- A Bargain Bin Stock For Such A Big Buyer

- Why Amazon Would Buy AMC Entertainment

- Why Amazon Wouldn't Buy AMC Entertainment

- Nothing is Guaranteed With an Attempted Buyout

[Cue a dramatic movie trailer voice] – “IN A WORLD… beset by bullying behemoth businesses, the Big Bad Bezos, bearer of a bonkers number of billions, begins to buy a bulwark of besieged and belittled bulls.”

Yes, the alliteration is reductive. Let me have a bit of fun. It's not a joke, though. A lot is at stake now and maybe a whole lot more later.

Let's get serious soon. First, let's properly set the scene.

A Bargain Bin Stock For Such A Big Buyer

Amazon Inc. (NASDAQ: AMZN) seems to be moving to buy out AMC Entertainment Holdings Inc. (NASDAQ: AMC).

So far, that's entirely based on rumors. To be fair, companies that move to buy others tend to see information leaks like this. It's kind of hard to hide the attention. The details are protected by law, so the odds are low that we'll get any real numbers soon.

In this case, the rumors started with a handful of anonymously sourced articles published last week. Take them with a grain of salt.

Plus, anything of substance involving AMC is going to get a lot of attention. Though not as prominent as GameStop Corp. (NASDAQ: GME) as a meme stock, it is a closely followed name with a dedicated retail shareholder base.

Much of the commentary focuses on the meme stock angle, some on AMC's financials, and less on the sheer scale of it all. Fair enough, but scale really matters, and it is daunting.

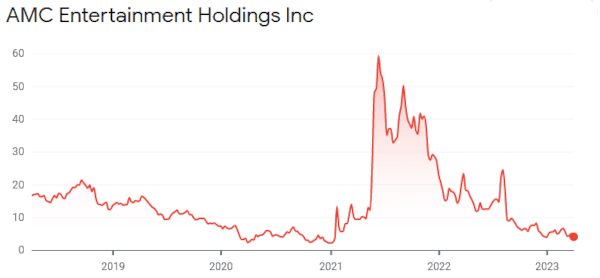

AMC Entertainment Holdings Inc. (NASDAQ: AMC) has a market capitalization of about $2 billion, trailing twelve-month earnings per share of negative $2.05, and a share price that – as of now – is around $4.

That's a steep drop from where it was not long ago.

Then there is Amazon, which makes AMC look like a rounding error in a quarterly report at most:

- Amazon's market capitalization is back over $1 trillion, making AMC Entertainment Holdings Inc. (NASDAQ: AMC) scale at 0.22%.

- Amazon also has $146 billion or so in liquid assets (it's a bit murky) with at least $70 billion in cash. That makes an all-cash buyout scale to under 3% of easily transferred equity.

- As of last quarter's free cash flow figures, Amazon pulled in about $12.5 billion, setting AMC's market capitalization at about 16% of three months of net positive money flow, all things considered.

AMC Entertainment Holdings Inc. (NASDAQ: AMC) is practically nothing compared to a company the size of Amazon. That doesn't mean the deal makes sense, but it does show how much opportunity cost is involved – not a lot.

That doesn't mean it's a deal Amazon may ultimately pursue, either. Billions are still billions, and they may matter less to Bezos than to us, but he didn't build an empire through largesse.

Let's look at the pros and cons quickly to see what will be evaluated by Amazon and AMC shareholders alike.

Why Amazon Would Buy AMC Entertainment

We've covered the scale of the potential buyout. Where is the value in AMC Entertainment Holdings Inc. (NASDAQ: AMC) for Amazon Inc. (NASDAQ: AMZN)?

Amazon is rumored to be planning a $1 billion annual investment in movies specifically for theaters in 2023, and that isn't an easy market to crack. Supposedly Apple Inc. (NASDAQ: AAPL) plans about the same, and there is a race, of sorts, implied.

A good analogy for the movie theater business comes from when Amazon paid nearly $14 billion for Whole Foods.

It had the potential for distribution and scale. It has no easy way to get into physical locations quickly, and it has plenty of cash to spend to skip the early stages of building such a thing.

This is another kind of business that always has to straddle two worlds – physical and digital.

The digital, streaming side is a collapsing field of “walled gardens,” so to speak. You've surely seen this so far. Owning rights to past content and stripping popular titles from any streaming service owned by other companies that used to pay for licensing is a defining trend. That makes new releases incredibly important to maintain subscription revenue.

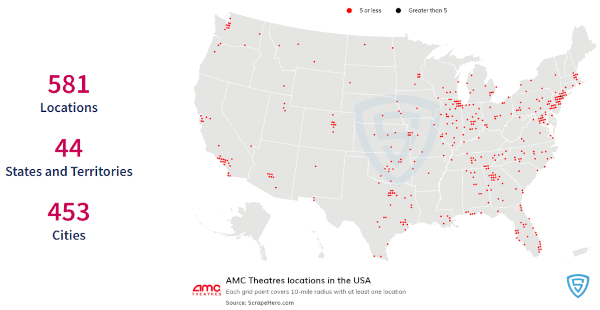

What falls between is what AMC has to offer Amazon — a whole bunch of big screens close to major population centers.

That is all Amazon would be buying that is of worth to it, in reality. The company already spends billions on movie and series production. It does not own a distribution network outside of its Amazon Prime streaming service.

This is a potential move into a business that it has failed to penetrate at scale. Plus, the add-on money makers – snacks and whatnot – Amazon already moves around. Imagine the markup on popcorn and candy it already delivers to Whole Foods at movie theater prices.

Why Amazon Wouldn't Buy AMC Entertainment

Amazon has a mixed relationship with retail space. It's tried storefronts a couple of ways. It maintains the Whole Foods business though it has been problematic for margins since the acquisition in 2017.

With that physical presence comes a lot of upkeep and the potential for high overhead costs for theaters that take up a lot of space. Plus, the movie theater business still languishes.

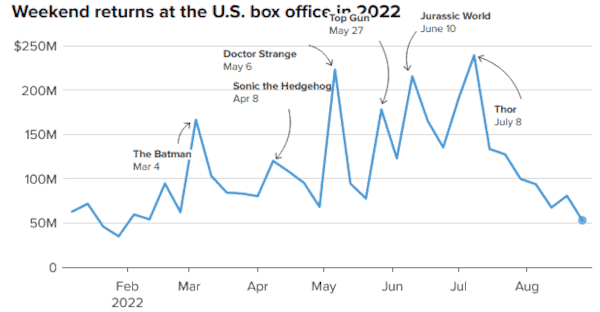

Ticket sales in 2022 still trailed pre-pandemic 2019 numbers by about a third. The number of movies released in the summer of 2022 was down almost 50% compared to 2019 as well.

How Amazon puts more butts in seats, so to crassly speak, is hard to see.

A rebound is far from guaranteed. Over the next several years, a mix of movie market prognosticators put year-over-year growth in the single digits, mostly 2% to 5%.

Plus, the business is highly dependent on big releases. A big bet from Amazon on its in-house content that doesn't follow fickle theater-goer demand is a big risk. Here's a chart:

In the five quarters leading into 2023, AMC shed over 60% of its cash reserves. It's sitting on an estimated $12 billion in debt, roughly six times its market capitalization.

An Amazon acquisition of AMC Entertainment means taking on that debt as well. Market capitalization on a per-share basis makes AMC look cheap. The cost of maintaining the business is functionally seven times higher ($2 billion market capitalization plus absorbing the $12 billion debt burden) to start.

Reversing a cash-burning business like AMC Entertainment adds an ongoing burden that, while relatively small, still messes with Amazon's already tight operating margins.

Nothing is Guaranteed With an Attempted Buyout

Short version? AMC is a dumpster fire of a stock. But that comes with a caveat.

AMC is something of a meme stock, which introduces what can be seen in two ways. Either:

- AMC has the potential for something akin to a classic “poison pill” stock play or…

- AMC has a shareholder base that sees it as an extremely undervalued company.

While retail shareholders, a nebulous measure, own something like 55% of outstanding shares, it pales in comparison to GameStop (NASDAQ: GME) by any measure.

The effect of retail shareholders, direct share registry, and a newfound profit can not be understated for the quintessential meme stock.

AMC can hardly count on the same fundamental support.

As part of a “poison pill” play, it can continue to dilute its share base to raise money. Its executives will continue to welcome such support.

However, insiders own something like 24% of the company shares. With everything AMC Entertainment Holdings, Inc. (NASDAQ: AMC) faces – especially a weak revenue outlook, an obscene debt ratio while interest rates continue to rise, and the potential to convert – at a premium – to Amazon (NASDAQ: AMZN) shares or cash, plus maybe jobs, a big buyout is hard to resist.

Of course, that depends on whether an offer is ever made. Again, it's all rumors to date. We can expect a couple of things going forward.

Details of any offer will be considered subject to insider trading laws until both boards agree on a limited press release about a formal proposal. There's nothing out of the ordinary there.

The AMC board and executives will continue to support the retail buyer and meme stock narrative. Anything to maintain share prices, especially if company offerings dilute outstanding shares without further drops in share prices.

My two cents? I don't see much reason to get involved and own shares of AMC Entertainment Holdings, Inc. (NASDAQ: AMC) going into a speculative deal.

Nor do I see any real upside to specifically buying Amazon (NASDAQ: AMZN) shares due to this speculation. If you're like me, you probably passively own a whole bunch of Amazon shares through total market or index funds or ETFs.

Over a much larger time span? Maybe it makes a lot of sense if you think Amazon still has an executive team that is reading the economic “tea leaves” and trends well. Amazon built one hell of a distribution system, online sales platform, and cloud computing juggernaut over a couple of decades.

I am very interested in seeing how this pans out. The digital studios and streaming market is a wasteland of bloated budgets and layoffs right now.

Any movement in the industry is worth watching with the hundreds of billions involved.

Take Care,

Adam English

The Profit Sector