EV Demand is Soaring Long-Term

The Short-Term EV Market is Bearish

How To Evaluate EV Companies in 2023

The Elephant in the Room – Tesla Inc. (NASDAQ: TSLA)

Checking In on Pure Play EV Stocks – Fisker, Lucid, and Rivian

What To Watch For Going Forward

Electric vehicles, EVs, have a bright future, and the numbers back it up.

Look ‘under the hood' of EV stocks and you'll see they're mostly clunkers.

This is going to be the paradigm through 2023 and beyond. It's one thing to build shiny new cars, it's another thing to make a business of it.

This article is about capturing the predicted EV market growth – or at least at a rate that can scale – and making a profit too. You know, like any company that will continue to exist for long term.

Demand in EVs is soaring, yet profit potential remains elusive.

The EV market – both cars on the road and stocks in the market – are at an inflection point this year. Here's what you should know…

Electric Vehicle Demand Is Soaring Long-Term

First up, we should make sure we know the baseline. The trajectory of the EV market on the whole. The “big picture.”

The short version? The U.S. is a laggard compared to China and Europe, and last year looks like it was brutal for EV manufacturers.

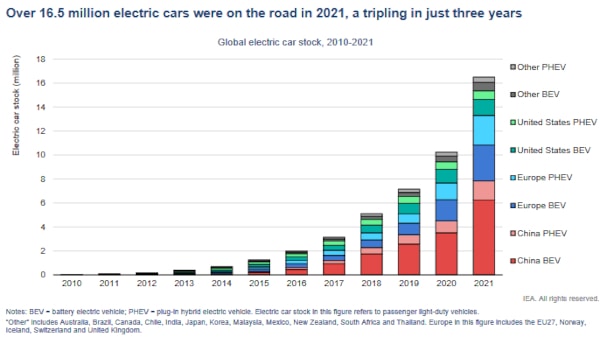

Let's start with the latest and best data from the International Energy Agency (IEA) 2022 report:

Look at China go. Europe is a powerhouse for percentage gains as well. The U.S.? Not so much.

To quote the report:

“More electric cars were sold in China in 2021 (3.3 million) than in the entire world in 2020 (3.0 million). China's fleet of electric vehicles remained the world's largest at 7.8 million in 2021, which is more than double the stock of 2019 before the Covid-19 pandemic.

“Electric cars accounted for 16% of domestic car sales in 2021, up from 5% in 2020.”

In Europe, it's about 17%, so about the same – one out of seven cars.

Meanwhile, EVs accounted for about 4.5% of car sales in the U.S., or just shy of one out of twenty.

The Short-Term EV Market is Bearish

So the trend is strong and carries weight. Yet the long arc with verified data from 2021, while we wait for numbers from 2022, offers little today.

Short-term deviations from the trend can be brutal for investors. Now is one of those times.

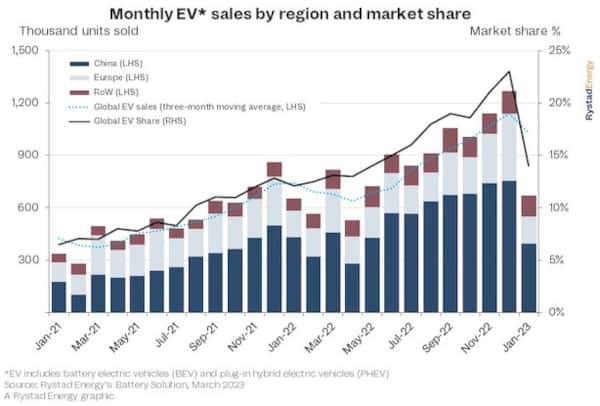

Rystad Energy has a snapshot analysis for January 2023. It isn't pretty in the short term. Here's a chart.

China may have seen a roughly 50% drop in EV sales in January 2023 compared to December 2022, and EV sales were basically flat year-over-year. European EV sales saw a similar, steep decline.

In January, U.S. EV sales worked out to about a 7.8% market share at about 80,000 vehicles sold. According to Rystad Energy, the U.S. market is expected to break the 10% adoption mark this year, but it pales compared to real numbers worldwide.

How To Evaluate EV Companies in 2023

We've set the stage – massive growth has happened and will continue, but it has staggered in the short term.

Meanwhile, EV companies are facing an intensely adverse business climate. Debt is more expensive, with higher interest rates, and we're in a bearish tech stock market that is worse than any since many EV makers were founded.

In short, revenues and cash flow are being pinched from the top and bottom – a rock and a hard place – all while company growth in EV markets is being challenged. All for the first time for many EV stocks.

As tough as it has been for EV makers during the good times, it's more challenging now. The gap between potential and profit is wider, the bridge they can afford between them is weaker, and the fall is deeper.

These companies are fighting for market share, revenue, and investors. They must secure all three of these, or they'll be unstable.

The Elephant in the Room – Tesla Inc. (NASDAQ: TSLA)

The first company up is the most obvious. It dominates market share in the domestic market and takes the lion's share of attention worldwide.

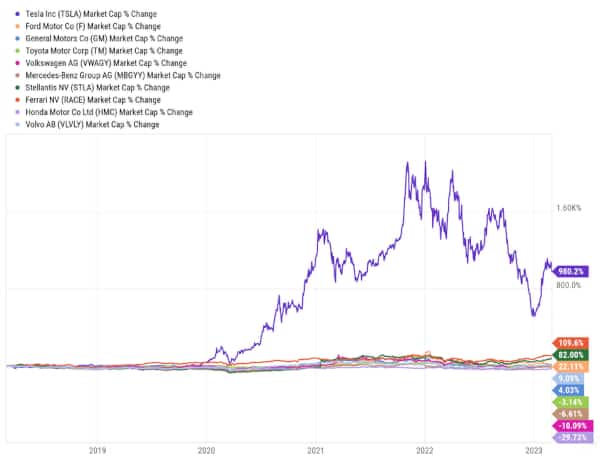

The absurd scale at which Tesla is valued compared to the top ten car makers by market capitalization cannot be understated.

That's a five-year chart of market capitalization change. Investment in Tesla is at a scale that functionally breaks this metric.

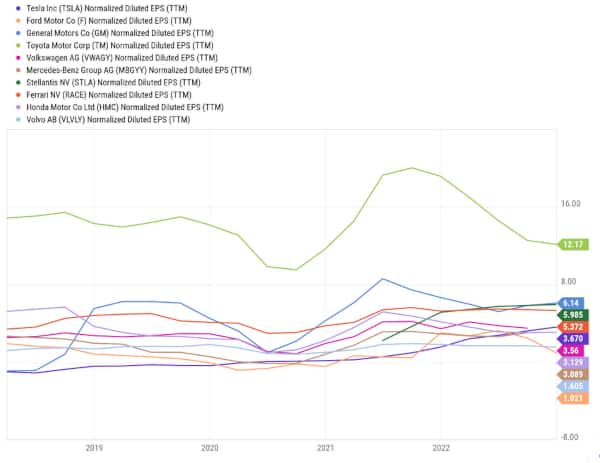

However, it isn't the only metric. Let's look at normalized earnings per share over the same time frame.

Tesla is a first mover and set a benchmark for tech and investment in EVs early in the emerging sector. It still leads EV sales in the domestic market but is not an impressive car company.

What does it really have to offer compared to how much it costs? There is a wide gap between investment and results — a gap it cannot possibly bridge.

Plus, it is a hotbed of speculative, derivative investments – options-based calls, puts, and shorts. Basically, Tesla is a bloated aberration.

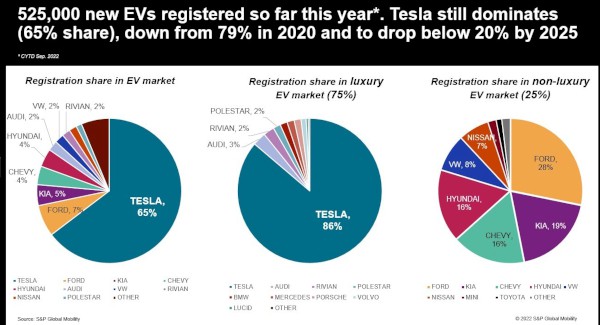

Consider this report from S&P Global Mobility. It evaluated domestic EV sales and concluded that Tesla still dominates with 65% of market share this year through the first nine months of 2022.

However, that is a drop from 79% in 2020. With only a nebulous pledge to offer a model under $50,000 in the next several years, an entire market segment is open for the taking.

In short, Tesla is a company that is about to face more competition across different price points, all while still being massively overvalued.

Elon Musk promised a car at a lower price point at a company event in February 2023. We're still waiting on the “Cybertruck” from his announcement in 2019.

It's the quintessential meme stock. One that is so completely divorced from reality that we need not cover it since it is so overly manipulated.

Meanwhile, S&P Global Mobility predicts that the number of EV models available in the U.S. will grow threefold from about 50 by the decade's end.

It also concluded that Tesla's U.S. EV share will drop below 20% of the overall market by 2025 as these models come to market.

These new models will have to sell, but the days of Tesla's first mover monopoly are over. A diverse and potentially oversaturated market is coming within a matter of years.

Checking In on Pure Play EV Stocks – Fisker, Lucid, and Rivian

It isn't all doom and gloom for “pure-play” EV stocks, though it will be a struggle. The next few years are make-or-break, but there is room for a breakout contender.

Three stocks, in particular, stand out as high-risk, high-reward plays we should watch in the EV car sector.

Fisker Inc. (NYSE: NYSE)

Fisker Inc.'s share price saw a massive surge in share price and investor interest after its fourth-quarter 2022 earnings results.

It will finally start delivering vehicles to customers, potentially working down a 65,000-vehicle backlog and locking in the revenue from it.

For fiscal year 2023, the company expects production of 42,400, a challenging total but one that may be possible with previous capital investment and over $700 million on hand at the end of last quarter.

Production means revenue and capacity to increase backlog. That ticks off two of the three things to look for, a start to market share and revenue capture, but not necessarily investor interest.

At least long-term. Shares surged 30% upward following the announcement.

Fisker pulled the trigger and needs to deliver now. Quite literally. It needs shiny new cars off the production line and to put keys in customers' hands.

It'll be months before a trend can be established that confirms this production outlook, but Fisker is at an inflection point for future growth.

If it can follow through, it will see far more investor demand.

Lucid Group, Inc. (NASDAQ: LCID)

Lucid, unfortunately, is failing by all three metrics – market share, revenue, and investor interest.

The company had to drop its forecast for 2023 production from 14,000 vehicles to 10,000. In line with the drop, it is not delivering vehicles and clearing its backlog with just 60% of what it promised compared to other EV companies that averaged 90%.

Market share is severely curtailed from a low start, revenue is not there, and investor demand is following suit.

Lucid needs one or two of three things – a buyout premium from another EV maker (especially the major car manufacturers), a tech market rebound, or a significant expansion of reservations.

Any one of these situations may push stock prices up, but the clock is ticking. Lucian has the tech. It has a good luxury sedan. It does not have a viable business without investors covering the bill. So far, it seems as if they don't want to.

Rivian Automotive, Inc.(NASDAQ: RIVN)

EV pickup truck maker Rivian is in a similar spot. It announced weaker revenue in 2022 than expected at the start of March 2023 – $663 million for the quarter versus an expected $742 million.

Worse was a 20% drop in expected vehicle deliveries to lock in 2023 revenue from 50,000 vehicles to 60,000.

It's sitting on a massive backlog too. In November 2022, it stood at 114,000, not counting an order for 100,000 delivery vans with a 2030 due date. It didn't help that the details were sparse, either.

Rivian needs to build into this enviable backlog soon. It has the advantage of a single chassis type across personal and corporate models. Making it happen at a larger scale is a challenge investors aren't convinced the company can tackle.

What To Watch For Going Forward

Going back, what we'd be looking for in electric vehicle makers comes down to three things…

Market share growth needs to happen, especially in the domestic U.S. market where EV market penetration is low, and predicted demand is significantly higher. People need to actually buy these EV cars, and there is no guarantee it will happen.

EV makers need to show that they actually CAN make money. It's one thing to make the best car in the world. It's another to make a million of them. Revenue matters, especially when companies try to convince investors that they will make all these cars one day.

Investor interest must be maintained or built In a brutal bearish tech market. There is no version where more than half of people that may be interested in what your company is doing today feel like they should hold it until tomorrow. EV car makers have been on the losing side of that for a long time.

It'll be several months before new quarterly reports come out. EV makers must focus on their three targets – market share growth, revenue growth, and investor interest – to show they stand out from their peers.

A lot of future profits are there for the taking if these companies can show progress as soon as possible.

Take care,

Adam English

The Profit Sector