The stock market closes tomorrow, December 23, at 2 pm. So that gives us one and a half more trading days before Christmas. And, with Monday the 26th also being a market holiday, there are just five and a half trading days left for 2022.

I expect most investors are happy to be rid of this investment year. But perhaps it will end on a decent note.

(You can find a full list of Market Holidays here.)

Yesterday’s action was a good start for the year-end rally. And, after last week’s beatdown, it was certainly nice to finally see a little green on the screen. Whether or not yesterday’s rally extends for a few more days, I don’t expect we’ll see a return to the intense selling that hammered the S&P 500 down over 7% in just 5 days…

We’ll get the final revision to 3Q GDP later today – which isn’t a market-moving event – and that’s about the end of it for economic data this year. And after last night, there are no earnings reports to speak of until fourth-quarter earnings reports start coming out on January 13.

So, about last night…

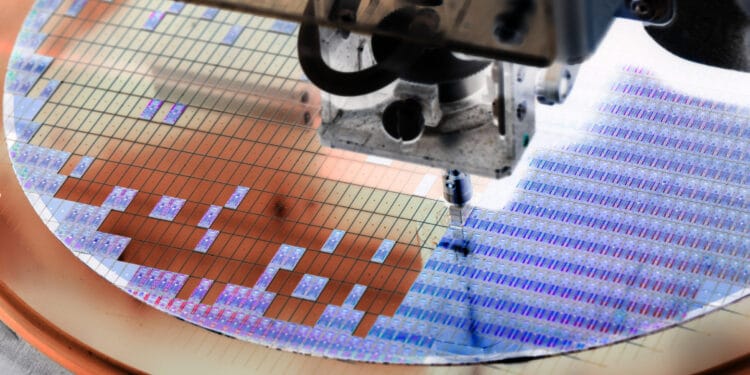

It was Boise, Idaho based Micron Technology (NYSE: MU) that reported earnings. Micron is one of three major producers of NAND and DRAM memory chips and products. South Korea’s Hynix and Samsung are the other two.

The business cycle for semiconductors is pretty volatile in a general sense. The ups and downs for memory chips are turbulent, to say the least. In the same quarter last year, Micron earned $2.14 a share on revenue of $7.79 billion. This year, Micron posted a $0.04 loss per share on revenue of $4.09 a share.

Point is, it is truly feast or famine with memory companies. The cycles are fast and swing wildly. Micron already announced that it was cutting production by 20% to bring down the glut of memory chips. And last night, it said it would fire 10% of its workforce to further cut costs.

So, Micron’s ugly quarter is not news, exactly. Nobody was expecting anything good to come from its earnings report, which is why the stock isn’t getting downright pummeled in the early going today.

In fact, Micron is getting close to the point where investors will start buying it for the next upturn for memory chips. I wrote about the cycle for Micron six weeks ago, here’s the most relevant bit:

When demand and prices fall, these three [Micron, Hynix and Samsung] will cut production to support prices, and they’ll go right back to making boatloads of money when demand returns. So watch that forward P/E ratio. It’s high now and could go higher. But the minute it starts to fall, the stock will rally.

Micron hinted that the memory chip glut will ease early in 2023, so keep an eye on Micron. I'll also be keeping tabs on Advanced Micro Devices (NYSE: AMD) and Wolfspeed (NASDAQ: WOLF).

That’s your “Morning in the Markets” for today, take care and I’ll talk to you tomorrow.

Briton Ryle

The Profit Sector