“You got your stuff with you?

Stuff is important. You gotta take care of your stuff. You gotta have a place for your stuff.

Everybody’s got to have a place for their stuff. That’s what life is all about, tryin’ to find a place for your stuff! That’s all your house is: a place to keep your stuff. If you didn’t have so much stuff, you wouldn’t need a house. You could just walk around all the time!

So now you have a houseful of stuff. And, even though you may like your house, you gotta move. Gotta get a bigger house. Why? Too much stuff! And that means you gotta move all your stuff. Or maybe, put some of your stuff in storage.

Storage! Imagine that. There’s a whole industry based on keepin’ an eye on other people’s stuff.”

-George Carlin

Reading the Carlin “stuff” bit really doesn’t do it justice. I’d recommend watching him perform it himself:

We love building up such giant piles of stuff so much that we need to find even more places to stash that stuff. In spite of how obvious these statements are to most homeowners, most investors are typically investing in companies that make the stuff people want. That’s what everybody does, right?

Just look at Apple. They make stuff that people really, really want. And they make a lot of it.

But how many old iPhones, iPads, and iPods (remember those?) are rotting away in a storage locker? Tons. Despite the fact that most folks won’t ever look at them again, there is a psychological backstop that prevents us from throwing things away that we spent hard-earned money on at some point.

That’s why I’m bullish on investing in the things that people want to keep but don’t have the space for. It’s a multi-billion industry that does not get the attention it deserves.

According to Storage Post, here are the top five items that people have run out of room for that end up in storage units:

- Furniture – That yellowing futon, your child’s first bunk bed, your grandmother’s old antique table. These are items that you really don’t use anymore but you cannot bear to throw away (even though you probably should).

- Seasonal Decor – Who doesn’t have a big box of tangled Christmas lights stuffed into a corner of the basement? Those massive inflatable Santas? How about Halloween? Americans spend over $3.3 billion on costumes and another $3 billion on decorations. Much of that ends up in storage.

- Appliances and electronics – Like the aforementioned Apple products, households regularly upgrade televisions, refrigerators, washers, dryers, and other large, expensive appliances. But they recycle them or throw them away. To storage they go!

- Collectibles – This is one of the first items that gets kicked to the storage shelter. Baseball cards, stamp and coin collections, old paintings, and those inexplicable Longaberger baskets are shipped off for safekeeping for the day that they become truly valuable.

- Books and media – Books? Who reads those anymore? They take up whole rooms of your house, and how often do you actually read them? (Editor’s Note: I do, and have gotten in several fights about how much room they take up. But if I’m eventually forced to, I wouldn’t be able to part with them. The same goes for the thousands of CDs, DVDs, and records in my collection.)

That’s why the self-storage industry is still booming and has grown even faster since the pandemic. We’re all still accumulating stuff and paying top dollar for a place to stash it.

Storage Wars

I’m sure you may have come across one of these reality shows where a bunch of treasure hunters crowd around an abandoned self-storage unit, willing to bid – sight-unseen – on the valuables inside.

Typically the bidder comes out with a bunch of useless family photos, old mattresses, and broken lamps. However, on some occasions, a lucky seeker strikes it big. In 2019, on the television show Storage Wars, a man bid on a unit for $500, without having even the slightest clue what lay inside. When the rusty metal door was rolled up, the man was shocked to find a safe inside containing $7.5 million in cash!

On another occasion, a homeless couple bid a mere $10 for a storage space, hoping to find some clothes or furniture. Instead they uncovered a beat-up old teddy bear. Undeterred, they cut open the teddy bear to find $300,000 in cash rolled tightly inside it.

When an art collector dropped $15,000 for a unit known to house various paintings, he figured he might uncover a couple of pieces that he could restore and make a buck or two. Little did he know that inside the locker lay several unknown paintings from the abstract expressionist Willem de Kooning. He turned that $15,000 into $2.5 million.

These stories are fleetingly rare, but the storage industry itself is its own treasure.

While other real estate asset classes took heavy hits during the pandemic, self-storage has flourished. In 2020, the global self-storage market was valued at $48.02 billion. It is expected to jump to $64.71 billion by 2026, an envious compound annual growth rate (CAGR) of 5.45%.

Of the many self-storage companies that operate today, there are a few that make up the bulk of the market. Here are the top three by market capitalization:

- Public Storage (NYSE: PSA) – $52.76 billion

- Extra Space Storage (NYSE: EXR) – $23.45 billion

- CubeSmart (NYSE: CUBE) – $10.74 billion

Each one of these companies operates as a REIT and spins off a juicy dividend of ~4%.

They are all solid companies with a pretty decent moat – most customers don’t tend to move their valuables from place to place, so the average rental times for these spaces tend to stretch out over many years.

But Public Storage is seeking to pull away from the pack with a semi-hostile takeover of another rival that could only be described as a real-life storage war.

Public Storage Vs. Life Storage

As mentioned above, Public Storage is the market leader in the space. But Extra Space and CubeSmart have been slowly encroaching on their turf. So Public Storage is doing what most large companies do when threatened by their competitors: they acquire one of them to boost their overall business.

Enter Life Storage (NYSE: LSI), a close number four on the list with a $10.4 billion market cap. The company also boasts 1,076 self-storage properties in 35 states, mostly around the Southeast and Southwest. They own a total of 78.6 million rentable square feet – an amount that Public Storage wants to tack on to their rental portfolio of 2,787 locations and 198 million square feet.

The merger would make the new company the largest self-storage company in history.

Public Storage recently offered to acquire Life Storage in an all-stock deal for $11 billion. They were turned down.

This type of maneuver is a pretty common one for REITs. Even though issuing more shares tends to rub shareholders the wrong way, if you want to grow your company’s footprint, it can seriously pay off in the long run. It all comes down to the valuation of the company that you are acquiring.

In this case, Public Storage’s offer would give shareholders 0.4192 shares of PSA for each share of LSI – a value of 19% above the price of LSI at the time.

Here’s how the company positioned it at the time of the offer:

- Accelerated Growth and Profitability: Stronger organic growth resulting in higher profitability as Life Storage’s portfolio benefits from Public Storage’s industry-leading revenue generation and expense efficiency. Public Storage’s same-store direct operating margin is approximately 80%, compared to 73% for Life Storage. Following the transaction, Life Storage shareholders would benefit from the higher income uniquely generated by Public Storage’s platform.

- Platform Cost Savings: Platform efficiencies within an industry where cost benefits of scale are well-demonstrated.

- Enhanced Ancillary Operations: Complementary enhancements to ancillary operating platforms, including tenant reinsurance, third-party property management, business customer offerings, and lending.

- Expanded Portfolio Growth Opportunity: Public Storage’s in-house development, redevelopment, and acquisition expertise and higher net operating income generation unlock greater opportunities externally and within Life Storage’s existing portfolio.

- Balance Sheet: Combined capacity to fund significant future growth at a more advantageous cost of capital utilizing Public Storage’s industry-leading balance sheet and A / A2 credit rating while maintaining prudent leverage.

It was pitched as a ‘rising tide lifts all boats' scenario, with shareholders from both companies coming out on top in the end. Life Storage clearly didn’t see it that way. I tend to disagree, as both CubeSmart and Extra Space Storage have enviable locations and a better return on investment (ROI) than PSA and LSI. They could each learn from one another to bridge that gap.

LSI also has a bit of a problem with overpaying their management – general and administrative costs exceeded $60 million last year – and the merger would be able to slash that by $50 million per year with the overlap in administrative costs, according to Dane Bowler at Portfolio Income Solutions.

It may be a tough sell with LSI management essentially deciding to fire themselves, but if PSA comes back with a more competitive offer – say 10% more – the shareholders may very well decide that the acquisition makes more sense for them.

That’s what I see happening in the months ahead. If it does come to pass, LSI shares will get a nice boost, and PSA shares will take a small hit, which is almost always the case in these types of acquisitions.

In that event, LSI shareholders will get a premium on their stock while merging with the leader in self-storage. They will also benefit from the 50% dividend hike that PSA just announced at the same time as the public offer.

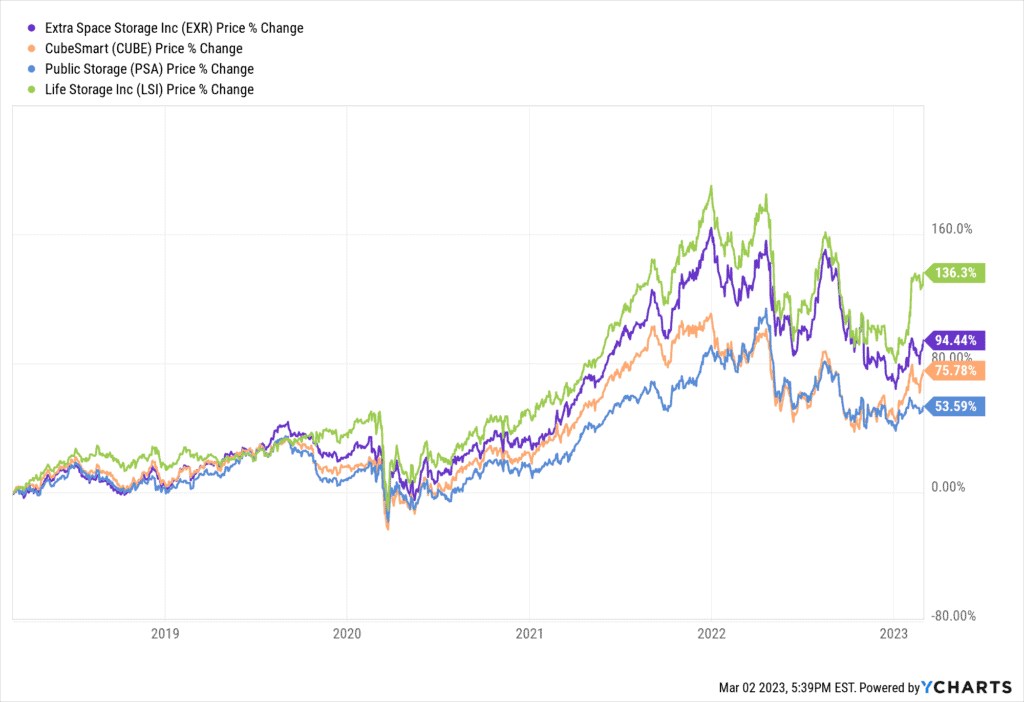

In any case, both companies have had a solid return over the past five years:

Life Storage does have more momentum right now, but Public Storage has both the footprint and G&A advantage to make the merger work. My guess is that PSA sweetens the offer by 5% to 10%, and LSI agrees.

If that is indeed the case, then you’d be wise to be an LSI shareholder when the deal gets done.

Otherwise, you could always bet on the other two companies mentioned, CubeSmart and Extra Space Storage, who both ran up on the news and sport the same 4% dividend. All three of the other storage companies have outperformed PSA over the past five years, so it's no secret why they are aggressively pursuing this acquisition:

The storage wars have begun. It won’t surprise me one bit if those other companies explore similar mergers to continue to compete and grow in those storage spaces.

Godspeed,

Jimmy Mengel

The Profit Sector

Follow me on Twitter @mengeled