The Immediate Silicon Valley Bank and Signature Bank Problem

The Risk of Bank Contagion Explained

Investor Risk and Federal Intervention

What Comes Next for Risky Banks?

Whenever I think of a bank run, I think of a scene from “It’s a Wonderful Life.”

Dancing, what looks like some kind of dark swill of liquor, and a celebration after a rough day. “Mama dollar and Papa dollar,” and a crisis averted.

I’m all for a classic Hollywood story and that implacable Jimmy Stewart drawl. But the reality is far different. It’s a brutal grind over time. Surviving overnight is not a thing. Two dollars wouldn’t cut it then, and scraping the bottom of deposits doesn’t now.

What doesn’t kill banks rarely makes them stronger.

We just saw several examples of bank runs with Silicon Valley Bank (NASDAQ: SVIB) and Signature Bank (NASDAQ: SBNY).

They had their overnight moments I’m sure. The following day their shares stopped trading, and the Fed’s swooped in.

Let’s look at what happened and what may happen next.

It isn’t heralding a banking apocalypse, not one that shakes the world at least. But that may be cold comfort.

The Immediate Silicon Valley Bank and Signature Bank Problem

There is a “canary in the coal mine” aspect to what happened. Silicon Valley Bank operated as a commercial bank on the fringe of what was tolerable. It always has.

It was always designed to take on more risk than other banks. Founded in 1983, it was a small depository bank for many years. It was designed to stay barely solvent according to banking rules with a focus on tech start-ups.

Back in 1983, it was very different — money in, rotating lending out, all in proportion with deposits and mandatory insurance.

Tech got big since then, the rules changed – quite the understatement – and the scale of banking with SVIB increased. The scale of what it thought it could do increased. The lobbying power it tangentially benefited from soared further.

In 2015, the bank stated that it served 65% of all US-based start-ups. It expanded to international lending. It accepted risky mark-to-market lending that other banks would not and ballooned in size, “on paper,” with $209 billion in deposits.

To put that in perspective, that’s about 10% below the market capitalization of McDonalds.

This accumulated depository ledger was offset by high-risk lending to provide an attractive profit margin for investors, which was undermined by a dramatic reversal in deposits and cash flow over the last several years.

In a matter of days, SVIB was called out by big names for its lack of solvency. There simply wasn’t enough cash flowing in to shuffle around to cover all transaction requests at the end of the day.

The rest you know. It collapsed due to a bank run on deposits and was basically seized by the federal government. Technically, the federal government forced it to turn all assets over to a newly made, government-controlled corporation with a charter predetermined by law.

It sounds terrible, and it is bad for the bank, but it works surprisingly well when the bank straight up falls into a bottomless void.

A void it was – of all account deposits, only 3% were under the $250,000 guaranteed limit through the Federal Deposit Insurance Corporation (FDIC).

To make matters worse, the lack of confidence bled over to Signature Bank, which failed as well. Of its $89 billion in deposits, 90% were not insured by the FDIC as of the end of 2022.

That’s nearly $300 billion technically frozen so far. The federal government has said it will back that up, but there is a very real fear that is far from the ultimate total.

The Risk of Bank Contagion Explained

What has happened since is nothing short of traumatic and only time will tell if it is justified.

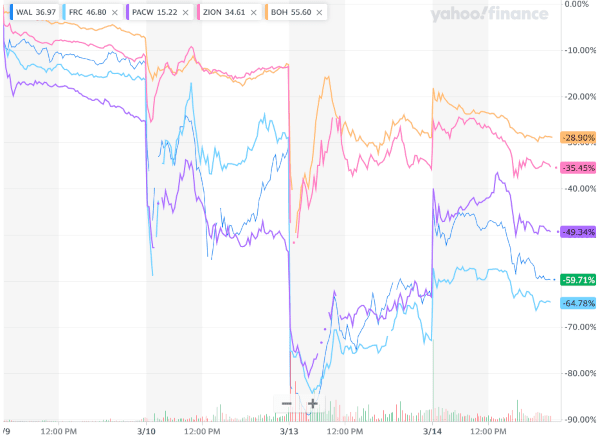

Let’s look at some of the most affected share prices for mid-sized banks with similar small or regional bank profiles, tech lending exposure, or some cryptocurrency involvement.

It’s clear the market is worried about the risk of contagion.

That’s five days of stock price movements for the following banking stocks:

- Western Alliance Bancorporation (NYSE: WAL)

- First Republic Bank (NYSE: FRC)

- PacWest Bancorp (NASDAQ: PACW)

- Zions Bancorporation, National Association (NASDAQ: ZION)

- Bank of Hawaii Corporation (NYSE: BOH)

This is far from a comprehensive list of stocks affected, but these are a handful of those most affected.

Other than SVB dying in a couple of days, the most dramatic movement was in First Republic Bank (NYSE: FRC) share prices, losing about 85% of value in a matter of days, most of it over one weekend.

Investor Risk and Federal Intervention

Share price movement doesn’t directly affect deposits, which ultimately drove the bank runs for Silicon Valley Bank and Signature Bank. Still, they show what will come – a cash flow squeeze and a limit on raising new capital from new stock or debt issuance.

- These banks don’t work without a return on investment by lending cash on hand.

- Rising interest rates and low – or negative – deposit flows ravage collateral.

- Lack of collateral and increasing competition drives up interest rates for debt.

- Risk is reevaluated, and interbank lending shrinks.

- Go back to step two and reevaluate.

That’s what has happened, basically. How far could it go, though? Time will tell, and that’s what the federal government is buying – time.

It will guarantee deposits and let some intrabank contracts unwind, dampening the losses for some counter-parties.

Employees of the failed banks will get paid for 45 days at 1.5 times their regular wages to rip the banks apart.

It will slow down how quickly contagion can happen. That’s what we need to understand with what the Federal government is doing. It is only buying time.

It is not buying security for a banking system that, on some levels, is starved for deposits, all while facing far higher interest rate costs.

A rock and a hard place. Pinched from both sides.

What Comes Next for Risky Banks?

The next couple of months, or quarters, will probably be pretty disappointing in the financial sector, especially for small or mid-sized banks. There is no real fix in the works.

If anything, all that has happened is the government jumping on a grenade and hoping it is bulky enough that no shrapnel hits anyone else.

That could work for stability now. It won’t work forever if the fundamental instability doesn’t end.

So what comes next? It depends on three catalysts: cash flow and margins, rising interest rates, and rampant inflation.

Cash Flow and Margins: The underlying problem is that there is no potential increase in cash flows. Even if it doesn’t undermine deposit requirements, banks exposed to similar problems that caused the bank runs will almost undoubtedly see cash flows and margins shrink over the next couple of quarters.

Rising Interest Rates: This isn’t necessarily a bad thing for banks if it happens much slower than it has. Their depositors and those they lend to – often the same – have to rotate their debt into higher-cost loans as interest rates rise. That creates a downward spiral. Higher debt servicing costs lead to less free cash flow, lead to lower deposits, perpetuating the need for higher interest rates.

Rampant Inflation: To make matters worse, inflation takes time to process. Higher business costs create greater risk if they can’t counter them with higher prices. Customers are limited in how much they can absorb higher prices.

The three of these amplify over time in reverse order of how they’re listed in a feedback loop too.

Climbing inflation drives up interest rates for borrowers and drives down deposits. In turn, that guts cash flow and margins, and the cycle starts anew.

The longer it goes on, the quicker it happens. The quicker it happens, the more likely it forms a feedback loop that freaks out depositors.

Now we’re right back to what we started talking about – a bank run.

It’s a brutal cycle. Here’s hoping the cycle slows down with the latest round of federal intervention, as unsavory as it may be.

For now, the intervention is limited to using FDIC funds in an extraordinary way to guarantee billions of dollars in deposits. Supposedly it will cost taxpayers nothing over time.

If the bank run continues, we can expect far worse. Insolvency for otherwise profitable small businesses, massive federal intervention we haven’t seen since TARP, and a bank run contagion.

The odds are low, but all the components required are in play.

Take Care,

Adam English

The Profit Sector