Dear Investor,

A dark cloud has settled over the investment world…

Inflation is raging, stocks are tanking, and a recession is imminent.

I wouldn’t blame you for being frightened.

If you’ve looked at your (401)k or IRA, you’d have every right to be scared…

Since the beginning of the year, trillions of dollars have been ripped from America’s retirement accounts.

The average 401(k) plan is down about $34,000 — more than 25% in less than one year.

That's money that has been stolen from you.

And it's going to get worse. Your retirement is under attack.

But I have good news. You don't have to feel defeated – If you act fast, there are ways you can safeguard your finances while the rest of the world watches their wealth disappear.

That's why I seek shelter in companies few people have ever heard of, like a mysterious company founded in an abandoned iron mine shaft…

This company has been a storage of wealth for over fifty years.

The stock has been a safe haven for some of the wealthiest people on earth.

Not only have they returned triple-digit gains since the pandemic began, but they also distribute a mighty dividend that they are legally required to pay out.

That’s right…

Due to an obscure pact signed by Congress in 1960, this company must shell out at least 90% of its taxable income in the form of shareholder dividends.”

The CEO of this little-known company once told investors he dances when inflation rises.

And he is not trying to be mean when he says this.

He's just emphasizing that his company's stock usually goes up when times are bad, and prices are high. And despite what you’ve heard from the Fed recently, inflation isn’t going anywhere.

You need to prepare yourself right away.

Let me give you some history on why this company is a “must own” for the challenging years ahead: a company that I call The Wealth Fortress.

“It All Began In An Iron Mine Shaft, Miles Underground…”

In 1945 – following the aftermath of World War II, the company's founder began sponsoring refugees from war-torn areas of Europe.

He quickly discovered that many of these people had lost every document that proved who they were and how much money they had. They lost their birth certificates, marriage licenses, bank records, and land deeds.

And that's when he decided that America needed a safe place for every citizen and business to keep essential documents in case of war, government overreach, or any other major disasters.

The founder owned a series of old mine shafts, which were the perfect solution to this problem…

The mine shafts were underground and very secure. They were also kept at a temperature that would not damage the documents with water or heat.

Thus, “The Wealth Fortress” was created.

What started as a noble record-keeping company ballooned into one of the most sought-after bunkers in the world.

The business continued to expand until the underground mine held over 225 individually locked vaults—each with its combination across seven underground levels.

The entrance was sealed with a 28-ton bank vault.

This fortress combines Fort Knox and a James Bond villain's lair…

To put it in perspective, Fort Knox holds 700,00 square feet of underground storage. “The Wealth Fortress” holds two and a half times that – 1.8 million!

And over time, these mysterious mines came to hold some of the most valued treasures in the world: ancient artifacts from cultural heritage sites, priceless renaissance paintings from historical masters, and one-of-a-kind, million-dollar Stradivarius violins.. to name just a few.

While the mines still hold priceless items, the company makes its bread and butter on the storage of documents.

Millions of top secret documents are still on file there – and have been for decades.

It's where Government agencies pay top dollar to secure birth and death certificates, tissue samples, and D.N.A.

In fact, “The Wealth Fortress” is so secure that in the 1960s, some of the richest executives in the world made a secret plan: they would use “The Wealth Fortress” as an underground bunker to save their families and themselves from nuclear fallout.

In case of nuclear war, sixty-five hotel rooms were constructed underground where families could stay for shelter.

Needless to say, the mines are a very secure location for any company or individual looking to store their precious records and valued assets.

“Although The Company Still Operates In The Mines, It Has Taken Its Business Globally”

“The Wealth Fortress” has grown significantly since those early days, expanding its mine shafts into thousands of facilities totaling 90 million square feet. Over 225,000 organizations in 50 countries around the world trust The Wealth Fortress to store and protect their valued assets.

It's a simple fact: 95% of the Fortune 1000 use its services today.

These companies pay top dollar to ensure the safety of these assets for decades on end – and “The Wealth Fortress” gets paid on every item in its safe houses.

That's why the company has grown revenue regardless of every market environment and generously shares profits with shareholders through a massive dividend payment.

Now it's your turn to get your cut, bank regular income, AND watch your investment rise even if the rest are falling…

“Inflation Hasn’t Been This Bad Since The 1970s”

You don't need an investment analyst to tell you that times are tight.

You get a cruel reminder whenever you buy groceries, fill up your tank or open your electricity bill.

So far this year, food prices are up double digits, gas prices spiked as high as 38%, and energy prices have soared up to 20% heading into winter – and will continue to rise.

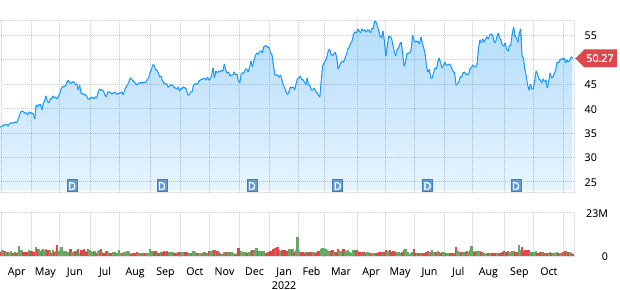

But look how well “The Wealth Fortress” has done during this troublesome period:

That's 132% in the two most volatile years since the financial crisis of 2008. I dare you to show me a company that has held up that well in your portfolio.

As I mentioned before…

Not only does “The Wealth Fortress” hold up during inflationary periods – it thrives.

That’s because the company’s top line is driven by inflation.

Because they are a low-margin company, every inflation point expands those margins.

It's just one of the many reasons that makes them the perfect solution for storing – and growing – your wealth in these uncertain times.

No wonder the CEO does “a happy dance” when he sees inflation numbers…

The Most Important Reason To Store Your Money In “The Wealth Fortress”

Their incredibly generous dividend payout has always provided a strong inflation hedge.

If you can find a company that has a dividend yield above inflation and has been able to grow that dividend year after year, you have the ultimate inflation protection.

And if you can achieve both goals while reaping double or triple-digit gains, you are surviving AND profiting.

That is certainly the case with “The Wealth Fortress.”

Not only does the company pay a dividend more than triple the S&P average, but it has been able to sustain this payout for over a decade. And during that time, the company increased the dividend by almost 10%.

If you had reinvested those dividends over that period, you would have banked a 184% gain.

That's enough to safely and easily turn $10,000 into $28,403.54.

And again – safely and easily, regardless of what shenanigans are happening in the market.

That's impressive, to say the least, but I'm not one to live in the past.

I'm far more concerned about the next ten years…

All of the stars have aligned: high inflation, market uncertainty, and a coming recession are the perfect catalysts “The Wealth Fortress” needs to catapult you to triple-digit gains.

You are probably wondering, who is this guy sharing this wild investment secret with me?

Welcome to The Profit Sector

Allow me to introduce myself…

My name is Jimmy Mengel. I’m the Chief Investment Strategist of The Profit Sector.

I’ve spent the better part of two decades in the underground world of financial publishing, scouring the world for under-the-radar opportunities like “The Wealth Fortress” for millions of readers.

I’m drawn to profit opportunities that are off the beaten path – I don’t just sit at my computer reading Twitter and staring at charts.

Unlike many analysts, I have made it my mission to get out into the world and find opportunities others miss.

And sometimes that means I go to places other people won't go. Like when I booked a last-minute flight across the country to track down an obscure warehouse in the middle of a back alley in the heart of Southern California.

I had heard rumors that the company was storing millions of dollars in rare collectibles.

And sure enough, the rumors were true.

Not only was the company legit, but during my trip, I was able to grip a signed Babe Ruth baseball bat, inspect a lock of Elvis Presley's hair and even hold the famous “Inverted Jenny” stamp.

Here's a picture of me holding the “Inverted Jenny” stamp:

That one stamp was worth a million dollars alone. But it wasn't worth the spit to lick it until it was brought to this warehouse.

The company I visited was Collector's Universe, which made its fortune authenticating these rare and valuable treasures.

I attended backroom meetings with the co-founders, CEO, CFO, and employees.

I traveled their basement vaults to observe the experts inspect these rare artifacts with microscopes, tweezers, and ultra-violet light.

And I walked away with the comfort and confidence to bring the story and the recommendation to my readers.

My trip to Collector’s Universe – and immediate recommendation – closed out at a 715% gain for my readers when the company went private.

After that, I discovered my passion for finding stocks poised for big profits and sharing my findings with you.

For my next act, I drove to Smiths Falls, Ontario, to an abandoned Hershey Chocolate factory. I was there to meet with the CEO of a burgeoning industry that had yet to materialize: legal cannabis.

This was before anyone was covering the investment possibilities of cannabis. They told me that I was the first newsletter writer ever to visit.

Full legalization was still years away, and Canada wasn’t yet the cannabis capital of the world.

When I arrived, the building didn’t look like anything to get excited about. It was a large facility set in an industrial area of town. It was gray, lonely, and appeared abandoned.

But when I stepped inside, everything changed. The factory was buzzing with employees in lab coats, and that first smell of stepping into the cannabis grow area was one I’ll never forget.

After touring the entire facility and spending all day inspecting the warehouse, learning about the plants, and interrogating the company brass, I was completely convinced that cannabis was going to be the next new industry.

Again, I immediately sent out a buy alert for a company that was then called “Tweed.” Shortly after the trip, they changed their name to Canopy Growth Corp. and became the largest cannabis company in the world.

My readers made as much as 3,200%.

I’ve also brought readers gains of:

- Liberty Health Sciences (CSE: LHS) – a gain of 127% – in three weeks!

- Charles River Laboratories (NYSE: CRL) – a gain of 182%.

- Cronos Capital Corp. (TSX: MJN) – a gain of 380%

Now, I could sit here and peacock like some “gurus” out there who are always bragging about their past exploits.

But I’m more interested in thinking about the future.

That’s why I’m so excited about Profit Sector Monthly...

Monthly Profits From Every Sector

I’m pleased to announce that we’ve just launched a newsletter that will give you access to all of our research – and immediate access to “The Wealth Fortress: The #1 Stock to Profit From Inflation” report – for pennies on the dollar.

We’ll deliver a brand new underground stock pick at the beginning of every month. It will cover a different part of every investment sector out there: income, energy, tech – you name it, we’ll bring it to you.

You’ll start with a copy of my report titled “The Wealth Fortress: The #1 Stock to Profit From Inflation” where I reveal the name, ticker symbol, and full research on this exciting stock.

Then, I’ll introduce you to my elite team of analysts…

You see, I’ve brought some colleagues along, each with a defining area of expertise.

Briton Ryle moves fast and brings a diverse range of quick trade strategies. Briton has been trading, investing, and sharing his insights with individual investors since 1998.

He has helped investors successfully navigate major market crashes like the Dot Com bust in 2000 and the financial crisis of 2008.

He learned the secrets of stock options trading directly from the experts on the floor of the CBOE.

He believes that there is no shortcut to deep research and dives head-first into topics, trends, and technology – and dives deep.

The rewards have been life-changing.

The very first stock he ever recommended was South Korea’s SK Telecom. His readers enjoyed a 150% profit in a matter of months.

Briton hasn’t stopped since…

In the past 25 years, Briton has helped tens of thousands of readers change their financial fortunes – and reap quick triple-digit gains like:

- Palo Alto Networks (Nasdaq: PANW), recommended at $138 and hit a high of $626 a share. A 353% gain.

- Maxar Technologies (Nasdaq: MAXR), recommended at $9 a share, ran to $54 before the bear market hit – a 500% gain.

- Chewy (NASDAQ: CHWY), recommended at $26.50 in October 2019, just months before the pandemic hit. Chewy shares topped out at $118. That’s a 345% gain.

Adam English brings a historical perspective on trends and technology. For over a decade, he’s worked alongside ex-brokers, options floor traders, and financial advisors.

As a history major, he knows well the old axiom, “Those who cannot remember the past are condemned to repeat it.”

That knowledge has given him the perspective to predict the 2008 housing crisis, the pandemic bounce of 2020, and the current inflationary market.

His readers have all benefited from his 20,000-foot view.

Here are a few highlights:

- GT Advanced (GTAT), recommended at $6.45 in May of 2012. By July of 2014, it hit $19.77 for a 207% gain.

- Osisko Mining (OSK.TO), recommended in November of 2013. A buyout announcement in April 2014 at $8.15 per share sent the stock upwards by 62% in under 5 months.

- NVidia (NASDAQ: NVDA), recommended at $58.02 in January of 2018, reached $272.47 by January of 2022 for a 370% gain.

That barely scratches the surface of what types of gains this team can regularly produce.

In all of my years of financial research and analysis, I’ve never been more excited to join such a powerful team like the one we have at Profit Sector Monthly.

Not only will you enjoy a brand new stock pick every month, but Profit Sector Monthly doesn’t leave you hanging. You’ll also get regular updates from our experts. Throughout the month, our analysts will email you important updates as needed, telling you when to lock in gains… add to or close a position… and any new developments.

You’ll also receive exclusive video dispatches from each editor with breaking news, stock tips, and personal musings.

I’m sure you’ll share the same excitement as soon as you claim your first issue: “The Wealth Fortress: The #1 Stock to Profit From Inflation.”

Not only will you immediately receive your Wealth Fortress report, we’ll also throw in three crucial reports from each editor:

- A copy of Jimmy Mengel’s Special Report: Legally Guaranteed Income: 3 Stocks to Buy Now for a Safe Retirement

- Briton Ryle’s Special Report: 3 Must-Own Tech Stocks for 2023

- Adam English’s Special Report: The EV Revolution: 3 Stocks For Inevitable Growth

There has never been a better time to reap the benefits of our research team. With the economy heading into recession, the stock market showing historic volatility, and inflation eating away at your hard-earned savings, you need to protect and grow your wealth in new, nimble ways.

Profit Sector Monthly will do just that, allowing you to sleep easy at night knowing that you have the information you need, every single month. We’ll bring you an exciting new stock pick from our dream team of experts at the first of the month.

You’ll also immediately receive “The Wealth Fortress: The #1 Stock to Profit From Inflation“ along with your basket of reports — completely risk-free.

There is no time to waste. Just click the button below to sign up, and we'll send you everything right away.