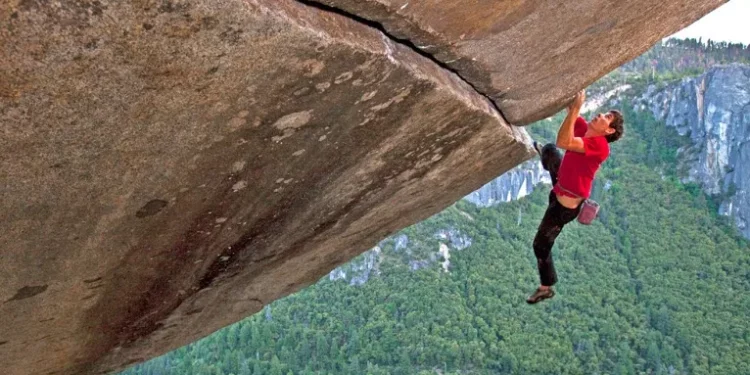

One of the road signs for determining when a careening bear market is ready to make the turn back to a bull market is called “climbing the wall of worry.”

It’s a simple concept: when stock prices start jumping higher and the news flow remains dark and ominous, it can signal that better times are ahead for earnings and economic data.

And if we parse the news flow of the last week, it’s universally bad.

Very much a wall of things to worry about…

First Up, the Fed and Interest Rates…

Last week, when the Fed dropped its 4th consecutive 75 basis point bomb on the economy, investors hoped that the Fed would indicate that it would slow the pace of rate hikes. Maybe the Fed would even say an end to the hikes was in sight.

Instead, Fed Chair Powell said pretty much the opposite, that it isn’t time to slow down, and in fact, the stopping point, or “terminal rate,” as it's being called, is almost certainly higher than what was expected a few days ago.

And so the teams of investment bank economists and strategists spent the last few days raising their estimates of where that terminal rate is from 4.5% to 5.5%.

That’s a big difference… For instance, if Fed interest rates go to 5.5%, the rate for a 30-year mortgage will be pushing 8%.

To put that in perspective, the payment on a home loan at 8% would be nearly 50% higher than a loan from 10 months ago. So an already reeling housing market will get worse.

On Deck, Inflation…

On Friday of last week (November 4), the Non-Farm Payroll report came in much stronger than expected. That’s bad news for inflation because people getting jobs means more money in people's pockets that will get spent. More spending (demand) doesn’t bring prices down. Conversely, strong demand means companies will pass their rising costs on to the consumer.

It seems likely that the next inflation report we get – the Consumer Price Index (CPI) on Thursday – will not show any slowdown for rising prices.

Now, you might see the financial media put a spin on the strong labor market, saying something like, “the strength of the labor market suggests that the economy can withstand more interest rate hikes.”

In other words, don’t worry about the U.S. falling into recession so long as the job market is strong. This line of thinking is baloney and completely misses the point of what rate hikes are supposed to accomplish. The Fed wants unemployment to rise. It needs companies to stop hiring and start laying people off. That’s the only way to slow spending (demand) and get inflation down.

In other words, the Fed’s job is to push the U.S. economy into recession.

Next Up, Earnings…

Outside of energy stocks, earnings were pretty bad last week. Especially in the tech sector:

- Apple (NASDAQ: AAPL) fell from $155 a share to $137 after it reported earnings and warned that it’s cutting production of its newest iPhone because of weaker demand. And it’s a warning that deliveries are likely to be delayed. Not good.

- Amazon (NASDAQ: AMZN) – which is technically a consumer discretionary stock, not a tech stock – is down 25% over the last two weeks after it said demand was falling sharply. Also not good.

- Microsoft (NASDAQ: MSFT) fell 12% after it said revenue at its cloud service Azure would be weak because corporate spending is falling.

- Facebook parent company Meta (NASDAQ: META) is down 30% after it admitted that advertising spending (an indicator of corporate spending) was falling off a cliff, average daily user numbers for Facebook were down, and the whole metaverse thing isn’t working, but they're going to keep spending wildly on it.

- Qualcomm (NASDAQ: QCOM) fell 17% after bad earnings. One of my favorite stocks, Twilio (NASDAQ: TWLO), was crushed by 35% after it missed earnings and offered up a pessimistic forecast.

And Finally, Layoffs…

Layoffs. Lots of them.

Tesla (NASDAQ: TSLA), Ford (NYSE: F), Twitter, Meta (NASDAQ: META), Snapchat (NASDAQ: SNAP), JP Morgan (NYSE: JPM), Goldman Sachs (NYSE: GS), Carvana (NASDAQ: CVNA), NetFlix (NASDAQ: NFLX), Peloton (NASDAQ: PTON), and Zillow (NASDAQ: Z) have all either announced layoffs or already laid people off.

And in the big picture, many economists say that the unemployment rate, currently 3.7%, has to reach 5% or even 6%, before inflation will start to come down.

Layoffs are bad pretty much everywhere you look.

And yet stocks are shrugging it all off and rallying ever since the brief knee-jerk reaction after the Fed’s latest rate hike last Wednesday.

Climbing the Wall of Worry

Back in March 2009, on the 9th day of the month, bank stocks went bananas. Bank of America (NYSE: BAC), Morgan Stanley (NYSE: MS), and Citi (NYSE: CITI) all ramped up 15% to 20%…

This was the tail end of the financial crisis. Bank stocks were hated and reviled. The conventional wisdom was that they were damaged beyond repair.

I remember the day vividly because I wrote an editorial where I said something like, “Sure, stocks are way oversold, but why, oh why, did a rally have to start with bank stocks, the mangiest of the Wall Street mutts…”

That bank stock rally marked THE bottom of the financial crisis bear market. It might be the perfect example of stocks climbing the wall of worry.

And I gotta say, the rally we’ve seen the last couple of days is making me wonder if another “climbing the wall of worry” is underway.

I will watch the market’s reaction to the CPI report later this week and earnings from Walmart (NYSE: WMT) and Target (NYSE: TGT) next week.

I am still holding the Bank of America (NYSE: BAC) puts I told you about last Thursday. Because I’m not 100% sure that this wall of worry rally will continue. But the odds have improved a lot that this rally could continue…

That’s it for now, take care, and I’ll talk to you soon.

Brit Ryle

The Profit Sector