or recession, which many of these dividend aristocrats have weathered time and again, some stocks keep paying out to shareholders in absolute terms that keep increasing.

When share prices can ebb and flow, these are stocks to hold. That's precisely why they have outperformed the market capitalization-weighted SPDR S&P 500 ETF Trust (NYSEARCA: SPY) and the equal-weighted Invesco S&P 500 Equal Weight ETF (NYSEARCA: RSP) in the last couple of years.

These are companies designed for stable cash flow, both internally and what is returned to shareholders externally.

To make it even better, many offer Dividend Reinvestment Investor Programs – DRIPs – that provide discounts on shares for direct investors.

If you're looking for core investments that are easy to buy and sell, far more stable than the broader market, and consistently build your wealth, you'd be hard-pressed to find better options elsewhere.

It may not seem like much, but the stability plus dividends – throughout a bear market or recessionary trend in 2023 – can add up to a lot more “oomph” if and when you decide to reallocate funds down the road.

Summing It All Up

Traditional approaches to bear markets also stress some sectors – consumer discretionary, utilities, and a couple of others stand out. We're not going to get into it here for several reasons.

- First, the companies often cited are ones people keep paying as a last resort – food, fuel, electricity, etc. The common denominator for these companies is constant revenue.

- Second, all bear markets and recessions are a bit different. Let's look back at that list – food, fuel, and electricity inflation is wildly high these days. Whatever bear market or recession we're going into will be more volatile in ways we haven't seen in past ones.

You can find all this stuff elsewhere, and I highly suggest you take it with a grain of salt.

Let's focus on the kind of stability we've discussed so far. The kind that puts us in a good position regardless of what we have to wait out and for however long.

We don't need to gut our accounts unless we're hard-pressed for cash. We can reallocate money towards funds that move away from volatile tech stocks still overrepresented in the S&P 500.

We can outperform the broader market and get a steady stream of cash flow from companies that have been fiscally responsible for over a quarter century.

And when it's time to strike out and go on the offensive, all of it will add up. There is no need to be purely defensive.

We need to make sure we have a good foundation, though. Hopefully, this has helped you find a clear vision of one.

Take care,

Adam English

The Profit Sector